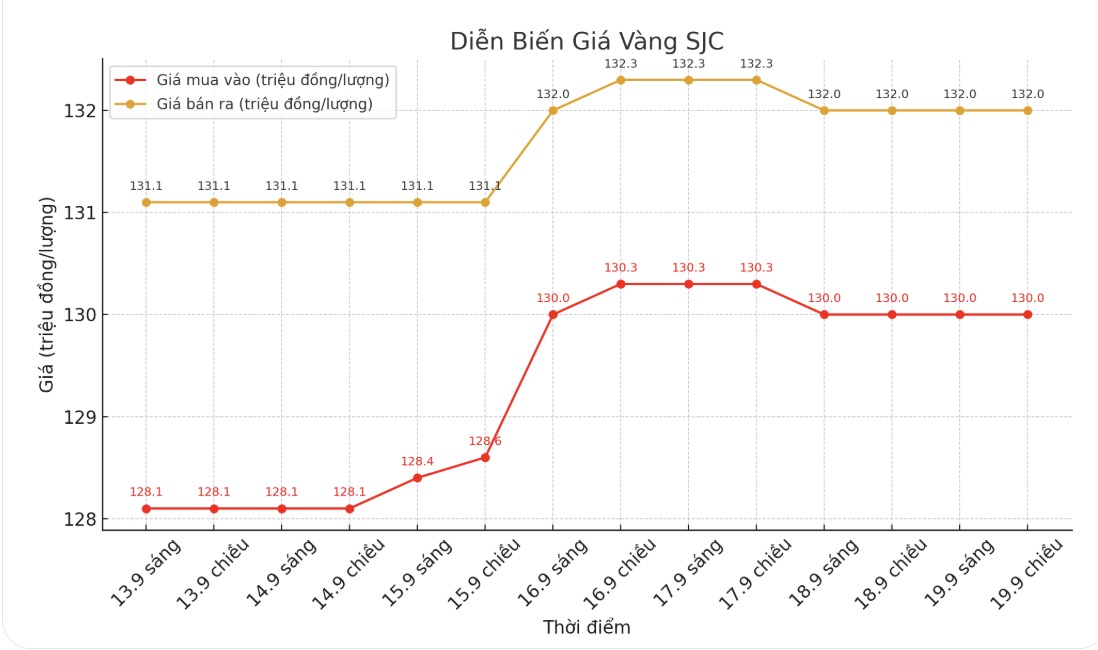

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 130-132 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130-132 million VND/tael (buy - sell), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129.3-132 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

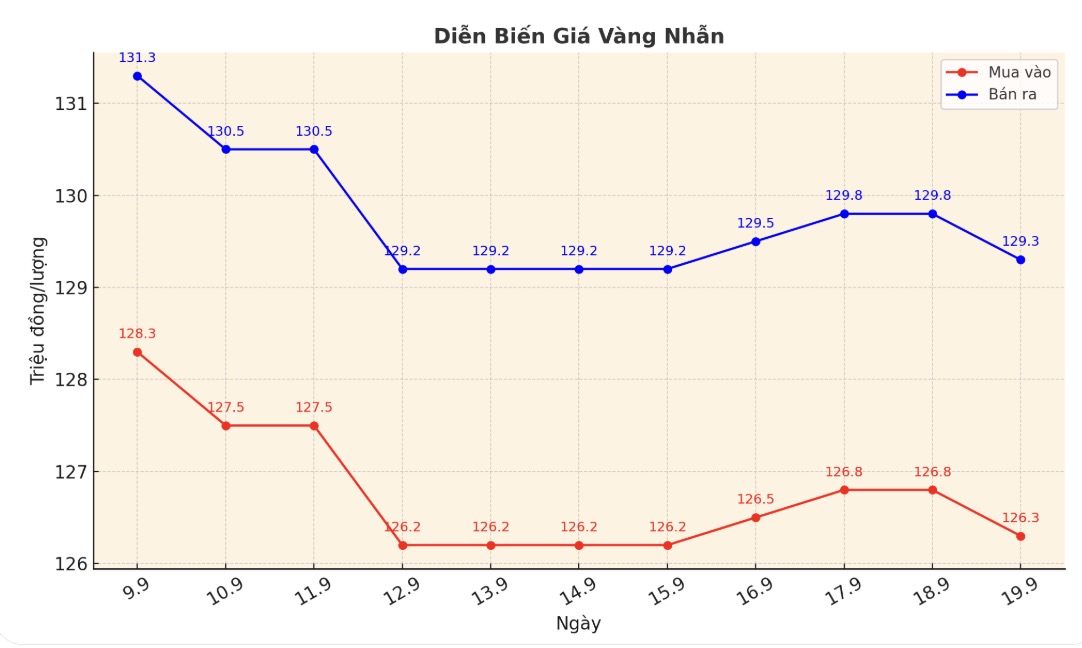

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

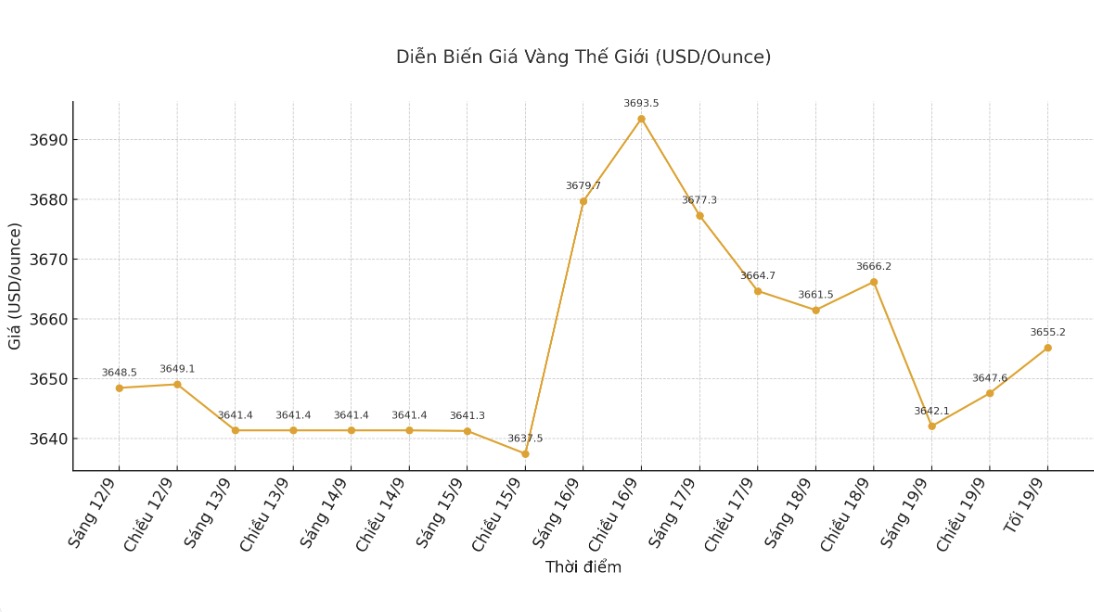

World gold price

The world gold price was listed at 20:30 on September 19 at 3,655.2 USD/ounce.

Gold price forecast

World gold prices increased slightly but were still held back by the USD index increasing sharply at the end of the week and US Treasury bond yields increasing.

December gold futures increased by 2.4 USD to 3,680.5 USD/ounce, December silver futures increased by 0.207 USD to 42.325 USD/ounce.

The global stock market last night had mixed developments to weaken. US stock indexes are forecast to open almost sideways and head towards record levels when the New York session begins.

The focus of investors' attention is the scheduled phone call between US President Donald Trump and Chinese President Xi Jinping during the day.

In Mexico, Canadian Prime Minister Mark Carney and Mexican President Claudia Sheinbaum announced the implementation of the Canady-Mexican Action Plan to promote bilateral trade in the fields of infrastructure, energy and agriculture.

The two leaders emphasized the importance of tripartite strength in the US-Mexico-Canada Trade Agreement (USMCA) ahead of next year's review, affirming that "North America is the world's envy for the economy" thanks to close cooperation.

Technically, December gold futures bulls still have a solid advantage in the short term. The next target for buyers is to close above the resistance level of $3,800/ounce. In contrast, the nearest target for the bears is to pull prices below the solid support of $3,600/ounce.

The first resistance level was determined at the peak on Thursday of 3,707.3 USD, followed by the peak of the week of 3,744 USD/ounce. For now, the weekly support is at $3,660.5 and then $3,650/ounce.

According to Quyuyy Christopher Lewis, a metal analyst, gold is still attracting buying momentum as prices have fallen following the interest rate cut by the US Federal Reserve (FED). The technical picture still supports the uptrend, despite the fluctuations caused by central banks this week.

The gold market has created a bearish space at the opening of the trading session on Thursday, due to a slight profit-taking. I think the market has been very positive for a long time, so a slight correction is necessary, Lewis said.

Meanwhile, Jim Wyckoff - senior analyst at Kitco commented that both gold and silver had a good increase before, so the downward correction is predicted and could continue for a while. However, December gold buyers still have a solid advantage.

In outside markets, the USD index continued to increase, crude oil prices decreased slightly to about 63.25 USD/barrel, and the yield on the 10-year US Treasury note is currently at 4.13%. No major economic data was released in the US on Friday.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...