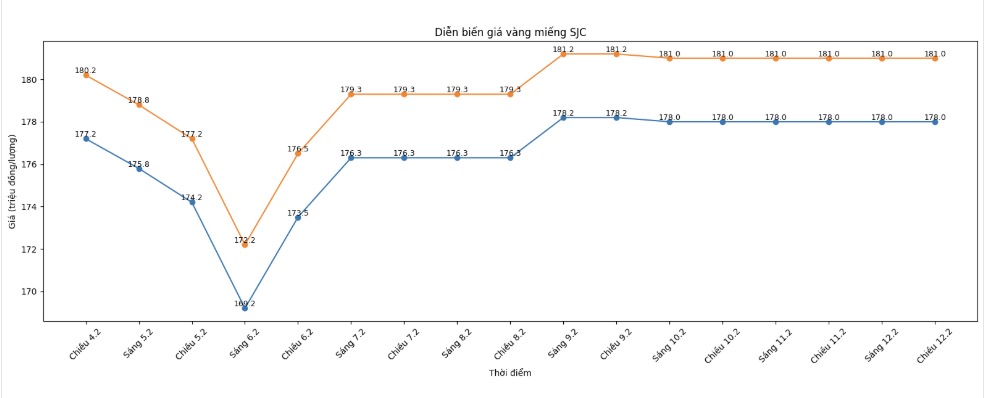

SJC gold bar price

As of 6:00 AM on February 13, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at 178-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar prices were listed by Phu Quy Gold and Gems Group at the threshold of 177.5-181 million VND/tael (buying - selling); unchanged in both directions. The difference between buying and selling prices is at 3.5 million VND/tael.

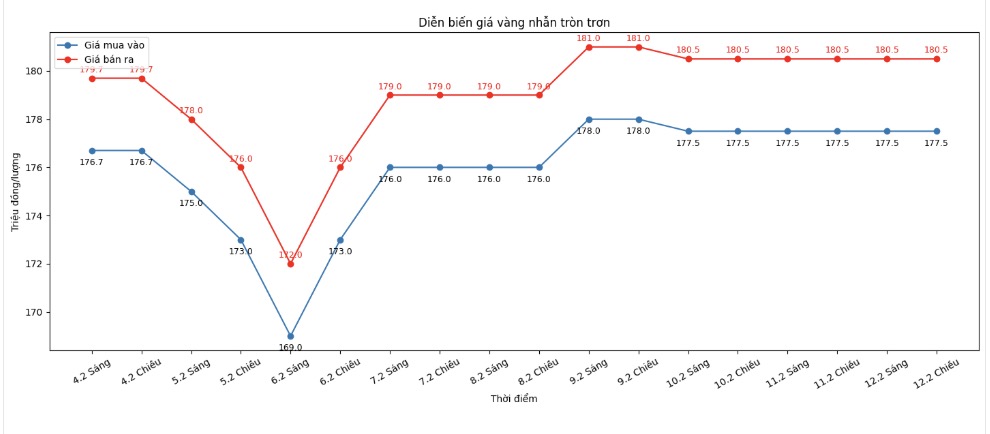

9999 gold ring price

As of 6:00 AM on February 13, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling); unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

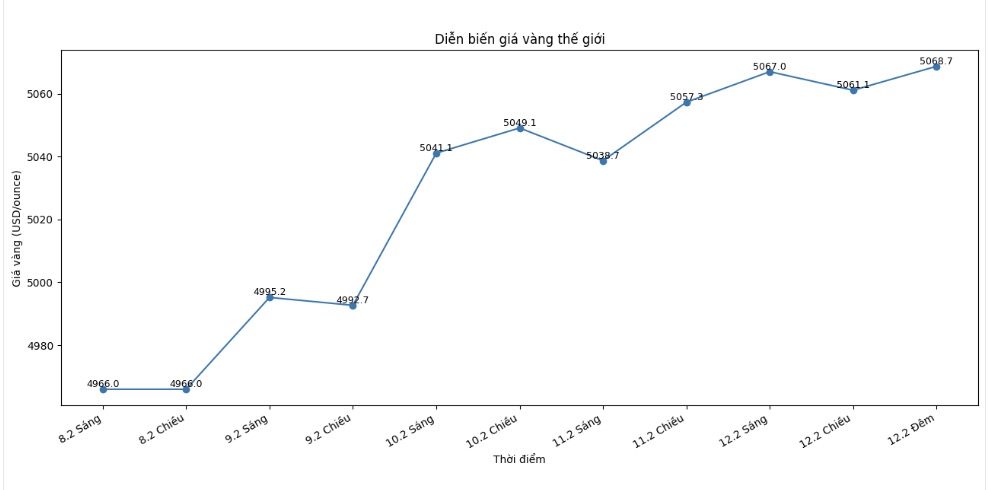

World gold price

At 10:35 PM on February 12, world gold prices were listed around the threshold of 5,068.7 USD/ounce; up 18.2 USD compared to the previous day.

Gold price forecast

Gold and silver prices are struggling in the context of risk-taking sentiment in the financial market showing signs of improvement at the end of the week.

Gold futures for April delivery recorded a decrease of 13.7 USD, falling to 5,084.4 USD/ounce, while silver for March delivery lost 1,125 USD, to 82.79 USD/ounce.

The developments of precious metals are affected by a series of international economic and trade information. According to a report cited by Bloomberg, US and Chinese leaders may consider extending the trade truce agreement for up to one year in a meeting scheduled to take place in Beijing in April. The meeting is expected to focus on short-term economic results, including new purchase commitments.

In another development, the USMCA North American trade agreement continues to attract attention as information emerges that the US is reconsidering its role. This agreement will enter a mandatory review before the possibility of extension on July 1.

Meanwhile, the US House of Representatives has passed a bill to end tariffs on imports from Canada, thereby increasing policy pressure before the midterm elections. The bill is currently awaiting consideration by the Senate.

Regarding monetary policy, a governor of the Federal Reserve said that positive jobs data in January does not necessarily change the outlook for interest rate cuts. Expectations for supply-side reforms and the possibility of housing inflation cooling down may create room for policy easing. However, traders have lowered the probability of the Fed's interest rate cut forecast at the June meeting to below 50%.

According to technical analysis, buyers on the April gold futures market are aiming to close above the strong resistance level of 5,250 USD/ounce. In the opposite direction, sellers expect to pull prices below the noteworthy support zone of 4,670 USD/ounce. Close resistance levels are identified at 5,144.50 USD and 5,200 USD, while support is at 5,036.30 USD and 5,000 USD.

The Wyckoff market rating index is currently at 6.5, showing that technical advantage is still slightly leaning towards buyers.

On the energy market, crude oil prices weakened slightly, fluctuating around the threshold of 64.50 USD/barrel. The USD index edged up, while the yield on 10-year US Treasury bonds remained around 4.167%, reflecting investors' cautious sentiment.

Gold price data is compared to the previous day.

The world gold market operates based on two main pricing mechanisms. The first is the spot market, where prices are listed for buying and selling and immediate gold delivery transactions.

The second is the futures contract market, where prices are determined for gold delivery at a time in the future. Due to liquidity factors and position adjustments at the end of the year, the December gold futures contract is currently the most actively traded contract on the Chicago Mercantile Exchange (CME).

See more news related to gold prices HERE...