Despite the pressure, gold prices are still expected to record an increase this week, thanks to cooling US inflation data, thereby strengthening expectations that the US Federal Reserve (Fed) will cut interest rates.

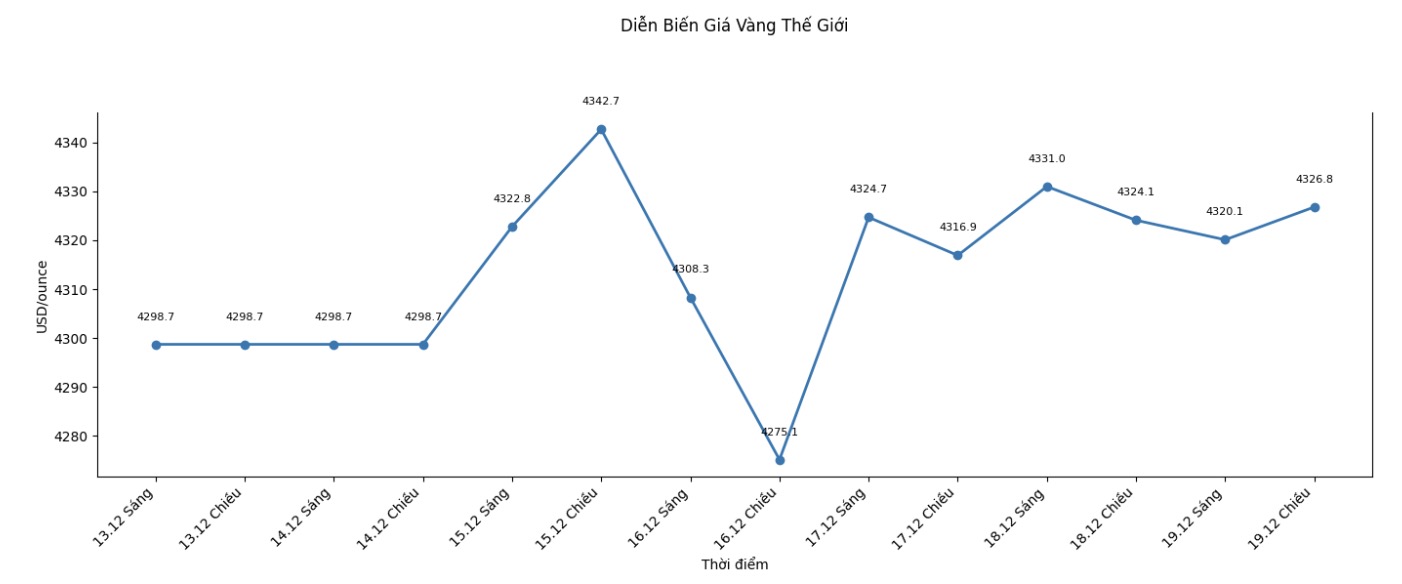

Spot gold fell 0.1% to $4,326.29 an ounce at 9:35 a.m. GMT, but was still on track for a 0.6% increase for the week, after recovering near record highs set in October. US gold futures fell 0.2% to $4,354.80 an ounce.

Meanwhile, spot silver rose 0.7% to $65.9/ounce and is on track for a 6% gain for the week, after soaring to an all-time high of $66.88/ounce on Wednesday.

Since the beginning of the year, silver has increased by 128% thanks to strong industrial demand, surpassing gold - a metal that has increased by about 65% in the same period.

The US dollar rose to its highest level in more than a week, making greenback-denominated precious metals more expensive for investors holding other currencies.

Mr. Zain Vawda - an analyst at MarketPulse of OANDA, commented: "Gold is under some pressure today, most likely due to year-end position adjustment activities and a quiet trading atmosphere before the holiday".

He added that recent weaker-than-expected US economic data has supported the prospect of a Fed rate cut next year.

According to published data, the US consumer price index (CPI) in November increased by 2.7% compared to the same period last year, lower than the forecast of 3.1% by economists.

Speaking on Thursday, Chicago branch Fed President Austan Goolsbee said that if this lower-than-expected inflation trend is maintained, it could open up opportunities for more interest rate cuts next year.

The federal interest rate futures market shows that the possibility of the Fed cutting interest rates at its January meeting has increased after the release of inflation data.

In a report released on Thursday, Goldman Sachs forecasts gold prices could rise 14% to $4,900/ounce by December 2026 in the base scenario, driven by strong, structural demand for gold from central banks, along with cyclical support from the Fed's rate cuts.

In other precious metals, platinum rose 1.5% to $1,944.71/ounce, after hitting a more than 17-year high on Thursday. Palladium fell slightly by 0.1% to $1,694.75 an ounce, despite previously reaching a nearly three-year high in the session.

Both metals are heading for a weekly gain, with palladium expected to record its strongest gain week since September 2024.