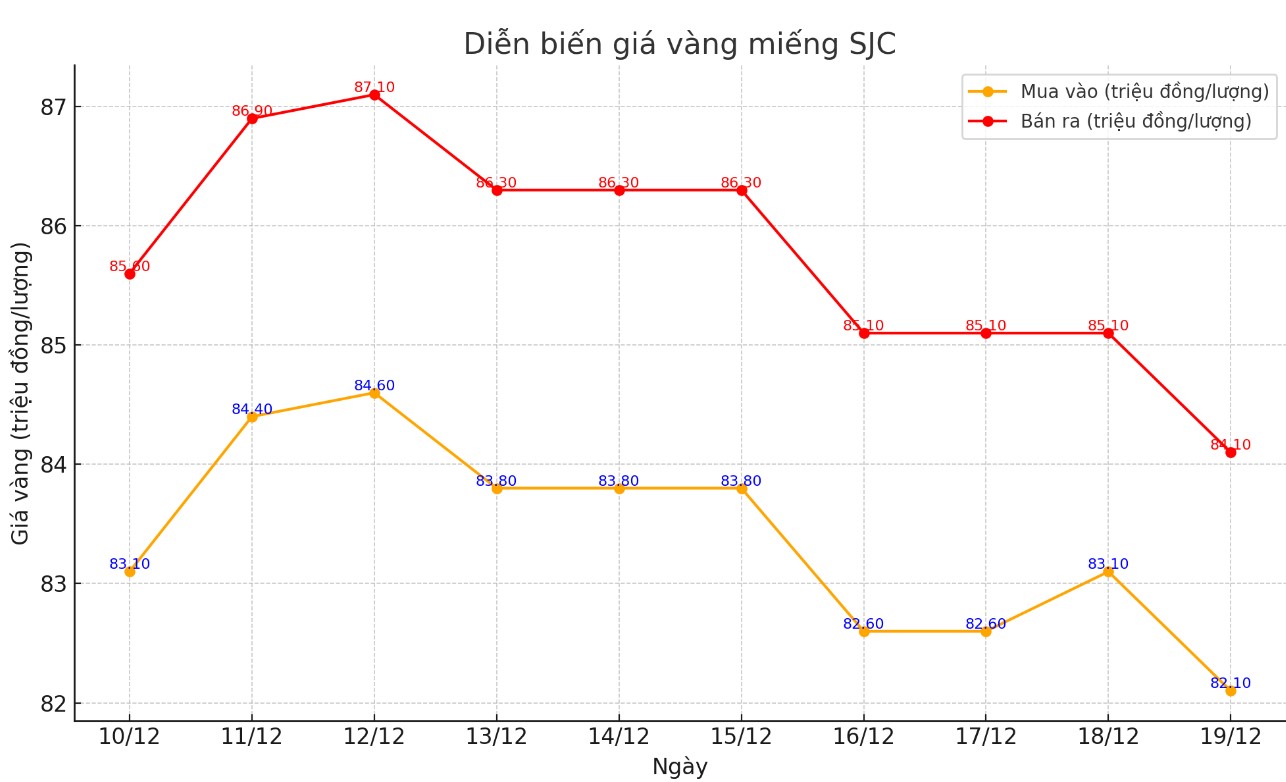

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.1-84.1 million/tael (buy - sell); down VND1 million/tael for buying and unchanged for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 81.9-83.9 million VND/tael (buy - sell); down 700,000 VND/tael for buying and down 1.2 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 81.9-83.9 million VND/tael (buy - sell); down 700,000 VND/tael for buy and down 1.2 million VND/tael for sell.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

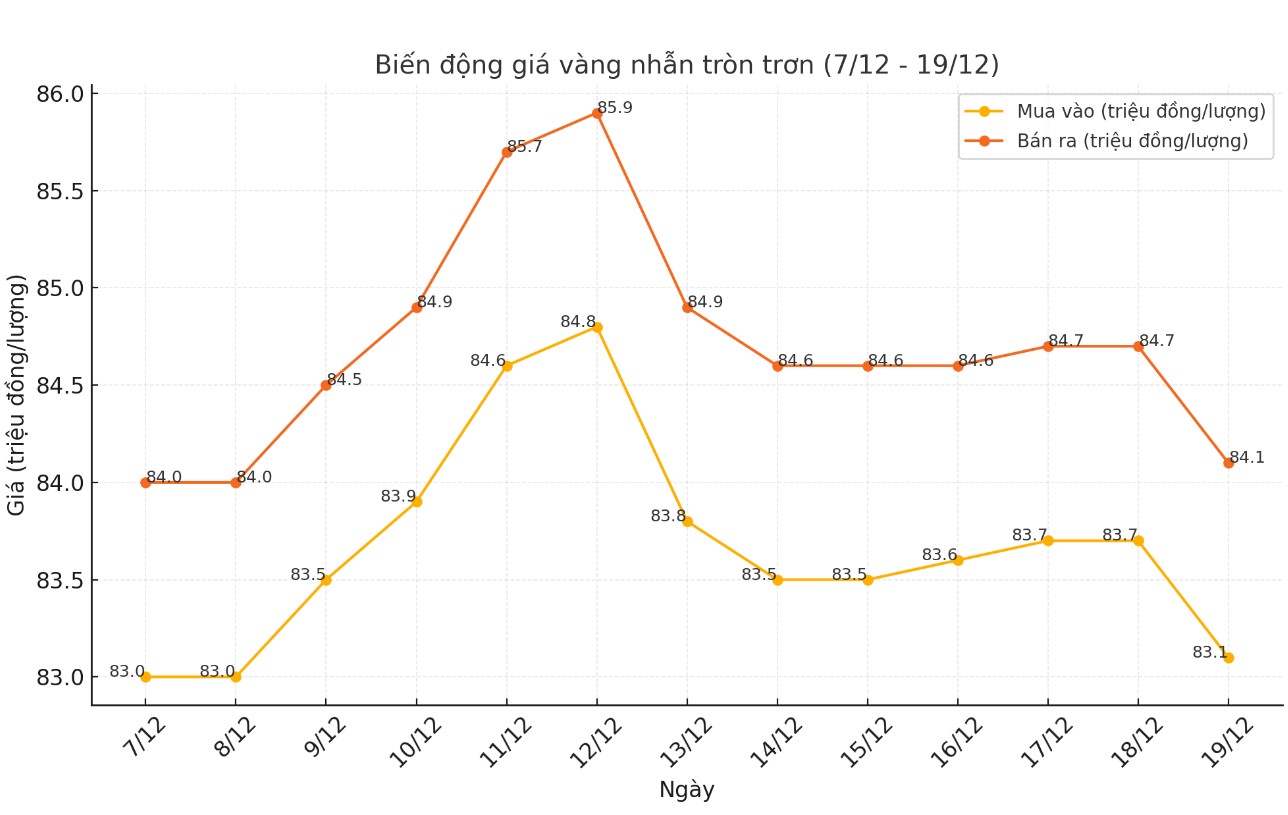

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.1-84.1 million VND/tael (buy - sell); down 600,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.83-84.03 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 1 million VND/tael for selling compared to early this morning.

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,609.5 USD/ounce, down 38.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell sharply as the USD increased. Recorded at 9:30 a.m. on December 19, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107,780 points.

According to Reuters, after a two-day policy meeting, the US Federal Reserve (FED) decided to cut its benchmark interest rate by 25 basis points (0.25%), pushing the interest rate down to around 4.25-4.5%. This decision completely matched investors' forecasts.

However, the Fed also appeared cautious about the prospect of monetary easing in 2025, with the total expected interest rate cut being only 50 basis points.

Lower interest rates are a fundamental factor that increases the appeal of gold, as the opportunity cost of holding the non-yielding precious metal will be lower. However, the Fed's cautious stance on fewer rate cuts than expected next year could put upward pressure on gold prices.

In addition, U.S. government bond yields edged up on December 18, with the 10-year yield hitting its highest since May. Bonds are considered a direct competitor to gold because they offer interest. As bond yields rise, gold may lose its appeal to investors.

The market is showing concern as Fed Chairman Jerome Powell signaled a slowdown in interest rate cuts amid a complicated inflation situation, said independent metals trader Tai Wong. Wong stressed that the core PCE data, due later in the week, is the focus of investors.

“Gold is falling below $2,600 an ounce, which may be a concern for some speculators. The US central bank has also just released a new forecast, expecting two quarter-point rate cuts next year. This is considered a cautious strategy, in line with the current situation, as President-elect Donald Trump prepares to take office in January 2025,” Wong said.

See more news related to gold prices HERE...