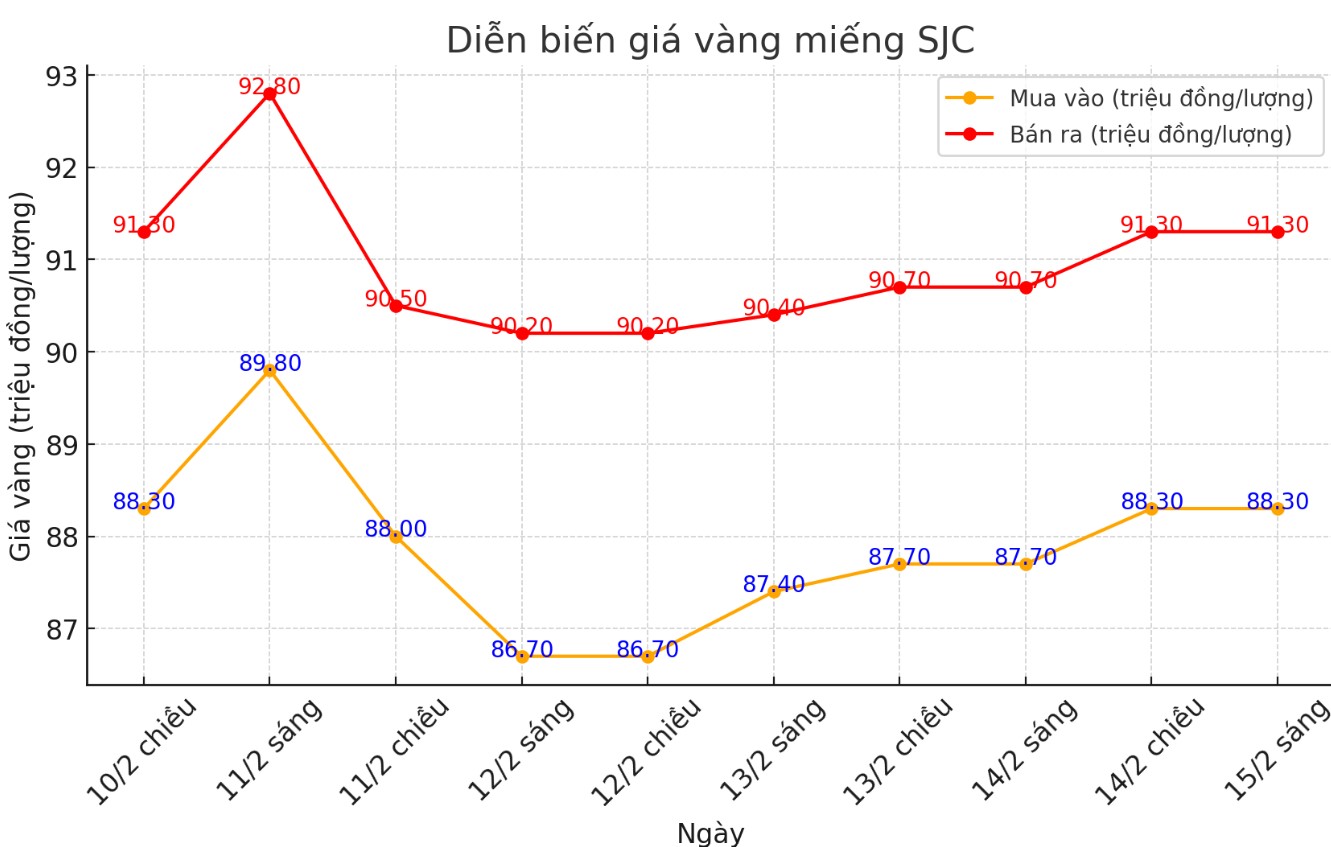

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 88.3-91.3 million/tael (buy in - sell out), an increase of VND 600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 3 million VND/tael.

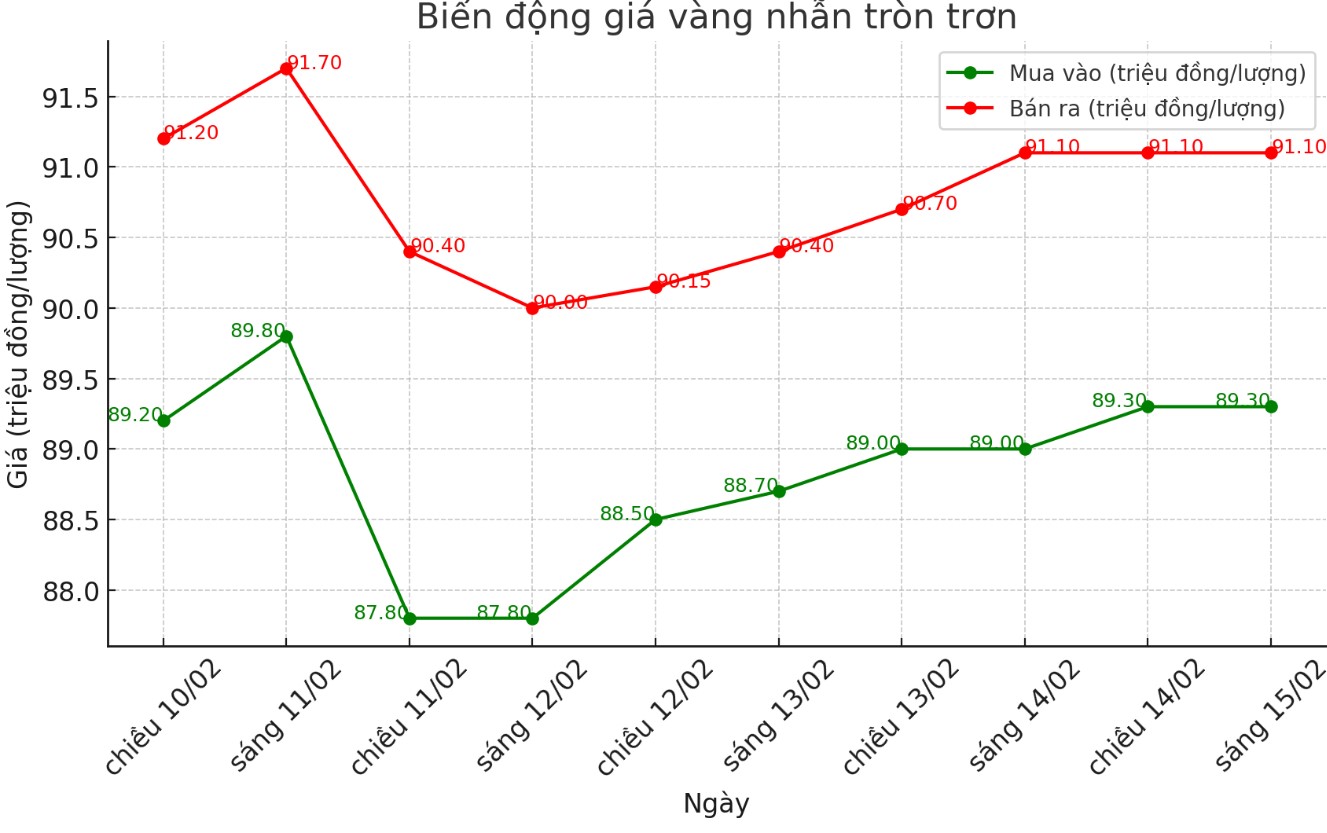

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND89.3-91.1 million/tael (buy - sell); increased by VND300,000/tael for buying and increased by VND400,000/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.3-91.3 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 600,000 VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

World gold price

As of 6:35 a.m. on February 15, the world gold price listed on Kitco was at 2,882.4 USD/ounce, down 45.9 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices fell freely despite a sharp decrease in the USD index. Recorded at 6:35 a.m. on February 15, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.670 points (down 0.51%).

According to Kitco, gold prices struggled as US retail sales fell sharply in January. According to the US Department of Commerce's announcement on Friday, the country's retail sales fell sharply last month, down 0.9% after increasing by 0.7% in December (adjusted data).

The data was much weaker than economists had predicted, who had expected a decline of just 0.2%.

Gold's consecutive rally to record levels appears to be stagnant as the precious metal ends its week below $2,900/ounce due to strong profit-taking pressure.

Phillip Streible, chief strategist at Blue Line Futures, said the sell-off in the silver market has dragged the entire precious metals sector down. He said that although the increase in silver to over 34 USD/ounce was a remarkable development, due to high volatility, many investors did not miss the opportunity to make a profit.

The latest weekly gold survey from Kitco News shows that industry experts are still bullish but more divided than last week. Meanwhile, retail traders are also more cautious in expecting gold prices to continue to rise.

Of the 14 experts participating in the Kitco News Gold Survey, 10 people (equivalent to 71%) predict that gold prices will continue to increase next week. Two (14%) see the precious metal falling. The remaining two predict gold prices will remain flat.

Meanwhile, Kitco's online poll attracted 201 votes. Small investors are also less optimistic but still maintain a positive view on the outlook for gold. 131 retail traders (65%) expect gold prices to rise next week. 48 people (24%) predict prices will fall and the remaining 22 people (11%) say gold will move sideways in the short term.

After a volatile week with a series of economic data and news strongly impacting the market, next week is expected to be less stressful when the US market closes on Monday on the occasion of President's Day.

Economic data that could impact gold prices this week include: Empire State Production Survey - an economic index released monthly by the US Federal Reserve (FED) branch in New York, to assess the performance of the manufacturing sector in New York state on Tuesday.

Minutes of the Fed's most recent monetary policy meeting and data on Construction Start-ups and US Housing Construction Permits on Wednesday; US weekly jobless claims report and Philadelphia Federal Reserve Production Survey on Thursday morning. Finally, the S&P Flash PMI and the US available home sales report on Friday.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...