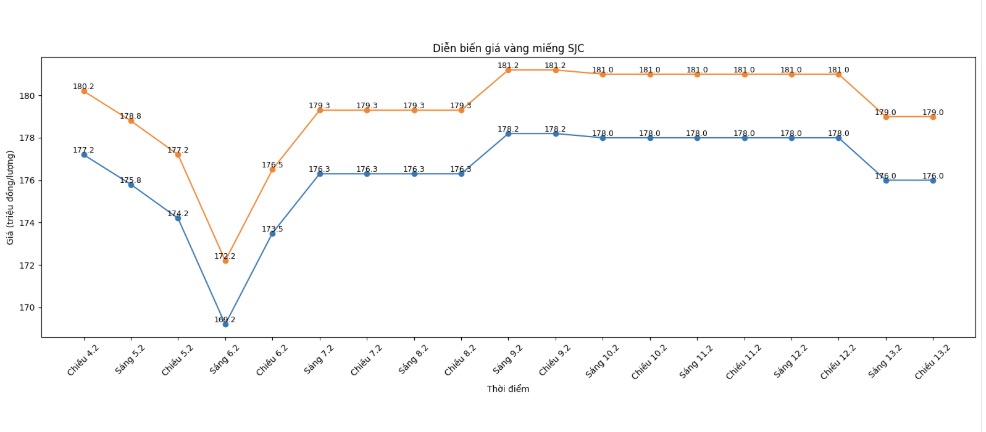

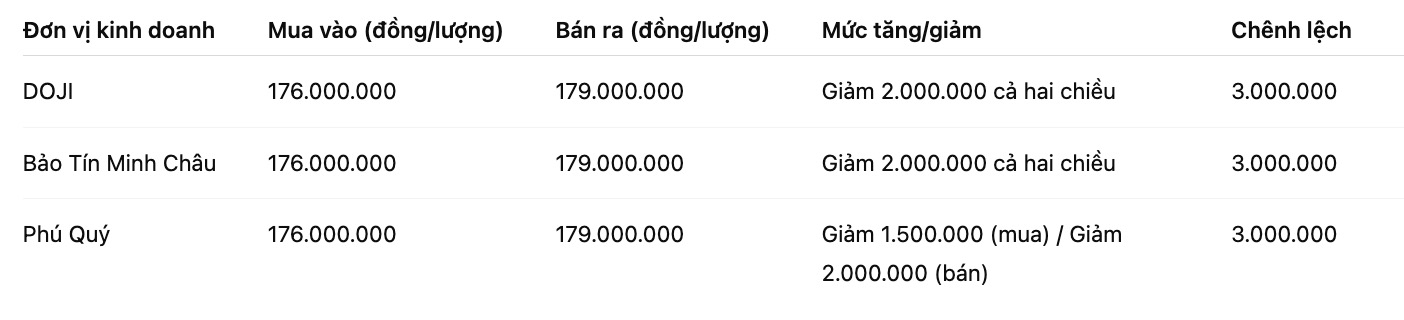

SJC gold bar price

As of 7:30 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Phu Quy Gold and Gems Group at 176-179 million VND/tael (buying - selling), down 1.5 million VND/tael on the buying side and down 2 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

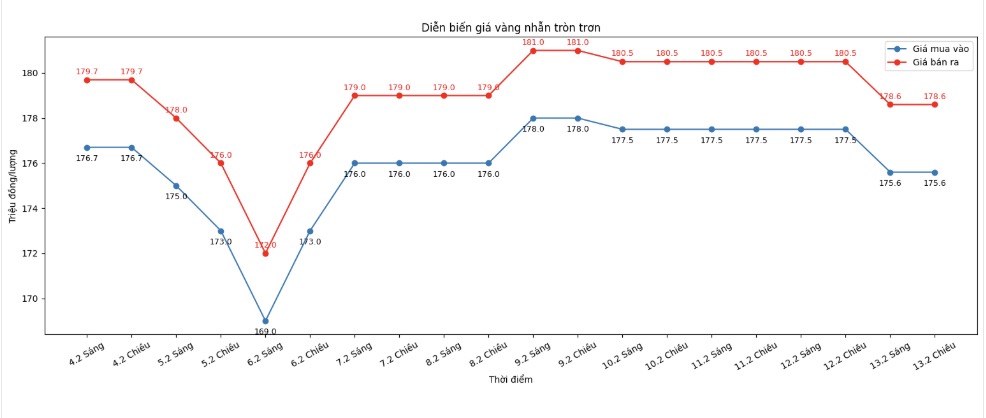

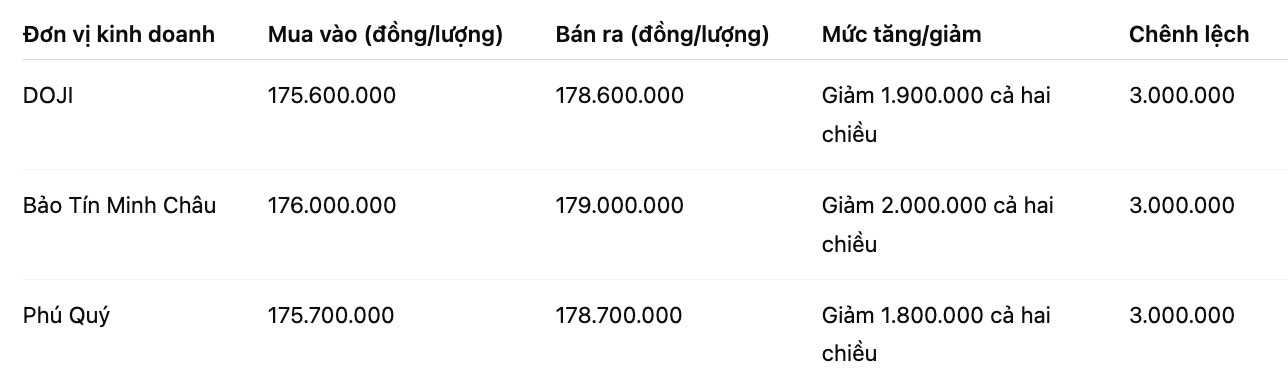

9999 gold ring price

As of 7:30 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), down 1.9 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 176-179 million VND/tael (buying - selling), down 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), down 1.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

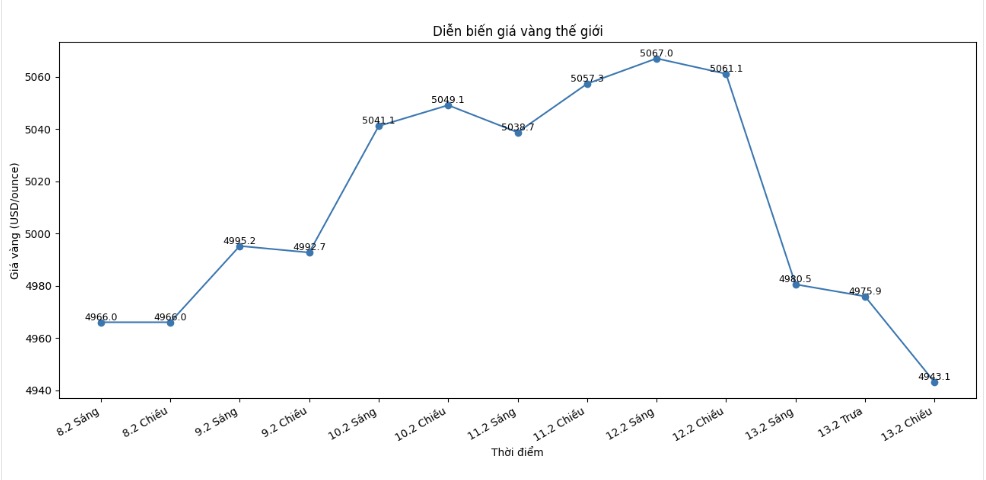

World gold price

At 6:45 PM, world gold prices were listed around 4,943.1 USD/ounce; down 118 USD compared to the previous day.

Gold price forecast

After a violent fluctuation in the last session of the week, the gold market is entering a phase of finding new trends as investors simultaneously face short-term profit-taking pressure and monetary policy expectations.

In recent sessions, world gold prices recorded a state of "gliding", falling deeply and then quickly recovering. This development reflects the widespread cautious sentiment in the global financial market, especially after US stocks fluctuated sharply. Systemic sell-off pressure, combined with algorithmic trading activities, is considered the main factor causing the precious metal to plummet in a short time.

Mr. Michael Ball - macro strategist at Bloomberg MLIV - said that the recent sharp decline was more technical rather than due to changes in fundamentals. According to him, the "risk-off" status stemming from fluctuations in technology and AI stock groups has triggered momentum selling orders, pushing gold and silver into an "air-pocket".

In the opposite direction, bottom-fishing demand quickly appeared when gold prices broke through the important psychological milestone of 5,000 USD/ounce. The price rebound shows that this threshold still plays a strong technical supporting role.

Mr. Kyle Rodda - senior market analyst at Capital. com - said that in a highly volatile environment, round price levels often become trigger points for both selling and buying orders, causing the fluctuation range to be amplified.

Regarding macroeconomic factors, positive US jobs data continues to reinforce the view that the Fed may maintain high interest rates for longer. This partly limits the upward momentum of gold - a non-rotating asset. However, expectations that the Fed will begin a reassuring cycle in the second half of the year are still the backbone for market sentiment.

Investors are currently focusing on the upcoming inflation report (CPI). If inflation maintains a cooling trend, gold may be supported by expectations of interest rate reductions. Conversely, higher-than-forecast figures may create short-term correction pressure.

Technically, gold is fluctuating in a sensitive zone. Keeping it above the 5,000 USD/ounce mark will strengthen the positive medium-term outlook. In unfavorable scenarios, the 4,800 USD/ounce zone is considered the next noteworthy support.

In the context of strong fluctuations, experts recommend that investors maintain a tight risk management strategy, avoid the psychology of chasing short-term fluctuations and closely monitor signals from US monetary policy.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...