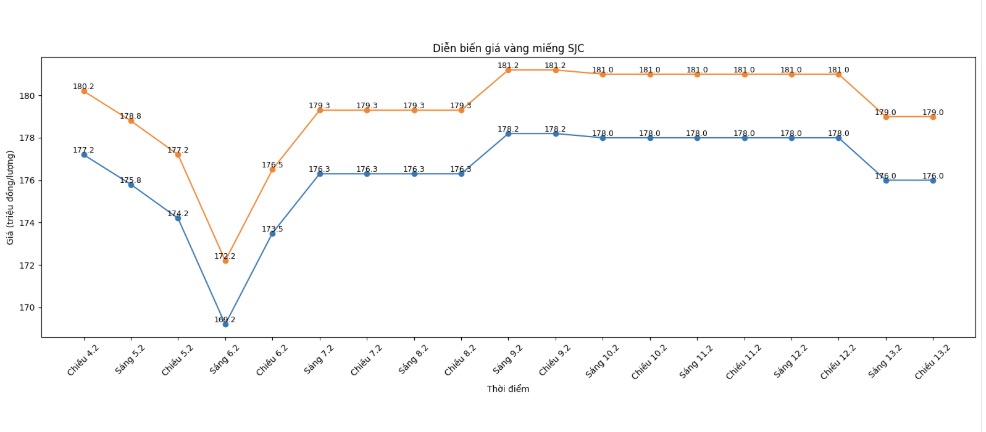

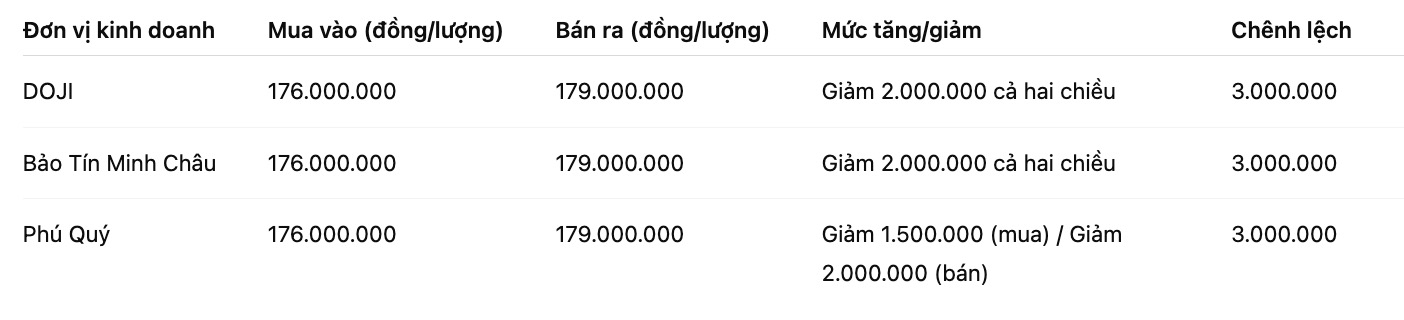

SJC gold bar price

As of 6:00 AM on February 14th, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Phu Quy Gold and Gems Group at 176-179 million VND/tael (buying - selling), down 1.5 million VND/tael on the buying side and down 2 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

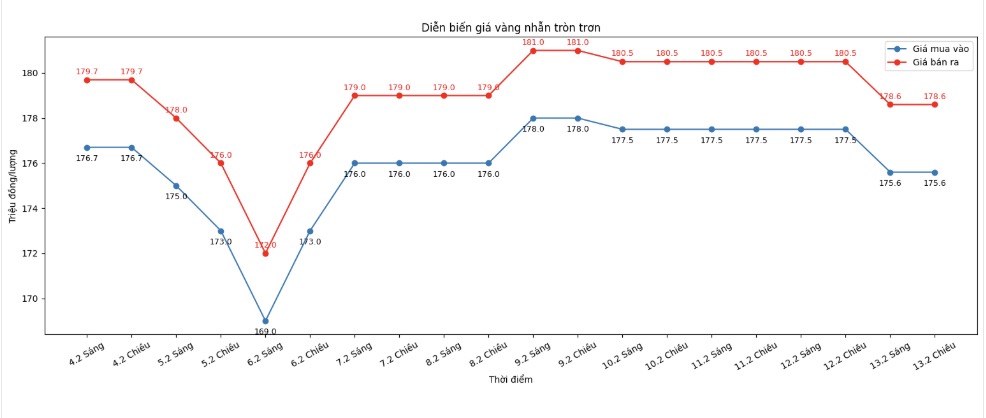

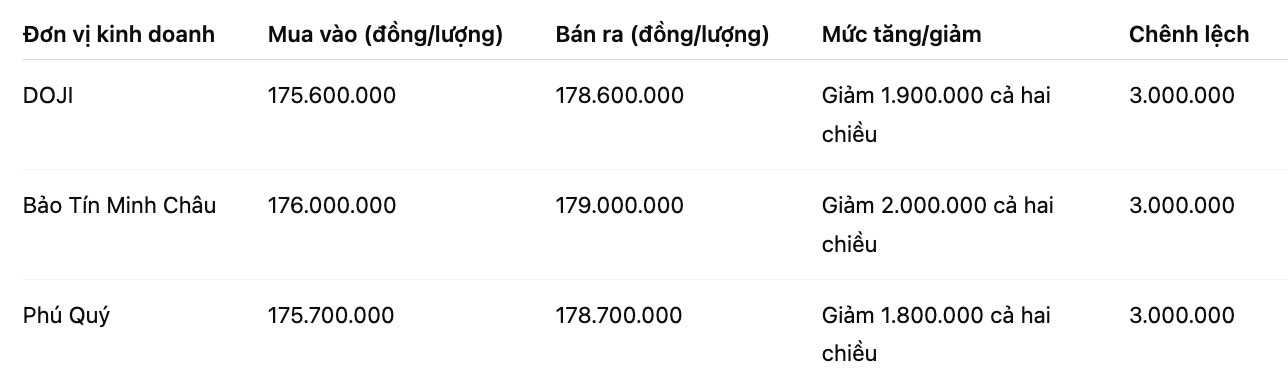

9999 gold ring price

As of 6:00 AM on February 14, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), down 1.9 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), down 1.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

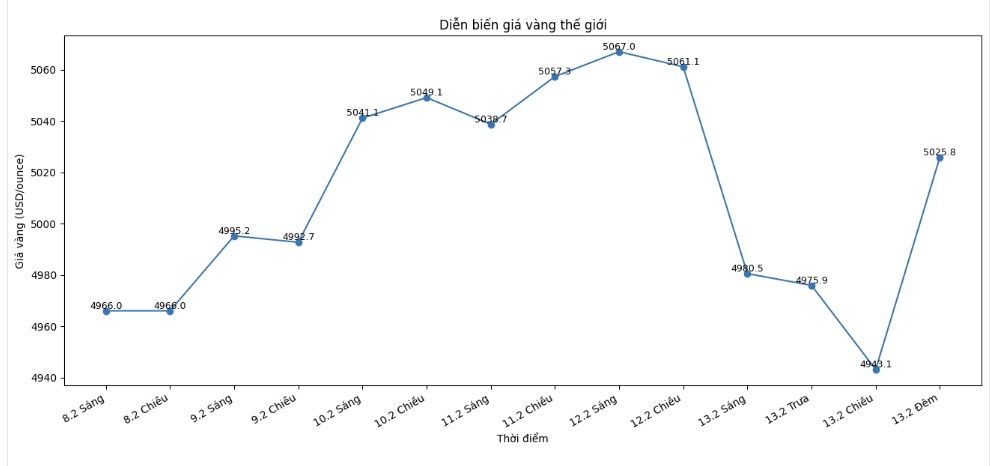

World gold price

At 11:33 PM on February 13, world gold prices were listed around the threshold of 5,025.8 USD/ounce; down 42.9 USD compared to the previous day, but showing signs of recovery after the US consumer price index (CPI) was announced.

Gold price forecast

Gold and silver prices rebounded as soon as one of the most important economic data of the month: (CPI) of the US was announced. Inflation pressure shows signs of cooling down, thereby creating room for the Federal Reserve (Fed) to cut interest rates by the end of this year.

The consumer price index (CPI) increased by 0.2% in January, after the 0.3% increase in December, according to a statement from the US Bureau of Labor Statistics (BLS) on Tuesday. Inflation data was slightly lower than expected, as economists forecast a 0.3% increase.

However, inflation calculated for the year reached 2.4%, a sharp decrease compared to 2.7% recorded in December. According to consensus forecasts, analysts expect 12-month inflation to be at 2.5%.

The report also said that core inflation - excluding volatile price groups such as food and energy - did not accelerate, indicating that high price pressure has not spread and is deeply ingrained in the economy. Core CPI increased by 0.3% in January, after the 0.2% increase in December, in line with forecasts.

Earlier on Thursday morning, gold, silver, copper, platinum and palladium contracts simultaneously plummeted. This development took place in the context of widespread "risk avoidance" sentiment, with algorithmic transactions said to have amplified the sharp decline of precious metals.

A report from Bloomberg noted that the sell-off lacked clear catalysts, possibly affected by the operation of CTA funds using computer models. Margin calls could also contribute to investors being forced to sell off positions to increase liquidity.

A metal strategy representative of MKS PAMP SA said that the fluctuation occurred very quickly and reflected risk avoidance sentiment. In stressful periods, even safe-haven assets such as gold can be sold to meet liquidity/cash demand.

According to Bloomberg, the US government is considering adjusting the scope of tariffs on some steel and aluminum products to reduce complexity for businesses. Details and timing of application have not yet been announced. After this information, aluminum prices in London fell.

Technically, bulls (buyers) of April gold futures set a closing target above the strong resistance level of 5,250 USD/ounce. Bears (bears) aim to push prices below the important support at the bottom last week of 4,670 USD/ounce.

The nearest resistance is at 5,016.4 USD/ounce (overnight peak), followed by 5,100 USD/ounce. Initial support is at 4,900 USD/ounce (Friday bottom), followed by 4,800 USD/ounce.

On the outside market, the USD rose slightly. Crude oil prices weakened, trading around 62.5 USD/barrel. The yield on 10-year US Treasury bonds was around 4.12%.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...