Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.7/18.7 million/tael (buy - sell), an increase of VND 200,000/tael for buying and VND 500,000/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-118.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-118.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-118.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

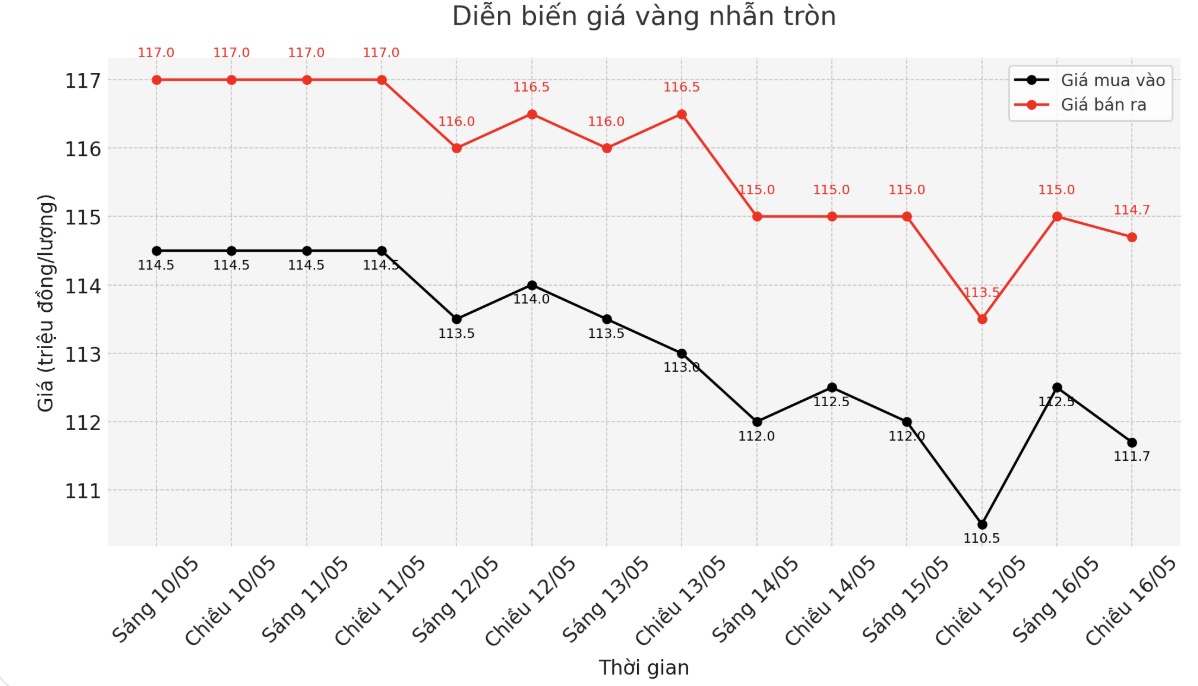

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.7 hydrangeas pertaining to VND11.7 million/tael (buy in - sell out), an increase of VND1.2 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

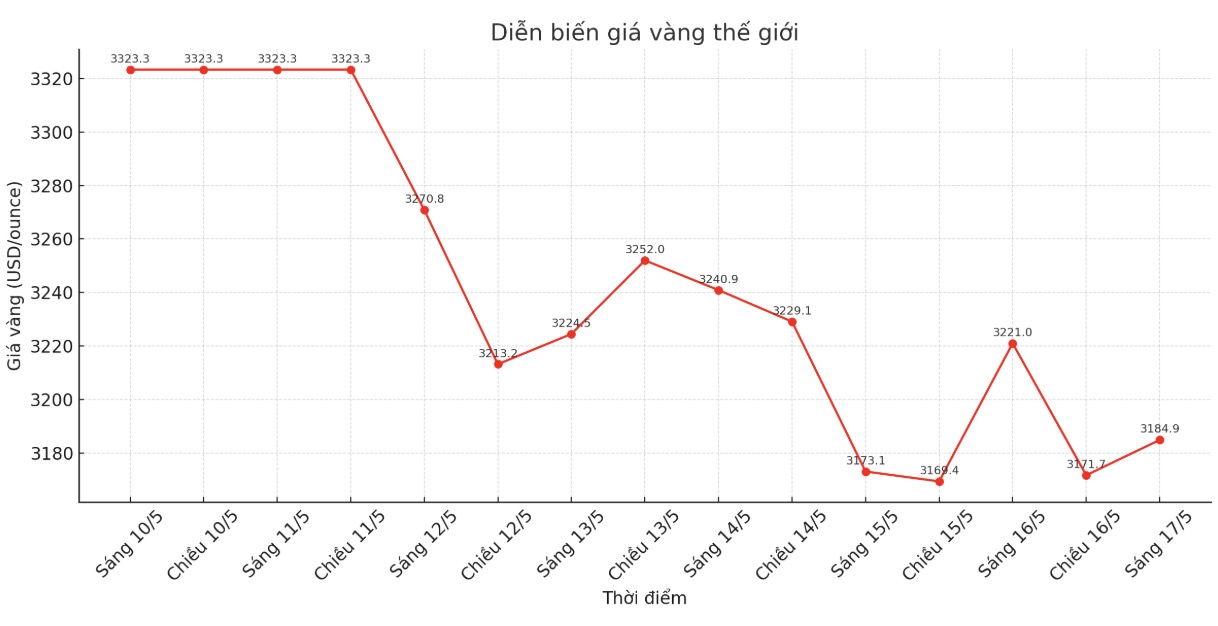

World gold price

At 0:30 am, the world gold price listed on Kitco was around 3,184.9 USD/ounce, down 36.1 USD/ounce.

Gold price forecast

According to Kitco, gold and silver prices fell sharply as investor sentiment became more positive at the end of the week. Both metals have been traded in a tug-of-war manner and have lacked a clear trend in recent sessions.

June gold contract fell 5:98 USD, down to $3,166.8/ounce. July delivery silver price decreased by 0.58 USD, to 32.1 USD/ounce.

The Asian and European stock markets last night fluctuated in opposite directions or weakened. Meanwhile, US stock indexes are expected to open for a rally, showing that investors' risk appetite has improved somewhat. This week saw positive moves from the US and China to ease trade tensions between the two countries.

Barron's magazine sings: "Waring from Walmart and the Fed is a red signal. The market needs to pay attention". The article quoted Walmart CEO as saying that current tariffs have caused costs to increase even though supply is still not really short after a month of trade disruption with China.

Federal Reserve Chairman Jerome Powell has also warned against the possibility of more frequent and prolonged supply shocks affecting the US economy a signal that the Fed is unlikely to cut interest rates in the near term.

Technically in the short term, the buying and selling factions of June gold are in a balanced position, but the buying force is gradually weakening. The goal of the next price increase of the buyer is to close the resistance of 3,300 USD/ounce. In contrast, the seller wants to bring the price below the strong technical support at 3,100 USD/ounce.

The first resistance level was $3,200/ounce, then $3,250/ounce. The first support level was $3,150/ounce, then the lowest level of the week at $3,123.3/ounce.

In the outside market, the USD index is weakening slightly. Crude oil prices traded on Nymex increased slightly, around 62 USD/barrel. The yield on the 10-year US government bond is currently at 4.404%.

See more news related to gold prices HERE...