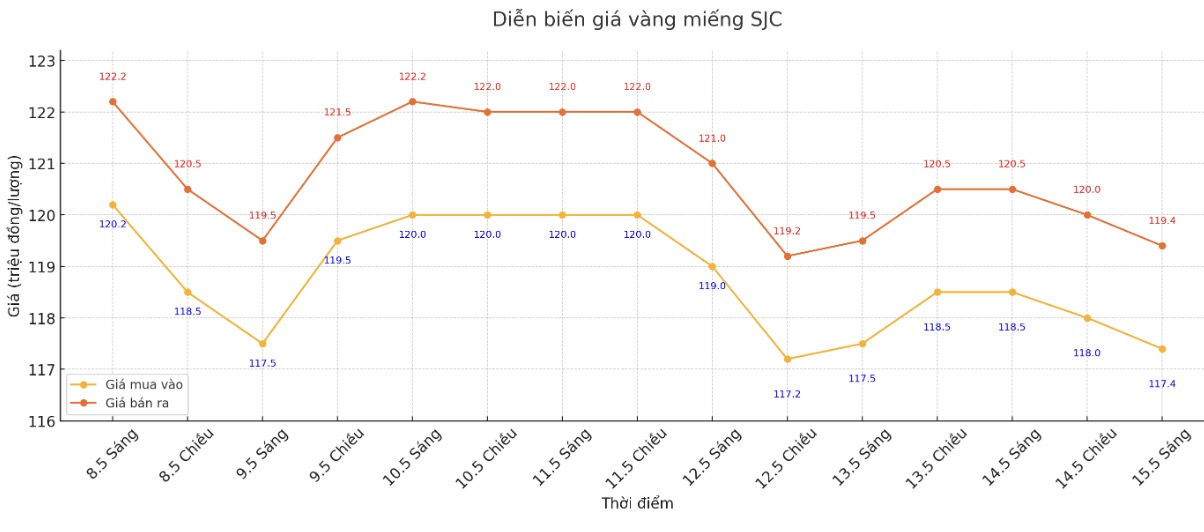

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out), down 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-1194 million VND/tael (buy - sell), down 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-1194 million VND/tael (buy - sell), down 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 116.4-119 4.4 million/tael (buy in - sell out), down VND 1.1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-115 million VND/tael (buy - sell), down 1 million VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.8-125.8 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

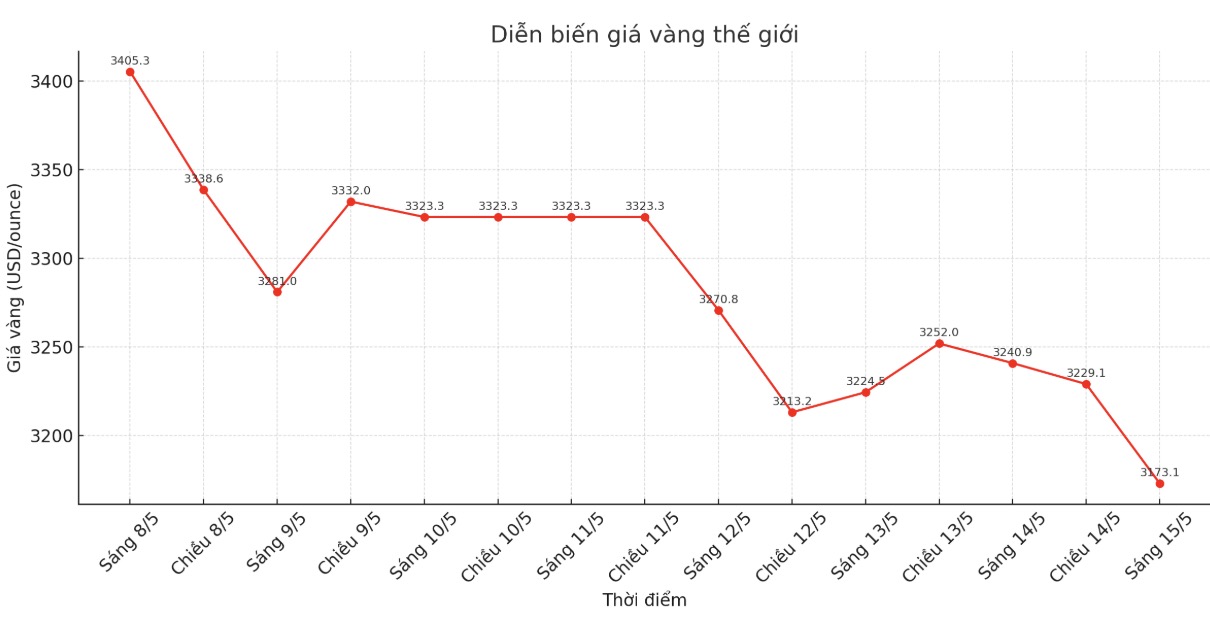

World gold price

At 8:57, the world gold price listed on Kitco was around 3,173.1 USD/ounce, down 67.8 USD/ounce.

Gold price forecast

According to Kitco, world gold prices fell sharply last night, to a 5-week low.

In addition, improved risk-taking sentiment in the investment and trading world is also a negative factor for safe-haven metals such as gold.

Tai Wong - an independent metals trader, commented: "The recovery in the global market due to strong tariffs cuts by the US and China has caused gold prices to break technical thresholds and adjust down".

The main indicators on Wall Street all increased points when opening, thanks to positive information from the tariff agreement and expectations for many other trade agreements.

Washington and Beijing have agreed to cut taxes sharply and postpone escalation measures for 90 days to complete the details of the deal.

US President Donald Trump said he could directly negotiate with Chinese President Xi Jinping, while revealing potential deals with India, Japan and South Korea that are being promoted.

Gold - which is considered a safe haven in times of geopolitical and economic uncertainty - hit a record peak of $3,500.05/ounce last month. Since the beginning of the year, gold prices have increased by 21.2%.

Fawad Razaqzada - market analyst at City Index and FOREX.com - predicted: "Although the long-term trend is still increasing, I will not be surprised if the short-term decline continues in the next few days. The first support level is $3,136/ounce, followed by $3,073/ounce and the important level is $3,000/ounce.

Investors are now waiting for US producer price index (PPI) data to be released on Thursday, after the consumer price index was lower than expected, to predict the direction of interest rate policy from the US Federal Reserve (FED).

Technically, buyers and sellers of gold contracts for delivery in June are in a balanced position in the short term, but buyers are gradually weak. The next upside target for buyers is to close above $3,350/ounce. On the contrary, the near target for the sellers is to push the price below 3,100 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...