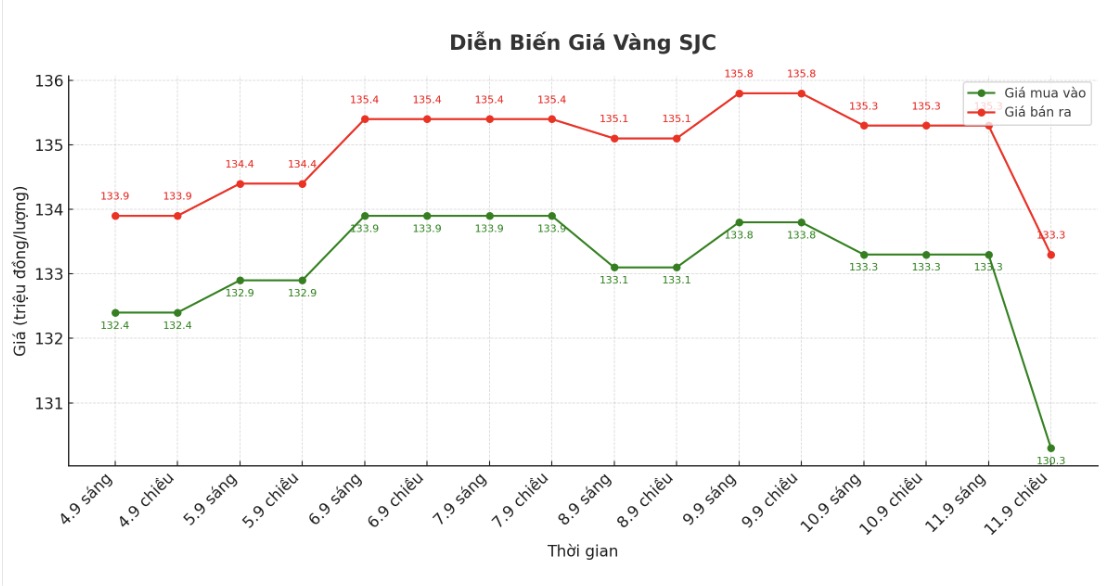

SJC gold bar price

As of 7:00 p.m., DOJI Group listed the price of SJC gold bars at VND130.3-133.3 million/tael (buy - sell), down VND3 million/tael for buying and down VND2 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 130-133.3 million VND/tael (buy - sell), down 3.3 million VND/tael for buying and down 2 million VND/tael for selling. The difference between buying and selling prices is at 3.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 130-133.9 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 1.4 million VND/tael for selling. The difference between buying and selling prices is at 3.9 million VND/tael.

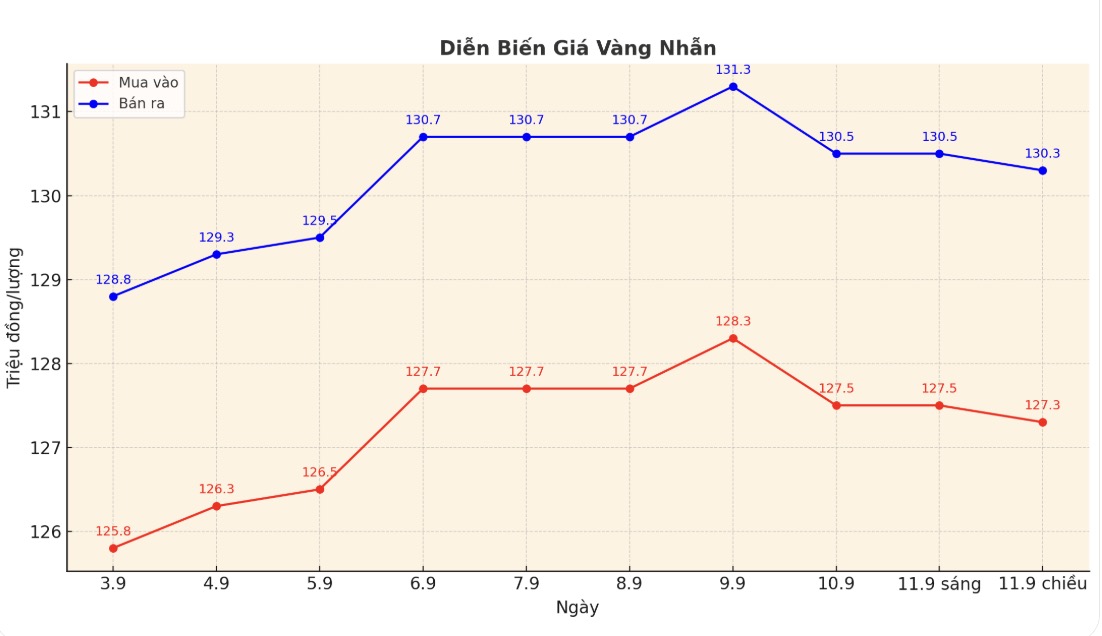

9999 gold ring price

As of 6:15 p.m., DOJI Group listed the price of gold rings at 127.3-130.3 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.7-130.7 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127-130 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

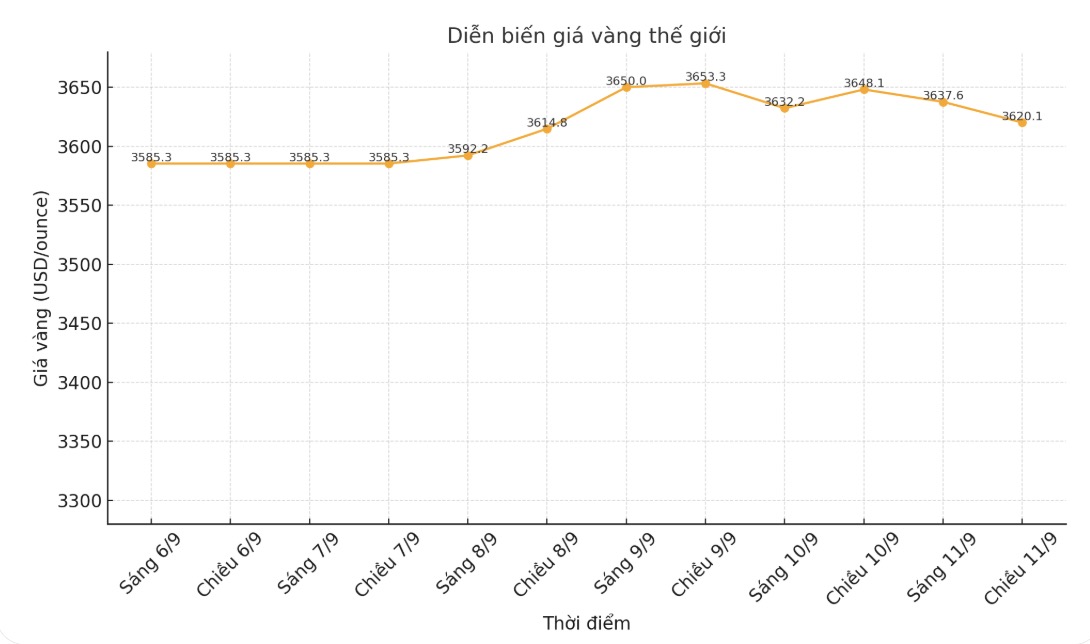

World gold price

The world gold price was listed at 6:10 p.m. at 3,620.1 USD/ounce, down 28 USD.

Gold price forecast

Gold prices fell slightly in the trading session on Thursday, hovering near a historical peak, as investors awaited the US consumer inflation data (CPI) to be released later in the day, after the weaker-than-expected producer price (PPI) data further reinforced expectations that the US Federal Reserve (FED) will cut interest rates next week.

Ilya Spivak - Head of Global Macro at Tastylive - commented: "Gold seems to be accumulating after a strong increase as the market awaits CPI data and how that will affect the Fed's interest rate cut expectations".

Previously, US manufacturing prices unexpectedly fell in August due to lower commercial service profit margins and only slight increases in commodity costs.

Investors are now focusing on the CPI report, due out at 12:30 GMT, with a Reuters survey predicting an August CPI increase of 0.3% compared to the previous month, after a 0.2% increase in July. Compared to the same period, CPI is forecast to increase by 2.9%, higher than the 2.7% of July.

The less-than-expected non-farm payrolls data last week, along with revised estimates showing less than 911,000 jobs in the 12-month period to March, also reinforced expectations of monetary policy easing. The weekly jobless claims data, also released at 12:30 GMT, will provide additional signals to the labor market.

The trend is still up, but if the CPI is higher than expected, it could increase the USD, putting downward pressure on gold prices in the short term. However, the decline could be limited as the market is unlikely to abandon expectations of a rate cut, even if the timing may be postponed, said Spivak.

According to the CME FedWatch tool, the Fed is likely to cut interest rates by 25 basis points at next week's meeting, and some investors are even considering the possibility of cutting 50 basis points. Low interest rates often support unyielding precious metals such as gold.

Meanwhile, the Trump administration appealed a federal court's ruling on September 10 to temporarily block the dismissal of Fed Governor Lisa Cook.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...