Gold and silver lead commodity group in decrease

The commodity market plummeted sharply on Monday, led by the sharp decline of gold, silver, oil and industrial metals.

Oil prices fell nearly 5.5%, cooling down from a multi-month high, while copper prices on the London Metal Exchange (LME) lost nearly 5%.

The fact that the market is selling off precious metals at the same time as US stocks shows that investors see Mr. Warsh as a more "hawkish" viewer of monetary policy" - Mr. Vivek Dhar - commodity strategist at Commonwealth Bank of Australia (CBA) said.

The strengthening USD is also putting more pressure on precious metals and other commodities, including oil and basic metals," Mr. Dhar added, while still maintaining his forecast that gold prices could reach $6,000 in the fourth quarter.

On Friday, US President Donald Trump chose Mr. Kevin Warsh, former Fed Governor, to succeed Jerome Powell as head of the central bank in May. This decision sparked a wave of sell-offs in the stock and commodity markets, while pushing the USD up.

Asian stocks followed Wall Street's futures contracts, sinking deep into red, as chaotic sell-offs in the precious metals market caused a new trading week to begin worryingly, amid a series of corporate profit reports, central bank meetings and upcoming economic data.

Metal market under selling pressure

Selling pressure on the precious metals market increased after CME Group raised margin requirements for metal futures contracts, effective since the market closed on Monday.

Increasing margins is often detrimental to related contracts, as higher capital costs can reduce speculation, narrow liquidity and force traders to close down positions.

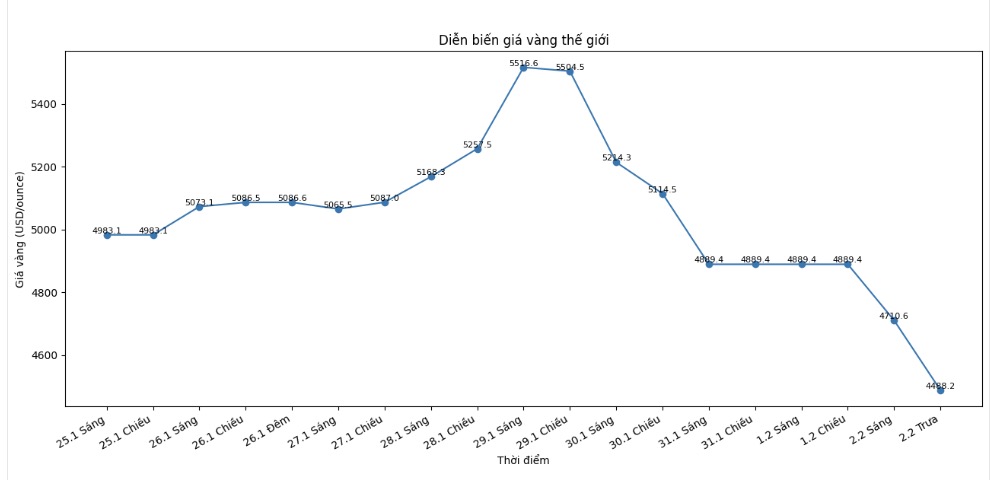

The decline began on Friday, with spot gold prices recording their strongest one-day decline since 1983, losing more than 9%, while silver plunged 27% - the largest one-day decline ever recorded.

On the energy market, prices also faced pressure on Monday amid signs of cooling US-Iran tensions, after President Trump said last weekend that Iran is "seriously engaging in dialogue" with Washington, easing concerns about the risk of conflict with this OPEC member country.

These statements, along with reports that the navy of the Iranian Revolutionary Guard does not plan to conduct live-fire drills in the Strait of Hormuz, are seen as signs that tensions are decreasing - according to market analyst Tony Sycamore of IG.

The copper and iron ore markets also face many obstacles due to concerns about high inventories and weak demand in the period before the Lunar New Year holiday in China - the world's largest consumer of industrial metals.

Analysts say demand from end users and trading volume are forecast to be sluggish before the holiday, starting from February 15.

In other commodities, rubber prices in Tokyo fell nearly 3%, while wheat and soybeans in Chicago both fell by about 1%.

The key question is whether this is the beginning of a structural downward cycle of commodity prices or simply a correction" - Mr. Dhar of CBA said - "We believe this is just a correction and a buying opportunity, not a fundamental change.