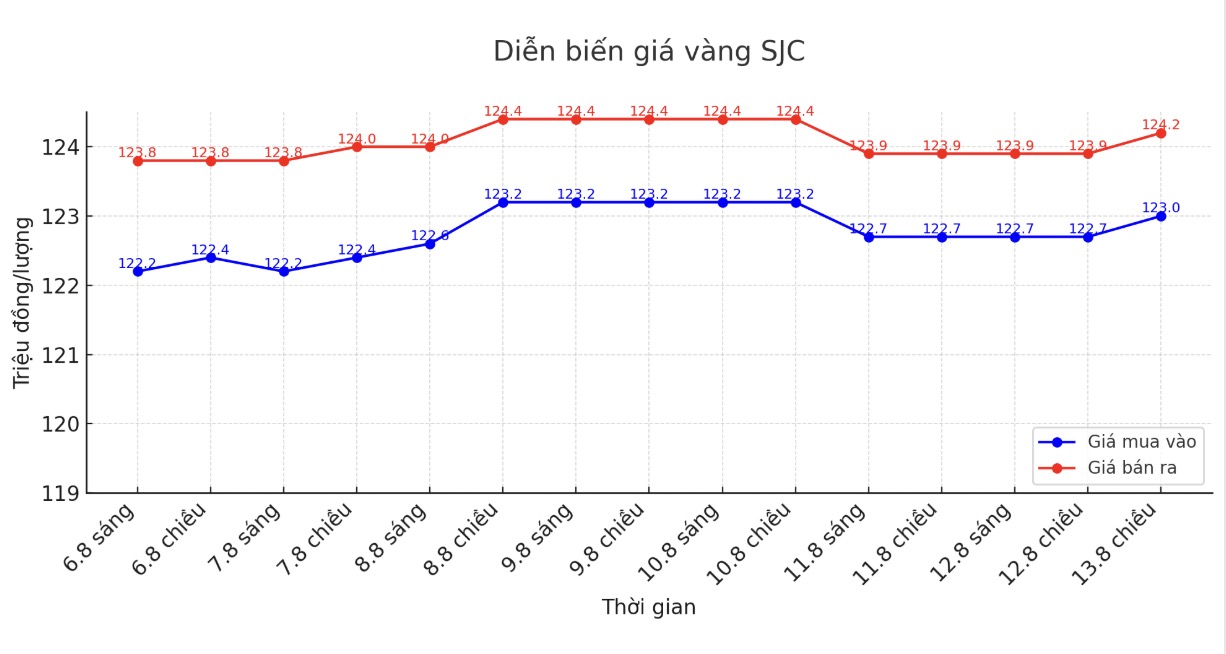

SJC gold bar price

As of 6:00 a.m. on August 14, the price of SJC gold bars was listed by Saigon Jewelry Company at VND123.2 million/tael (buy in - sell out), an increase of VND300,000/tael for both buying and selling. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 122.7-123.9 million VND/tael (buy - sell), unchanged. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123-124.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.2 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

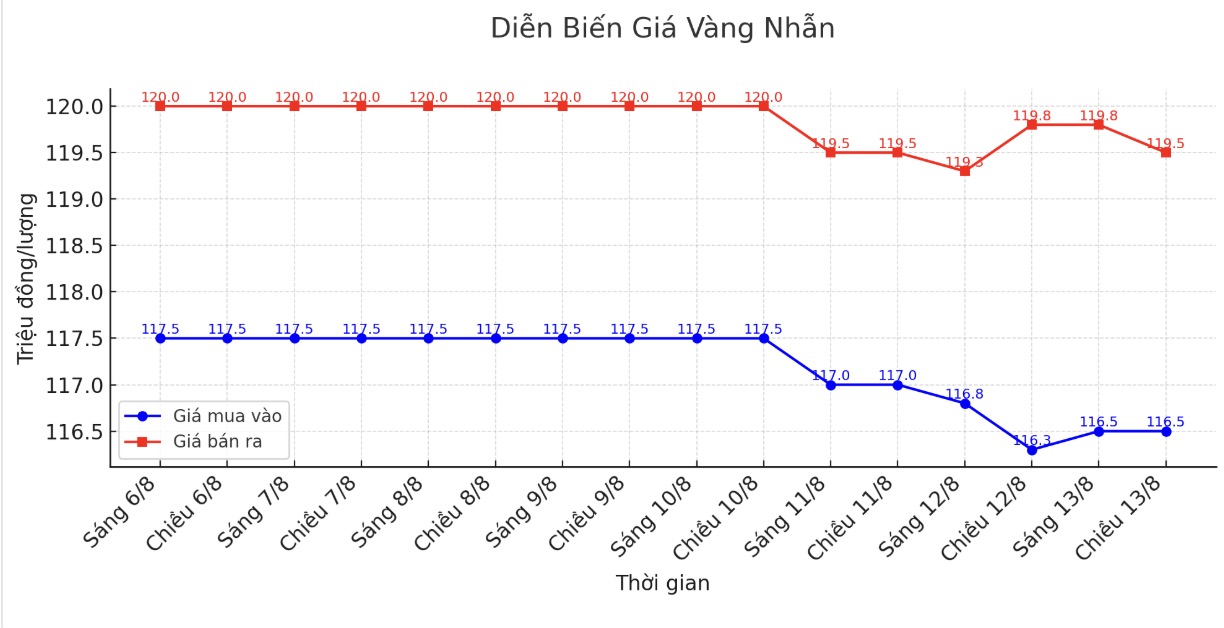

9999 gold ring price

As of 6:00 a.m. on August 14, DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 300,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

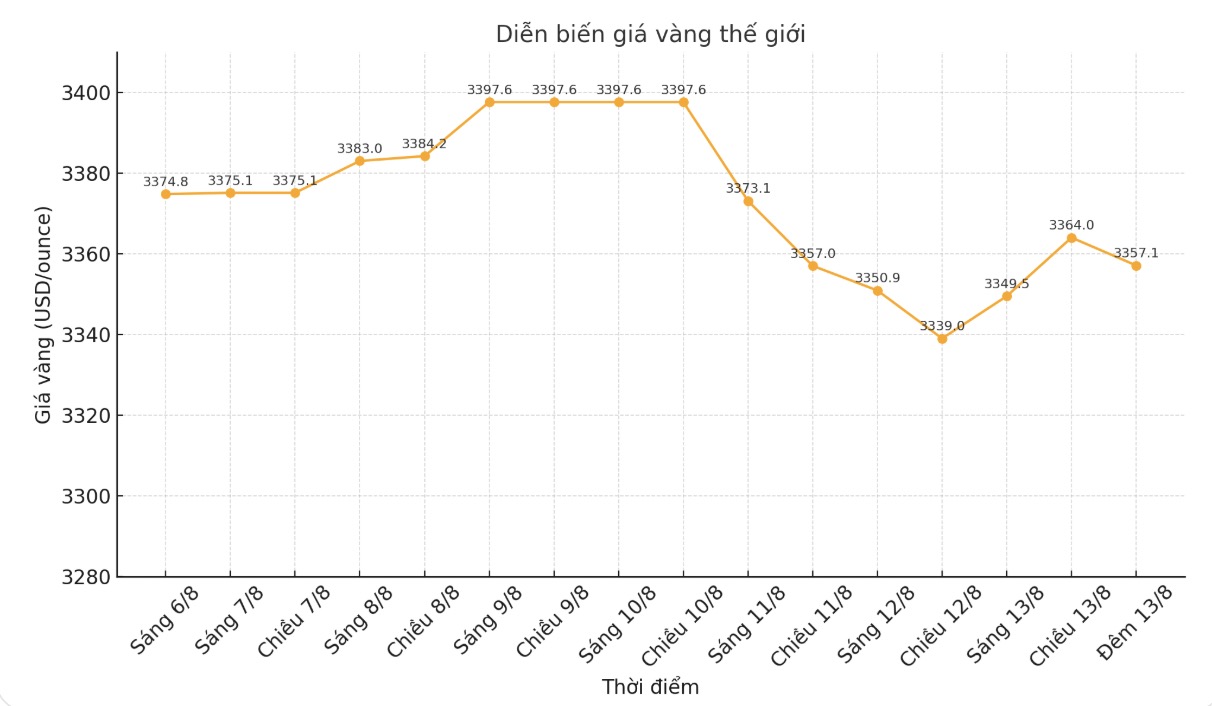

World gold price

The world gold price was listed at 11:45 p.m. on August 13 at 3,357.1 USD/ounce, up 10.3 USD.

Gold price forecast

World gold prices recovered, supported by the USD index falling to a three-week low and US Treasury bond yields falling in the middle of the week.

December gold contract increased by 13.8 USD, to 3,412.3 USD/ounce.

The gold and silver markets also recorded buying momentum as many Wall Street companies predicted that the US Federal Reserve (FED) would start cutting interest rates in September, in the context of a weakening labor market and maintained relatively low inflation.

Nomura economists forecast the Fed to cut key interest rates by 25 basis points at the FOMC meeting in September, followed by two more cuts in December and March. The market is also reflecting this expectation, with another decline expected in December.

US inflation data released on Tuesday showed the core index (excluding food and energy) increased 3.1% in July compared to the same period last year, slightly higher than the forecast but not considered a concern.

In another development, the Central Bank of Thailand has just cut key interest rates and said it will maintain a loose policy, as higher US taxes risk causing a prolonged period of economic downturn. The banks monetary policy committee voted unanimously to cut repo rates by another 25 basis points to 1.5%. The move is part of an easing cycle that began last October, with a total decline of 100 basis points.

Technically, December gold buyers still maintain a clear advantage in the short term. The next target for buyers is to close above the strong resistance zone of 3,500 USD/ounce. In contrast, the immediate target for the bears is to push prices below the strong support zone at the bottom of July at $3,319.2/ounce.

The immediate resistance level is at 3,425 USD/ounce and then 3,450 USD/ounce. immediate support for the lowest level this week is 3,379.1 USD/ounce and followed by 3,350 USD/ounce.

In the outside market, the USD index decreased, crude oil prices decreased slightly to around 62.25 USD/barrel, and the yield on the 10-year US Treasury note was around 4.23%.

Economic data to watch this week

Wednesday: Speeches by Barkin, Bostic and Goolsbee (FED).

Thursday: US PPI July, US jobless claims.

Friday: US retail sales in July, New York Empire State Production Index, Michigan Consumer Confidence Index (preliminary estimate).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...