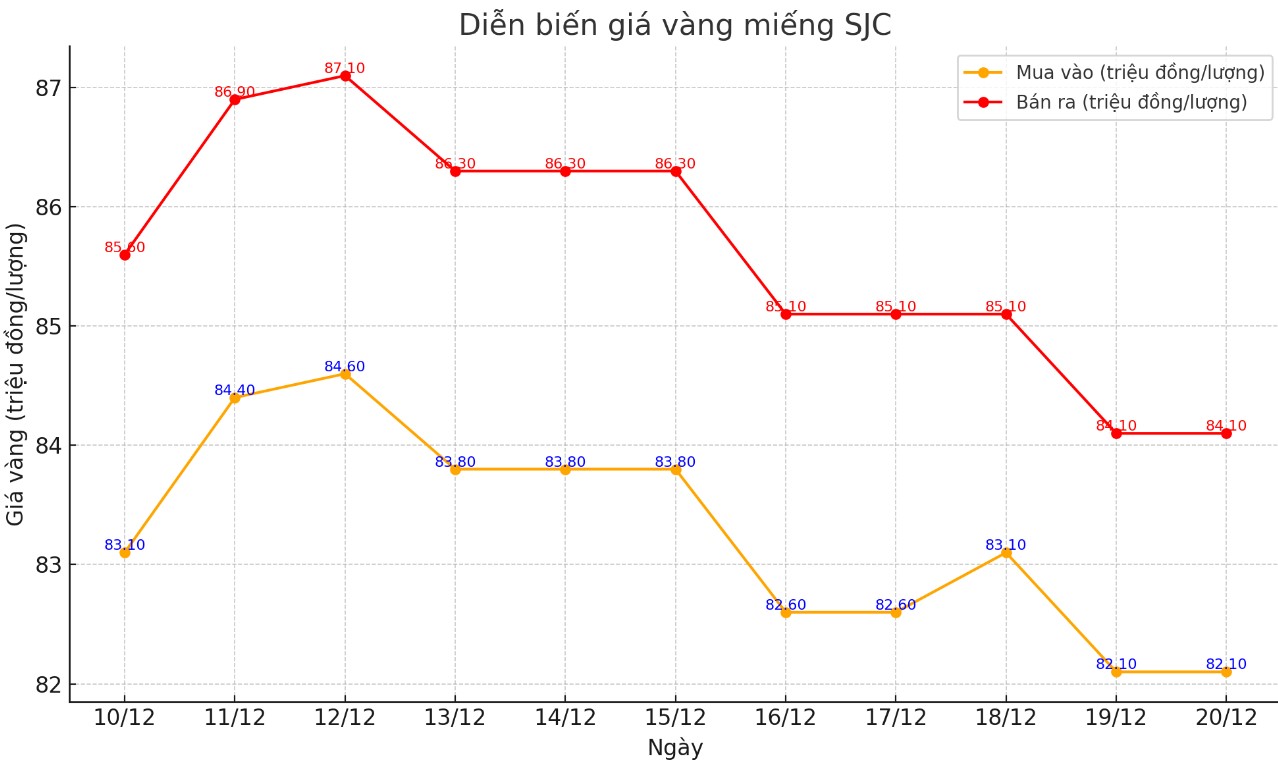

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.1-84.1 million/tael (buy - sell); down VND1 million/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.1-84.1 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 1 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.1-84.1 million VND/tael (buy - sell); down 1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

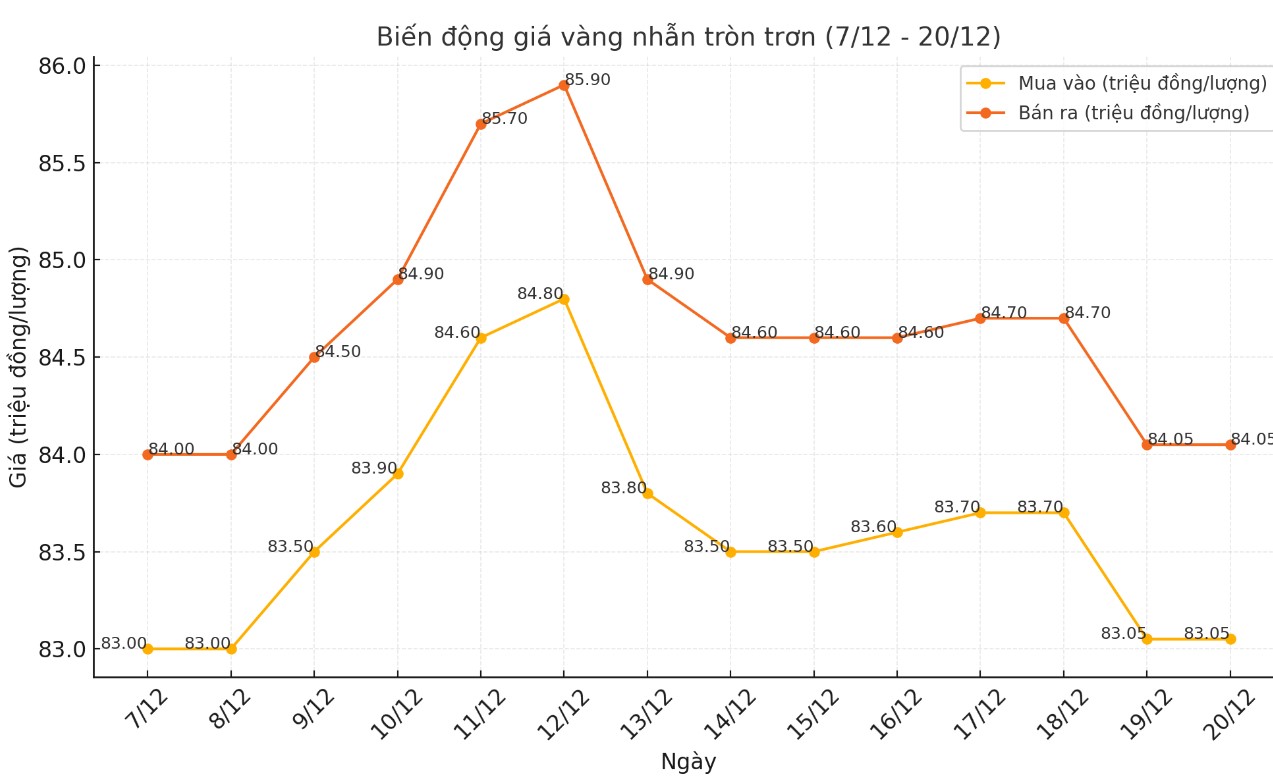

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.05-84.05 million VND/tael (buy - sell); down 650,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.1-84.1 million VND/tael (buy - sell), down 630,000 VND/tael for buying and down 930,000 VND/tael for selling compared to the beginning of yesterday's trading session.

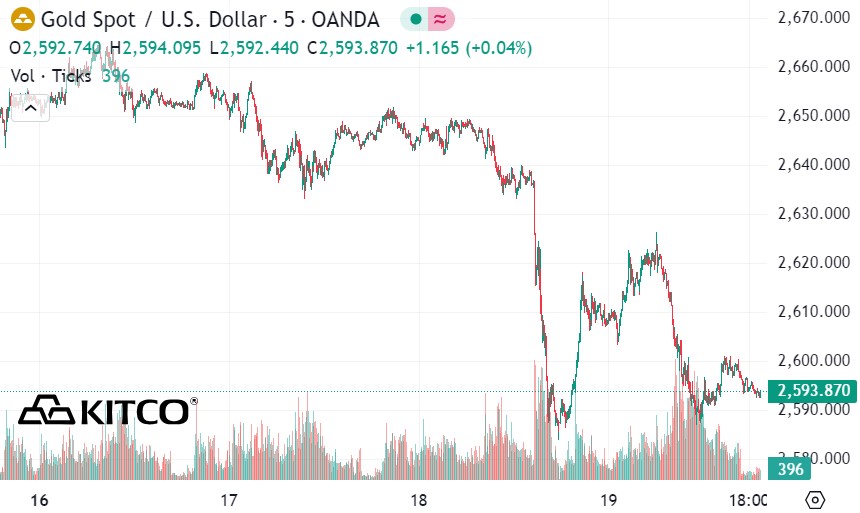

World gold price

As of 7:20 a.m. on December 20 (Vietnam time), the world gold price listed on Kitco was at 2,593.8 USD/ounce, down 42.4 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices fell sharply as the USD index increased. Recorded at 7:20 a.m. on December 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.150 points (up 0.37%).

Gold and silver prices fell sharply after the US Federal Reserve's unexpectedly hawkish message on Wednesday afternoon. Gold prices hit a four-week low, while silver prices fell to a three-month low.

Investors were stunned by the Fed’s surprise shift in U.S. monetary policy. Although the Fed announced a 25 basis point rate cut as expected, the dot plots in the Federal Open Market Committee’s (FOMC) quarterly summary report showed that most members forecast only a 50 basis point rate cut in 2025. This is a big change from the last meeting in September, when the FOMC forecast a 100 basis point cut in 2025.

The move sent the dollar index soaring and US Treasury yields rising sharply.

Fed Chairman Jerome Powell said in a press conference after the FOMC meeting that this is a “new phase” where inflation concerns are again on the table. He said that current policy “remains significantly accommodative,” and that this is necessary because inflation is still above the 2% target. “We still have a lot of work to do to bring inflation down,” Powell stressed.

Despite the steep decline, the precious metal could get some support on Friday as a temporary funding deal for the U.S. government collapsed after President-elect Trump objected, raising the possibility of a U.S. government shutdown this week. If the debt ceiling is not raised and the U.S. government shuts down, it would “certainly cause chaos,” according to a Bloomberg report.

“The US stock market could be affected, but any rise in US yields could have negative implications for the rest of the world,” the report said. If markets become more concerned about the risk of a prolonged US government shutdown, gold and silver prices could be supported.

Overseas markets saw Nymex crude oil futures fall slightly, trading around $70 a barrel. The yield on the 10-year US Treasury note is currently around 4.6% - its highest level since May.

Economic data calendar this week:

Thursday: Bank of England monetary policy decision, US weekly jobless claims, Q3 GDP final, Philly Fed manufacturing survey, existing home sales

Friday: US Personal Consumption Expenditures (PCE) Index.

See more news related to gold prices HERE...