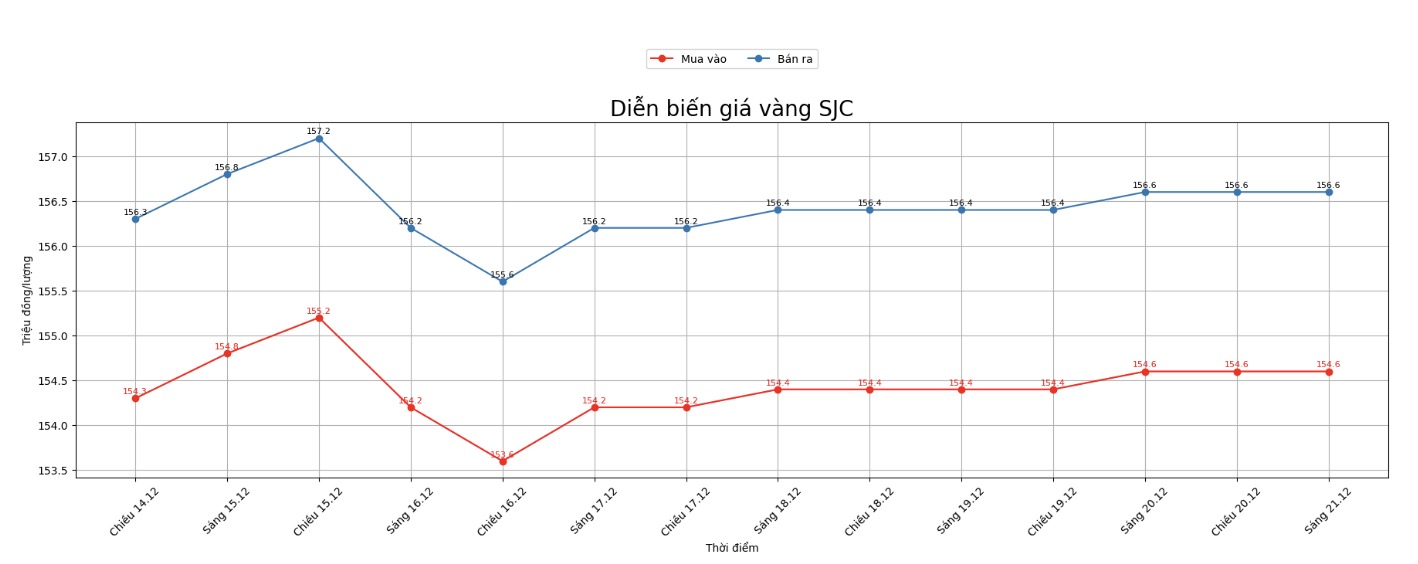

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND154.6-156.6 million/tael (buy in - sell out), an increase of VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

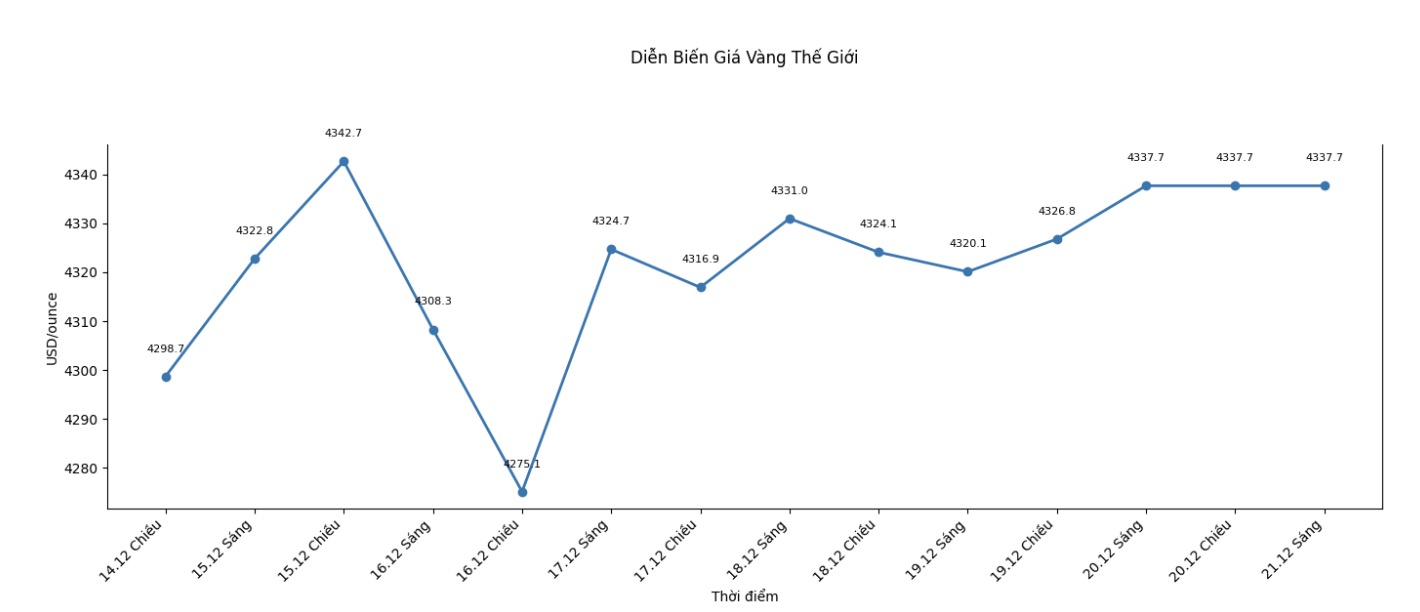

World gold price

The world gold price was listed at 6:00 a.m., at 4,337.7 USD/ounce, unchanged from a day ago.

Gold price forecast

The gold market has set new highs in the last session of the week, after the latest data showed that consumer confidence in the US declined, while inflation expectations continued to decline.

The University of Michigan said on Friday that the final result of the December Consumer Confidence survey reached 52.9 points.

This figure is lower than the forecast of the economists, when the market consensus expected a rate of 53.5 points, after the preliminary figure of 53.3 points. However, the result is still higher than the 51 point mark for November.

The US dollar rose to its highest level in more than a week, making greenback-denominated precious metals more expensive for investors holding other currencies.

Mr. Zain Vawda - an analyst at MarketPulse of OANDA - commented: "Gold is under some pressure, most likely due to the year-end position adjustment and the quiet trading atmosphere before the holiday".

He added that recent weaker-than-expected US economic data has supported the prospect of a Fed rate cut next year.

Notably, Goldman Sachs forecasts gold prices will continue to set new records thanks to the Fed cutting interest rates, while crude oil is under additional supply pressure until 2026.

Goldman Sachs analysts, including Daan Struyven and Samantha Dart, said gold prices could set a new record next year, while the oil market continues to be under pressure from supply. The bank's base scenario is gold prices rising to $4,900/ounce, with the risk leaning up.

Overall, the commodity market is forecast to increase slightly this year, but this general picture hides a huge differentiation between key commodity groups. While gold continues to increase thanks to strong central bank buying, the US Federal Reserve's (Fed) interest rate cutting cycle and cash flow into ETFs, crude oil prices are under heavy pressure from concerns about large-scale excess supply.

Shooting US interest rates is starting to make ETF investors compete directly with central banks to hold limited physical gold, said the Goldman Sachs analysis team.

According to this bank, two key drivers - highly structured demand from central banks and cyclical support from the Fed's interest rate cuts will continue to push gold prices higher.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...