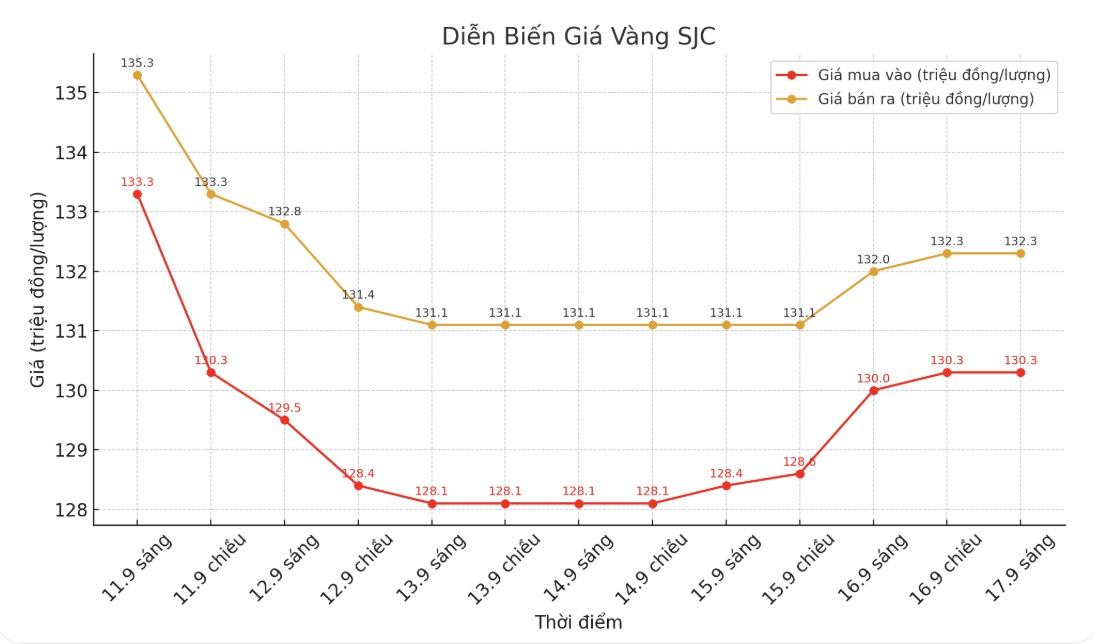

Updated SJC gold price

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 130.3-132.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130.3-132.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129.8-132.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

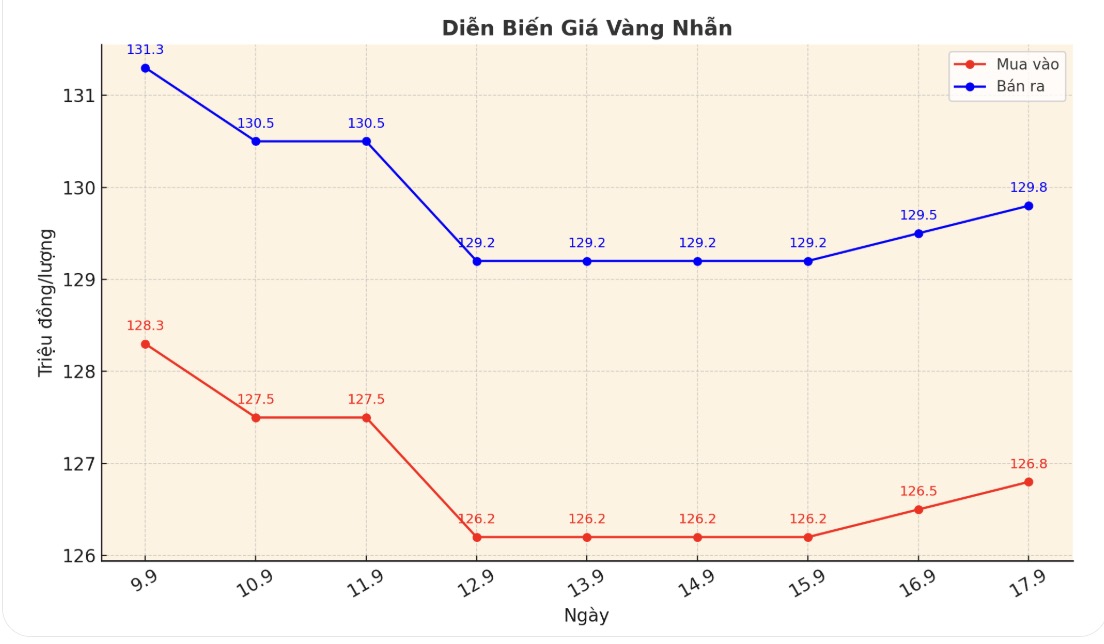

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.6-130.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

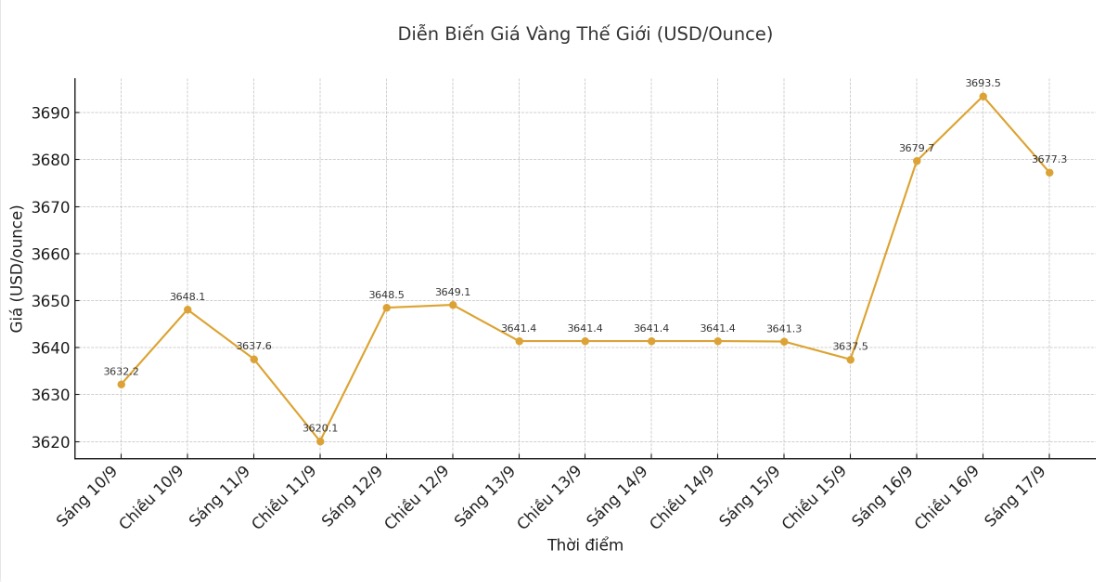

World gold price

At 9:05, the world gold price was listed around 3,677.3 USD/ounce, down 2.4 USD.

Gold price forecast

Gold prices increased sharply last night, approaching a peak of 3,700 USD/ounce due to receiving support because the US Federal Reserve (FED) expected to loosen monetary policy in the coming months. However, the precious metal quickly fell as many investors took profits at peak prices.

The Federal Open Market Committee (FOMC) meeting ended Wednesday afternoon (US time) with a policy announcement and a press conference by FED Chairman Jerome Powell.

The FOMC is expected to cut interest rates by 25 basis points, which will be the first time it has cut since November 2024. The decision comes amid criticism that the Fed responded slowly to weakening US economic data.

The Fed's updated forecast today could show slowing US growth and rising unemployment rates, while Chairman Powell will face harsh questions about monetary policy at the press conference.

The global stock market last night had mixed movements. US stock indexes are expected to open slightly and be at a record level when the New York session begins.

In overnight news, there are positive signals from US-China trade negotiations in Madrid (Spain). The US and India are also stepping up talks to address trade tensions, with two groups of officials meeting in New Delhi this week.

The meeting is expected to decide the next direction of negotiations, after the US imposed a 50% tariff on Indian goods last month to punish trade barriers and India's purchases of Russian oil.

Bank of America experts say the current economic context is especially favorable for gold. The bank stressed the risk of stagflation as a key driver of demand for precious metals.

In fact, as high inflation comes with slow growth, the intrinsic value of gold becomes more attractive to both institutional and individual investors.

In further strengthening this trend, the US consumer price index (CPI) in August increased by 2.9% - high enough to continue supporting gold prices.

Technically, December gold futures show that buyers still have a strong advantage in the short term. The next upside target is to close above the resistance level of $3,800/ounce.

The first support level was at an overnight low of $3,711.8/ounce and then $3,700. The first resistance was at $3,750/ounce and then $3,775/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...