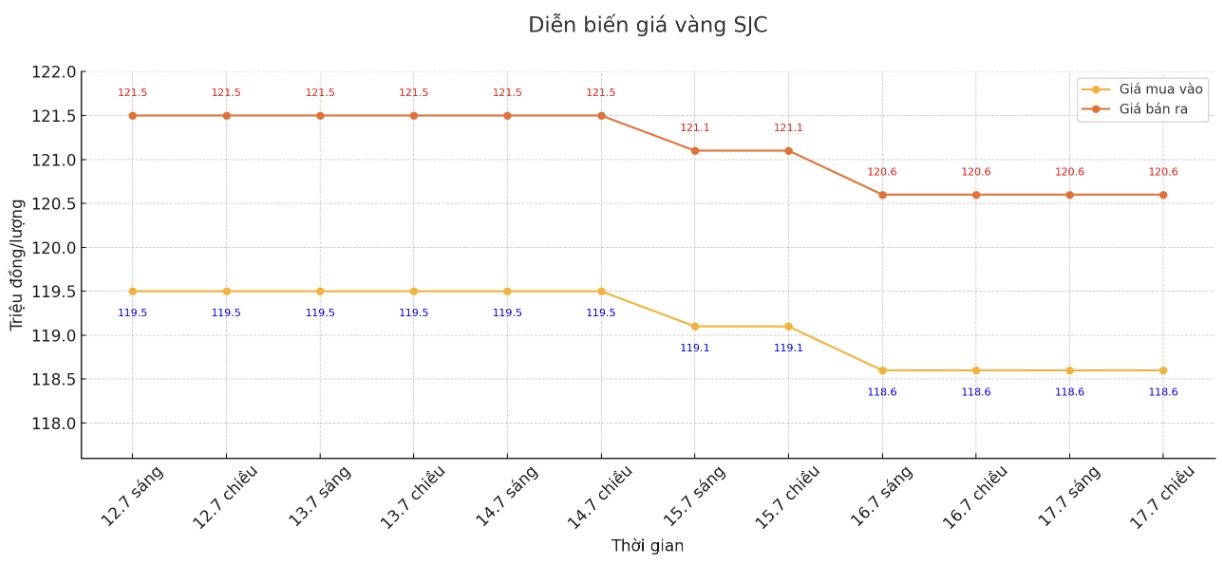

SJC gold bar price

As of 6:00 a.m. on July 18, the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.6-120.6 million VND/tael (buy - sell); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

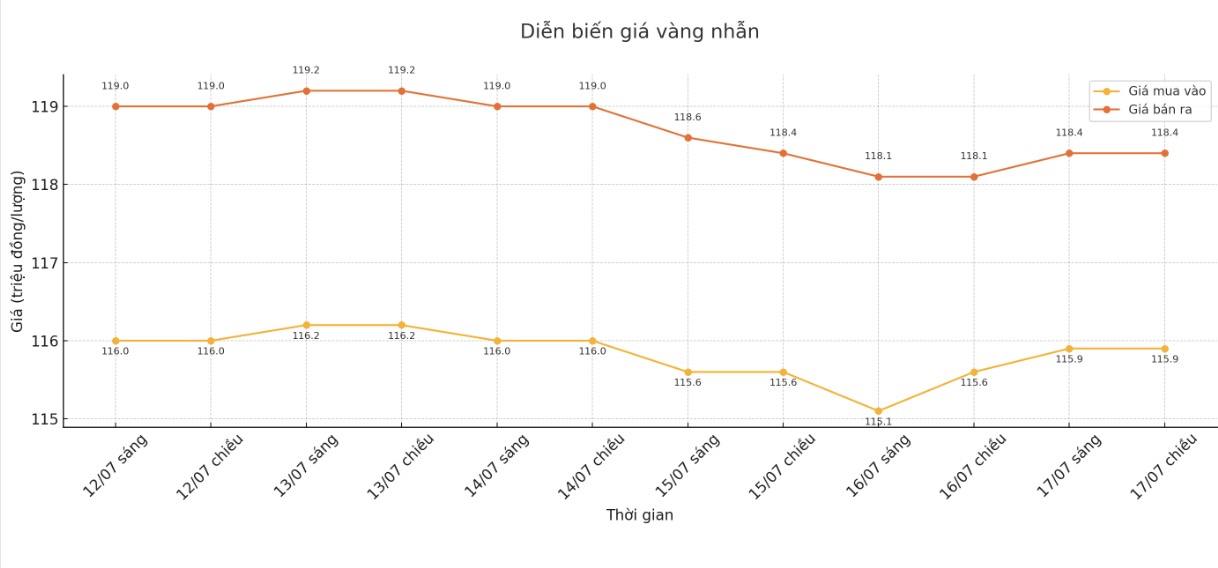

9999 gold ring price

As of 6:00 a.m. on July 18, Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

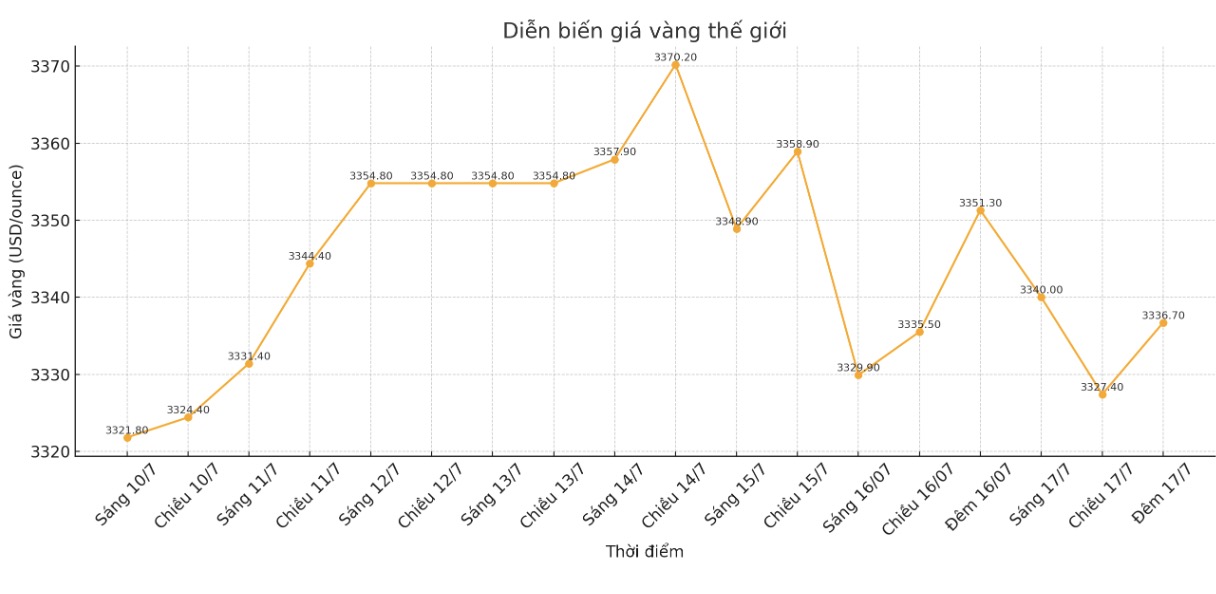

World gold price

Recorded at 53:00 p.m. on July 17, spot gold was listed at 3,336.7 USD/ounce, down 14.6 USD.

Gold price forecast

World gold prices are under selling pressure as the USD index recorded a solid increase today, along with US Treasury bond yields also increased slightly.

August gold contract decreased by 28.7 USD, to 3,330.4 USD/ounce. September delivery silver price decreased by 0.034 USD, to 38.085 USD/ounce.

Asian and European stocks last night had mixed to positive developments. US stock indexes are heading for a mixed opening in New York today.

The quiet trading atmosphere of the summer was stirred up late Wednesday morning after the news that US President Donald Trump could fire FED Chairman Powell. The stock market immediately plummeted while gold prices skyrocketed, but Mr. Trump later announced that he had no plans to fire Powell at the present time. The market quickly stabilized.

Today, the market is returning to a quiet summer, but there will be many US economic data coming out soon.

Technically, August gold buyers still have a short-term technical advantage. The next target for buyers is to get prices above the strong resistance level at $3,400/ounce. The next target for the sellers is to push prices below the solid technical support level at the bottom of June at 3,250.5 USD/ounce.

The first resistance level was last night's high of $3,358.2 an ounce, followed by this week's high of $3,389.3. First support was seen at a weekly low of $3,326.1 an ounce, followed by $3,300 an ounce.

Investors are now waiting for US unemployment claims and retail sales data along with speeches from some Fed officials to reveal monetary policy prospects.

It was the outside market that recorded the USD index continuing to increase today. Nymex crude oil futures increased slightly, trading around 66.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.459%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...