Gold prices fell in the fourth session from the record high reached in the previous session, due to investors' profit-taking activities and a stronger USD, which put pressure on the time the US Federal Reserve (FED) announced monetary policy.

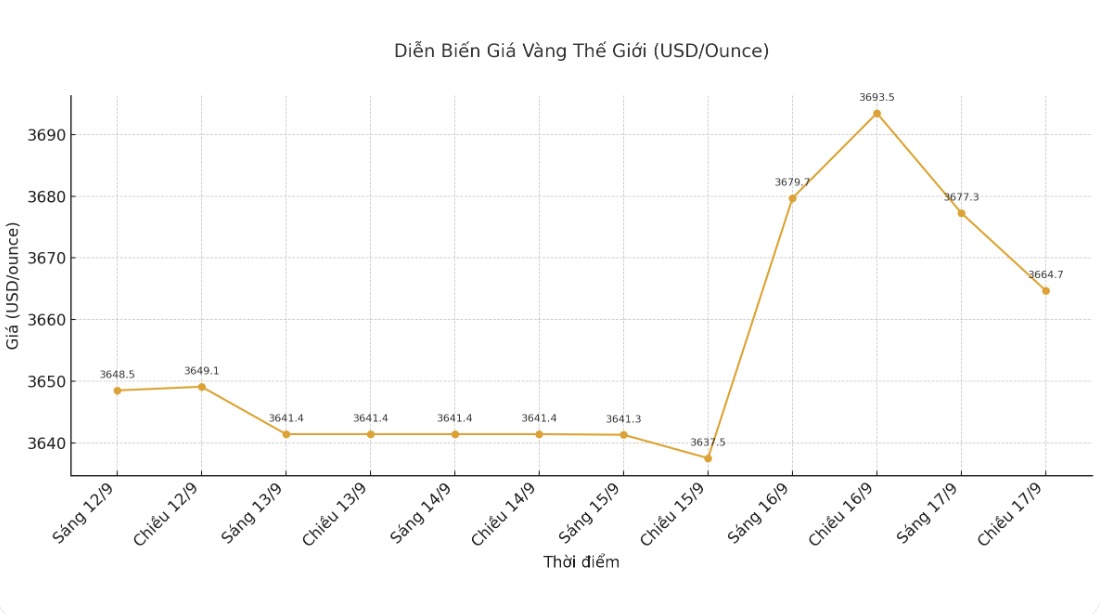

At 4:05 p.m. (Vietnam time), spot gold prices fell 0.7% to $3,663.93/ounce, after hitting a record peak of $3,702.95/ounce on Tuesday. December gold futures in the US also fell 0.7% to $3,700.10/ounce.

The USD Index (DXY) increased by 0.2% after falling to a 2-month low in the previous session. The yield on the 10-year US Treasury note remained near a 5-month low.

Gold has risen nearly $3,700 an ounce and then dropped several times, possibly because investors are using options (a financial derivative, a form of contract that allows them to bet on gold prices to increase or decrease without actually buying gold) to keep prices above this level, explains StoneX analyst Rhona O'Connell.

Gold's relative strength index (RSI) was at 75, down from a 17-month high of 81 recorded on Tuesday, showing that the precious metal is in a state of overbought conditions.

Data released on Tuesday showed that US retail sales in August increased more strongly than expected. However, a weakening labor market and rising price pressure due to tariffs may reduce spending momentum.

The Fed is expected to cut interest rates by 0.25 percentage points per day. Fed Chairman Jerome Powell's speech will also be closely watched for signals on the upcoming interest rate path. We still plan a 0.25-point cut, but there may be three members voting against, OConnell added.

US President Donald Trump called on Chairman Powell to make a "bigger" interest rate cut. Low interest rates reduce the opportunity cost of holding non-interest-bearing assets such as gold.

Deutsche Bank on Wednesday raised its forecast for the average gold price in 2026 from 3,700 USD to 4,000 USD/ounce.

SPDR Gold Trust - the world's largest gold ETF - said that gold holdings increased by 0.32% to 979.95 tons on Tuesday, from 976.80 tons on Monday.

In other precious metals markets, spot silver fell 2.2% to $41.59/ounce, platinum fell 1.1% to $1,375.83/ounce and palladium fell 3% to $1,139.0/ounce.

See more news related to gold prices HERE...