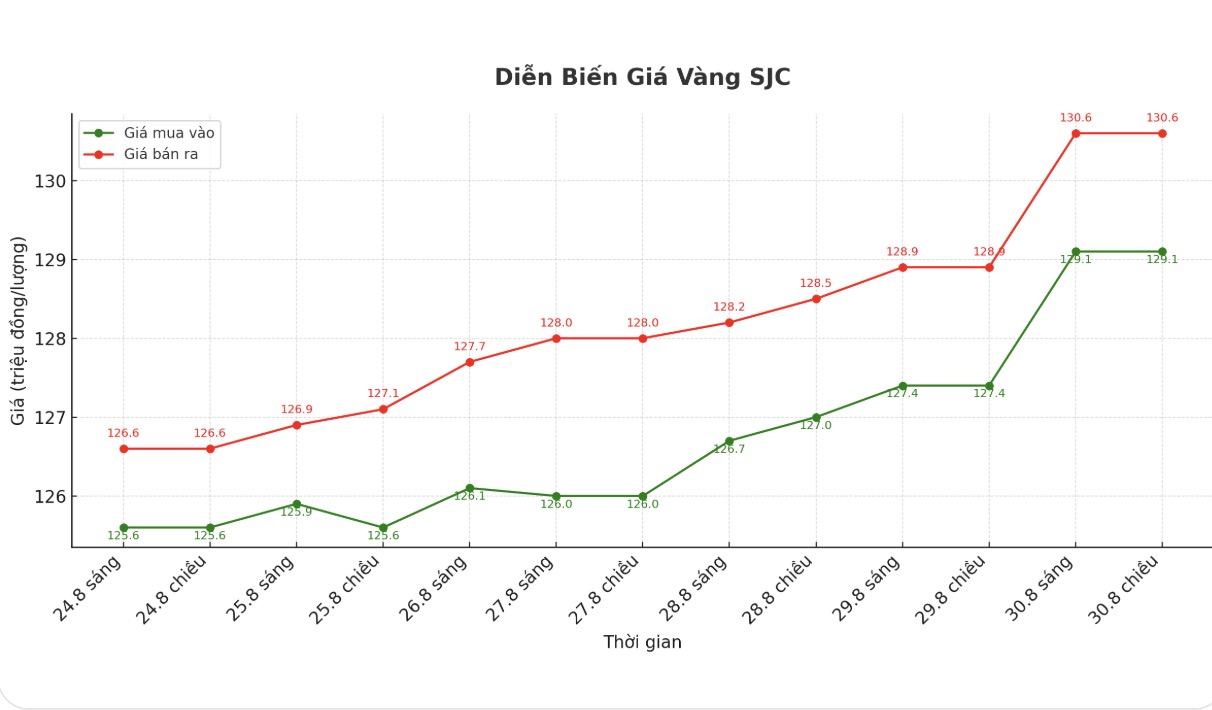

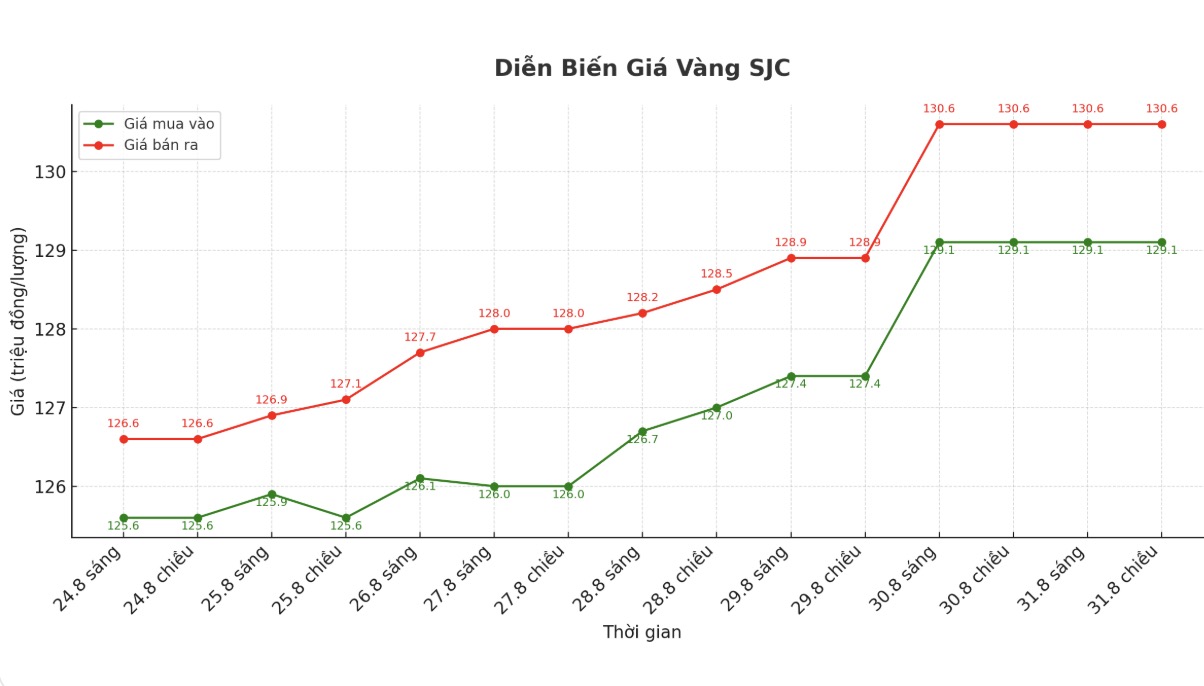

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 129.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 128.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 122.5-125.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 122.6-125.6 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.3-125.3 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

World gold price

The world gold price was listed at 6:00 a.m. at 3,446.5 USD/ounce.

Gold price forecast

The weekly gold survey of an international financial information platform shows that Wall Street is fully supportive of the scenario of gold prices continuing to increase. While the majority of retail investors also predict the precious metal will move up this week.

There were 14 analysts participating in the survey. After last week's strong price increase, no expert predicts that gold will decrease. Of these, 12 people (86%) expect gold prices to rise this week, while the remaining 2 people (14%) expect gold to move sideways.

179 investors participated in online voting. After a week of strong gold gains, optimism is also spreading: 121 investors (68%) predict gold prices will continue to increase, 30 people (17%) believe gold will decrease, while 28 people (16%) predict gold will fluctuate sideways in the following week.

In the medium term, gold prices are forecast to reach $5,000/ounce in the event that the FED cuts interest rates and global instability continues to increase.

RBC Capital Markets expects gold to average $3,722/ounce in the fourth quarter of 2025, reaching $3,813 by 2026.

For longer, InvestingHaven has set a gold scenario of $3,500 this year, or even $3,900 in 2026.

HSBC is more cautious, predicting that gold prices could retreat to around $3,215 in 2025 due to cooling demand.

In short, most major organizations agree that gold will maintain its upward trend in the short and medium term, with the new bottom higher than before. By 2030, many forecasts predict that gold could reach the $5,000/ounce mark if the geopolitical and monetary scenario continues to be unstable.

Notable US economic data next week

Monday: North American market has Labor holiday.

Tuesday: ISM manufacturing PMI.

Wednesday: JOLTS employment data.

Thursday: ADP, unemployment claims, ISM services PMI.

Friday: Non-farm payrolls report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...