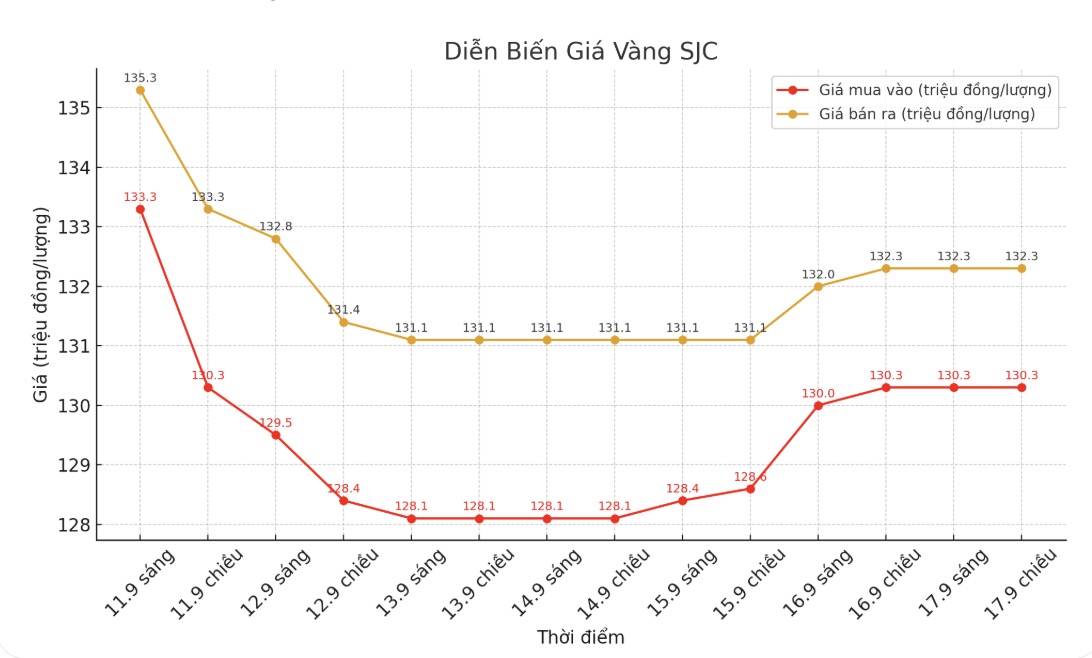

SJC gold bar price

As of 6:00 a.m. on September 18, the price of SJC gold bars was listed by DOJI Group at VND130.3-132.3 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 130.3-132.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129.8-132.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

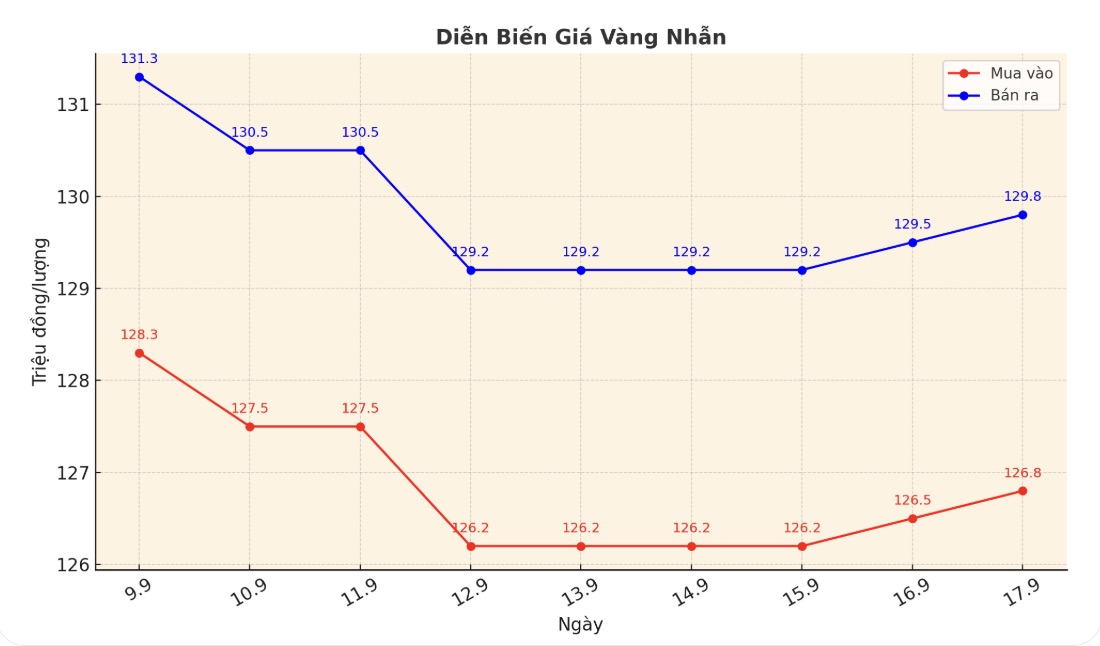

9999 gold ring price

As of 6:00 a.m. on September 18, DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.6-130.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

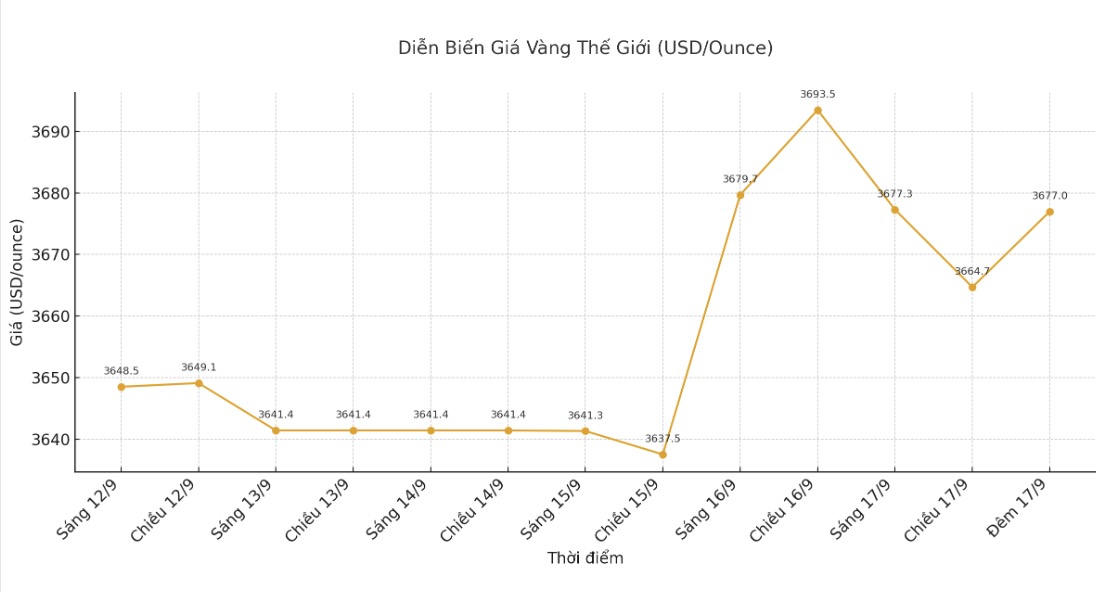

World gold price

The world gold price was listed at 20:30 on September 17 at 3,677 USD/ounce, down 19.1 USD.

Gold price forecast

World gold prices continuously reversed as investors adjusted their portfolios before the US interest rate policy meeting. December gold futures fell $23 to $3,701.40 an ounce, while December futures fell $0.942 to $41.965 an ounce.

The Federal Open Market Committee (FOMC) meeting, which began Tuesday morning, will end Wednesday afternoon (US time) with a statement and press conference by Federal Reserve Chairman Jerome Powell. The FOMC is expected to cut operating interest rates by 0.25 percentage points - the first time since November last year.

The new Fed forecast could also show slowing US economic growth and rising unemployment. At the press conference, Chairman Powell will have to answer many questions not only about economic prospects and interest rates but also about the independence of the Fed.

The global stock market generally increased slightly overnight, while US futures are forecast to open for differentiation. In other developments, China's cyberspace Administration is said to have asked companies such as Alibaba and ByteDance to cancel orders for Nvidia's RTX Pro 6,000D chip line - a chip line designed to avoid restrictions on AI technology exports to China.

This move comes as the US and China have just announced progress in trade negotiations in Madrid (France).

Technically, December gold delivered the short-term bullish advantage. The next upside target for buyers is to close the session above the strong resistance level of 3,800 USD/ounce.

On the contrary, the target for the sellers is to pull the price below the support zone of 3,600 USD/ounce. The nearest resistance zone was at an all-night high of $3,732.8 and then the peak of the week at $3,739.9.9. First support was at an all-night low of $3,695.4, followed by $3,675 an ounce.

In other key markets, the USD index increased slightly, crude oil prices fell to around 64 USD/barrel, and the yield on the 10-year US Treasury note was at 4.02%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...