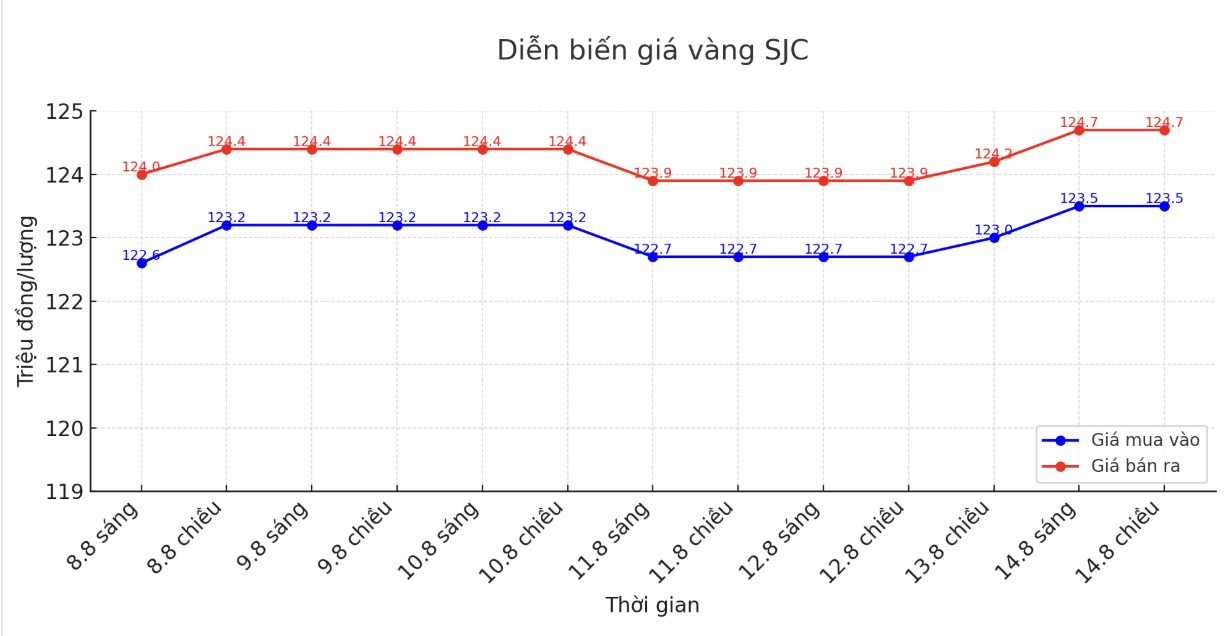

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND123.5-124.7 million/tael (buy in - sell out), an increase of VND800,000/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.7-124.7 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

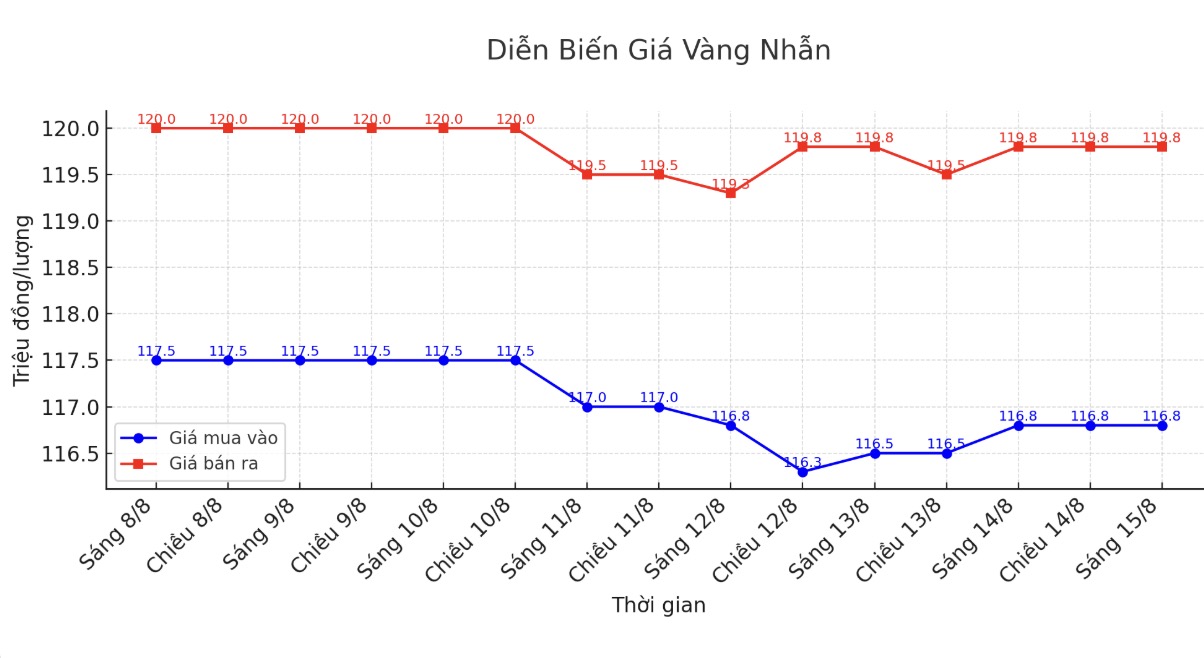

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and unchanged for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 seven million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

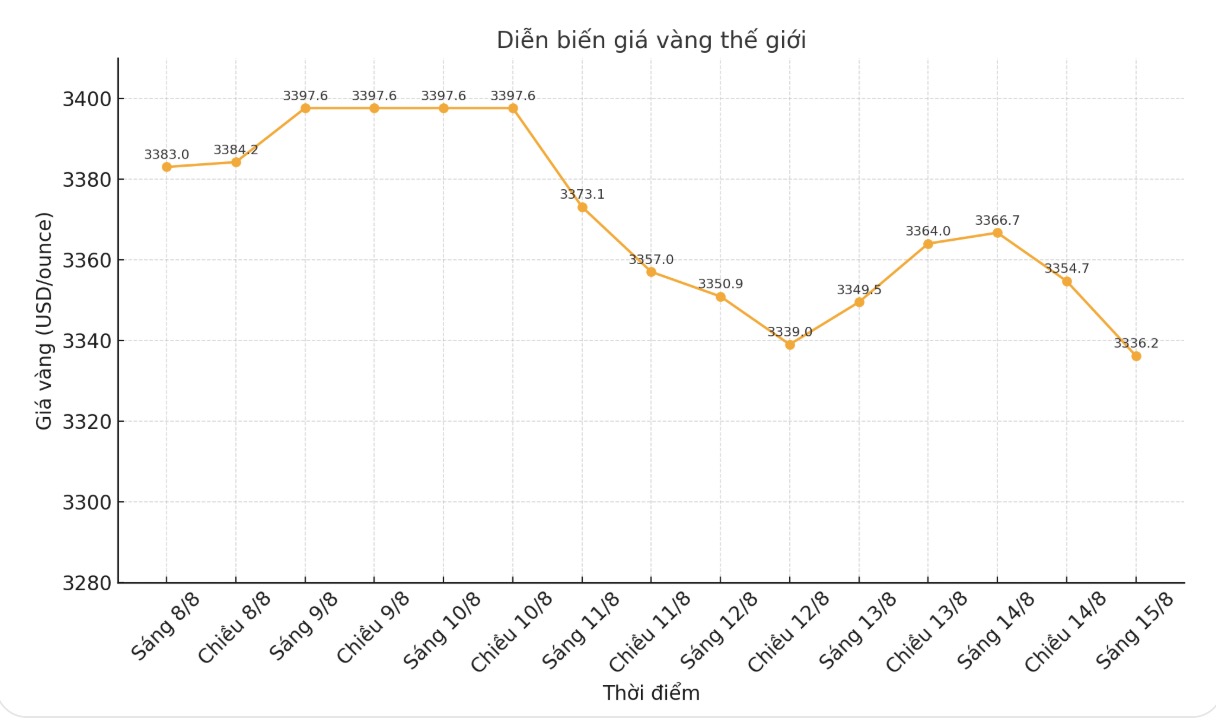

World gold price

The world gold price was listed at 1:25 at 3,336.2 USD/ounce, down 20.9 USD.

Gold price forecast

World gold prices fell after the important US inflation report announced results much higher than expected.

The US producer price index (PPI) in July increased by 0.9% compared to the previous month, much higher than the sideways level in June and far exceeding the forecast of 0.2%. This is the strongest increase since June 2022.

This report reinforces the hawkish view on US monetary policy, which does not want the US Federal Reserve (FED) to cut interest rates soon. Compared to the same period last year, the overall PPI increased to 3.3% - the highest level in 5 months and exceeded the forecast by 2.5%. Core PPI (excluding food and energy) also increased by 0.9%, higher than the forecast of 0.2%.

For the year, core PPI increased by 3.7% compared to 2.6% previously. The hotter-than-expected PPI data in July onlyred the possibility of the Fed cutting interest rates by 25 basis points in September, but almost ruled out the possibility of a 50 basis point cut that a few investors had expected before.

Technically, December gold buyers still have a clear advantage in the short term. The next upside target for buyers is to close above the strong resistance zone of $3,500/ounce. The closest downside target for the bears is to push prices below the solid technical support level at the July low of $3,319/ounce.

The first resistance level was at the overnight peak of $3,423.80/ounce, then $3,450. First support at the lowest level of the week was 3,379.1 USD/ounce, followed by 3,350 USD/ounce.

In other markets, the USD index increased after the PPI report; crude oil prices increased and fluctuated around 63.75 USD/barrel; the yield on the 10-year US Treasury note is currently around 4.2%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...