Analysts believe that this development is mainly due to forced sell-off activities, rather than fundamental factors.

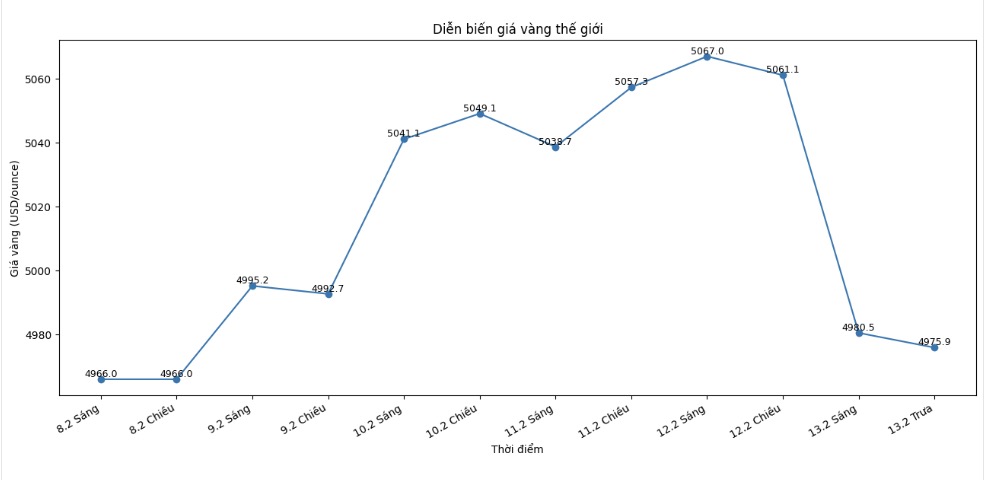

The 30-minute plunge from 11:00 AM to 11:30 AM (EST time) was the worst daily decline for both metals since January 29, when gold once evaporated nearly 500 USD and silver lost 26% of its value.

The sell-off started from the artificial intelligence (AI) stock group. Businesses such as Nvidia and Alphabet weakened right from 9:00 AM (EST time). Alphabet started falling from 9:00 AM and temporarily found a support zone at 10:00 AM - 30 minutes earlier than the time selling pressure spread to other industry groups.

By 10:30 am, the negative impact had expanded to the US stock market. As of 11:00 am, Nasdaq decreased by 2%, while S&P 500 lost 1.57%. After that, the sell-off wave spread to the commodity market, in which precious metals were heavily affected.

Mr. Michael Ball - macro strategist at Bloomberg MLIV, said this is a more systemic sales activity than reflecting a fundamental factor:

The "risk-off" diễn biến due to disruptions from AI on the stock market on Thursday is spreading, with metals falling sharply, likely due to algorithmic trading.

Despite a slight rebound, metals are still under great pressure in an "air-pocket"-style price slip, resembling momentum risk reduction activity - often seen from CTA strategies when price thresholds are broken.

This deep decline does not seem to stem from changes in the fundamental outlook for the precious metal. Some opinions suggest that the market reacted late to positive job data released on Wednesday. However, the timing and selling pattern do not support this explanation.

Investors are currently focusing their attention on the January CPI report expected to be released on Friday. Consensual forecasts show annual inflation increasing by 2.5% - a factor that could affect short-term sentiment in the precious metals market and financial markets in general.

See more news related to gold prices HERE...