According to the World Gold Council (WGC), the first half of 2025 is a "record-setting" period for the gold market. Gold prices have risen nearly 26% in USD, setting 26 new peaks in just 6 months, continuing a series of 40 historical peaks recorded in 2024.

This strong rally was driven by a weakening of the US dollar recording the worst start to a year since 1973, US bond interest rates moved sideways amid expectations of rate cuts and increasingly complex geopolitical tensions.

Not only that, investment activities through ETFs, exchanges and the OTC market have also increased significantly. On average, gold is traded for up to $329 billion per day, the highest level ever recorded in the first half of a year.

ETF gold holdings increased by 397 tonnes to $38 billion, bringing their total assets to $383 billion, their highest since August 2022.

Using the GRAM model, the WGC analyzed that gold's price increase comes from three main groups of factors, including risk and instability (contributing 4%), opportunity costs (7%) when the USD and market momentum (5%) are due to capital flows into ETFs.

From the second half perspective, the WGC builds three scenarios based on four fundamental factors of the gold market: Economic growth, risks and uncertainty, opportunity costs, and investment momentum.

Optimistic scenario, gold targets nearly $4,000/ounce. In the event of a significant deterioration in economic conditions such as a global recession or recession, safe-haven cash flow will continue to pour strongly into gold.

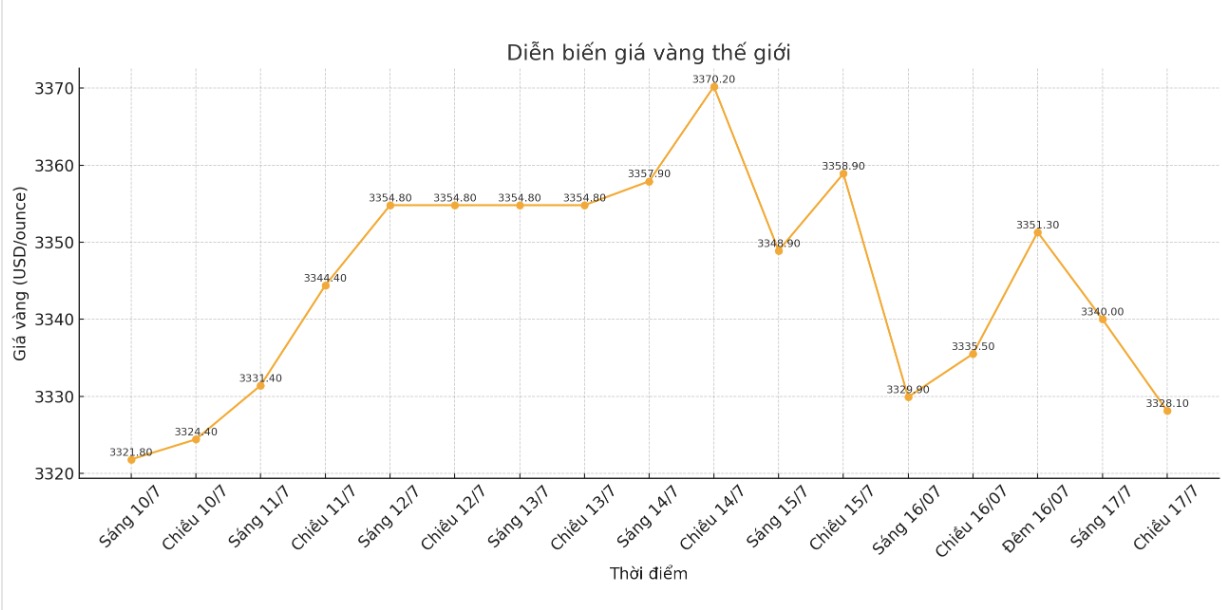

Gold prices could increase by 10 - 15% compared to the current level, ending the year with an increase of nearly 40%. With gold prices currently around $3,300 to $3,450 an ounce, this could bring prices closer to $4,000 an ounce an unprecedented level in history.

The WGC said that although capital flows into ETFs in the first half of the year were very strong, total holdings were still below the historical peak in 2020 of 3,925 tons. In previous boom periods, ETFs have bought between 700 and 1,100 tons at each time, showing great room for further increase if the crisis breaks out.

The neutral scenario reflects market consensus: Global growth is flat, inflation remains high (over 5% globally, 2.9% in the US), and the US Federal Reserve (FED) may cut interest rates by 50 basis points by the end of the year.

In this scenario, gold prices may increase by 0 - 5% in the second half of the year, equivalent to an annual increase of about 25 - 30%. This is a scenario where gold continues to benefit from a favorable macro environment, but no longer breaks out like in the first half of the year.

The negative scenario is built on the most optimistic assumption for the global economy: Geopolitical and trade conflicts are resolved, growth recovers, bond interest rates increase and the USD strengthens again.

At that time, gold will lose its appeal in the risk defense portfolio, possibly losing 12 - 17% compared to the present. However, the WGC believes that technical support at $3,000/ounce will help attract investment cash flow back, limiting the decline too deep.

In the report, the WGC affirmed: With existing fundamental factors including geopolitical instability, loose monetary policy and central bank demand, gold remains an important strategic investment vehicle in the current volatile period.