Updated SJC gold price

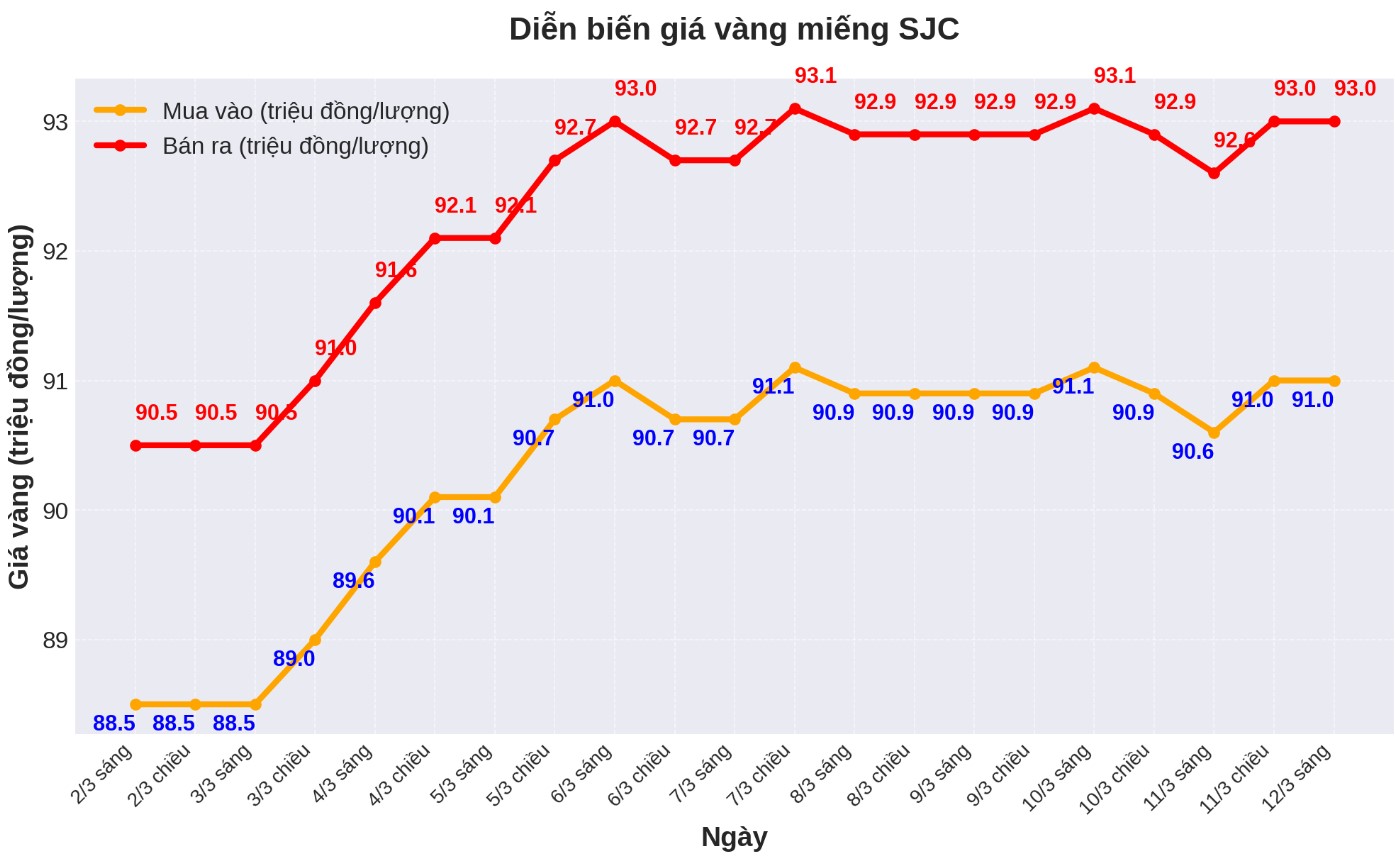

As of 6:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND91-93 million/tael (buy - sell), an increase of VND100,000/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 91-93 million VND/tael (buy - sell), an increase of 100,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.8-92.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold is listed at 2 million VND/tael.

9999 round gold ring price

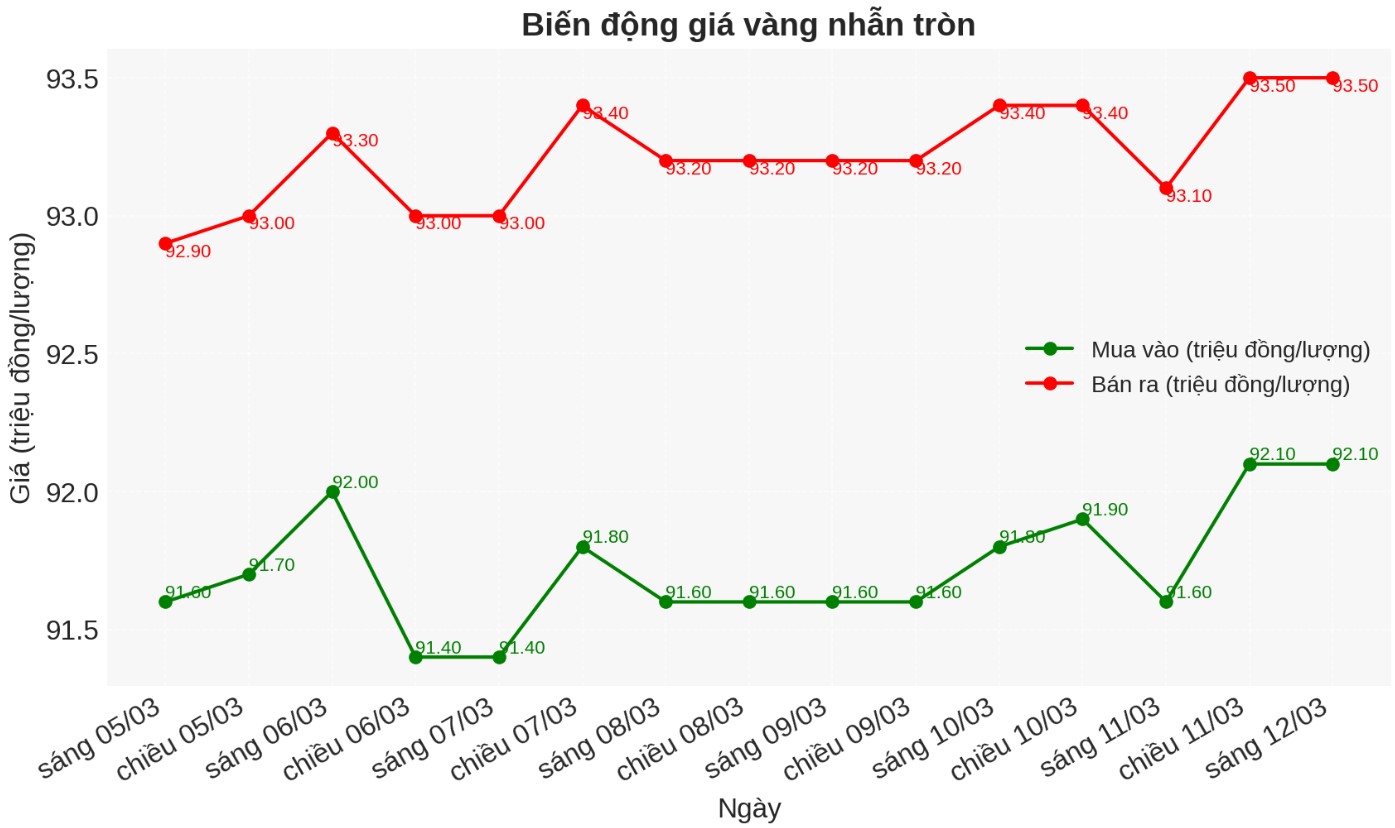

As of 6:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND92.1-93.5 million/tael (buy - sell); increased by VND200,000/tael for buying and increased by VND100,000/tael for selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.9-93.4 million VND/tael (buy - sell); kept the same for buying and decreased by 100,000 VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

In the context of high world gold prices, domestic gold rings may increase when the market opens a new trading session.

World gold price

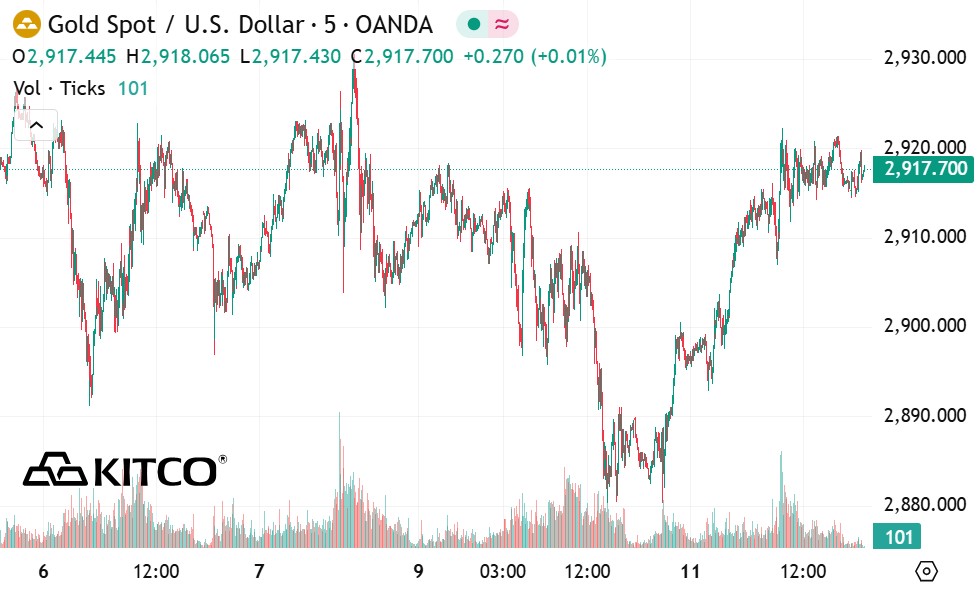

As of 6:30 a.m., the world gold price listed on Kitco was at 2,917.7 USD/ounce, up 23.8 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased in the context of a sharp decrease in the USD. Recorded at 6:30 a.m. on March 12, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.360 points (down 0.58%).

Gold and silver prices increased sharply due to increased demand for safe-haven assets due to concerns about the risk of a US economic recession and a major sell-off in the US stock market.

Gold contracts in April increased by 23.3 USD to 2,922.9 USD/ounce. The May silver contract increased by 0.7 USD to 33.23 USD/ounce.

The US stock index fell in the middle of the session and hit its lowest level in many months, in the context of the country announcing a new trade tax on Canada. The Wall Street Journal wrote: "The stock market plummets, fearing a widespread recession".

This week, important US economic data included the February consumer price index (CPI) report on Wednesday and the February producer price index (PPI) report on Thursday. The CPI is expected to increase by 2.9% over the same period last year, down slightly from the increase of 3.0% in the January report. The PPI is expected to increase by 0.3% compared to the previous month, lower than the increase of 0.4% in January.

Gold for April futures is having a short-term technical advantage. The next target for buyers is to push prices above the resistance level of 2,974 USD/ounce - the highest level this contract has ever achieved.

On the contrary, the sellers will aim to pull prices below the important support zone at the low of 2,844.10 USD/ounce last week.

The first resistance level was at a high of $2,929/ounce on the day, followed by a high of $2,941.30/ounce last week. The first support level was at 2,900 USD/ounce, followed by a low of 2,882.5 USD/ounce on the day.

In the outside market, Nymex crude oil futures increased slightly, trading around 66.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.25%.

Important economic data for the week

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...