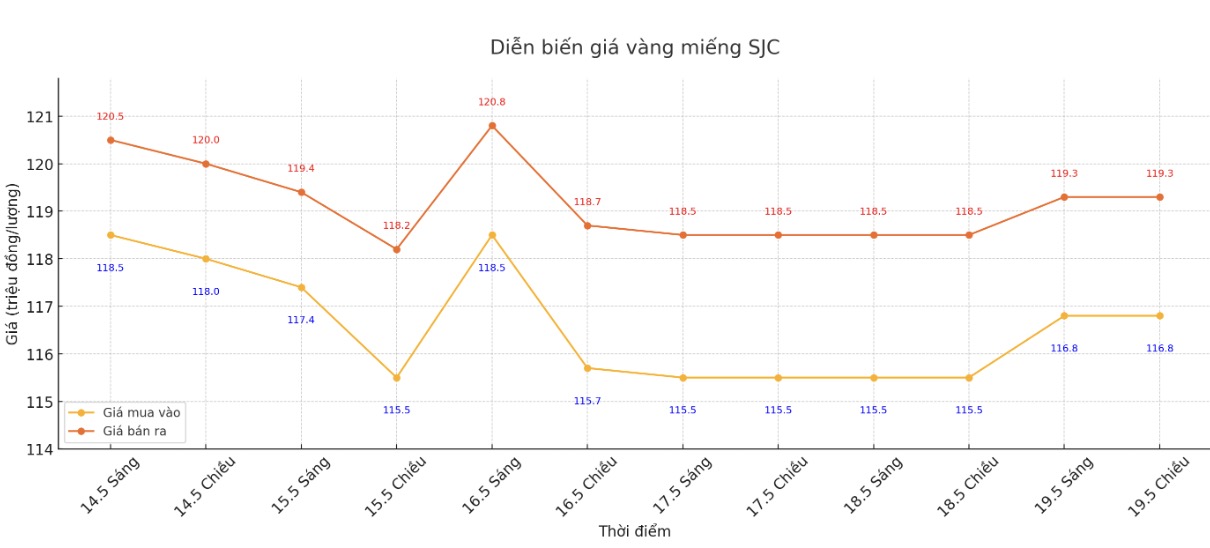

Updated SJC gold price

As of 6:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.8-19.3 million/tael (buy - sell), an increase of VND1.3 million/tael for buying and an increase of VND800,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.3-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

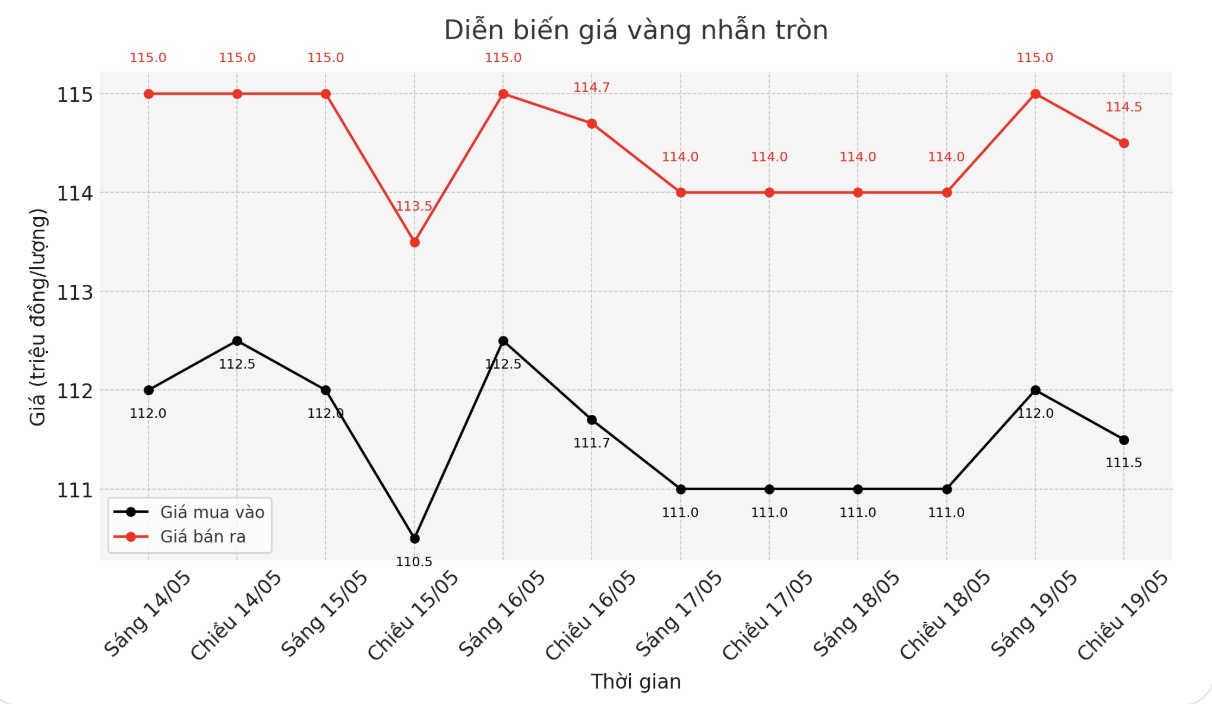

9999 round gold ring price

As of 6:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-124.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.2-117.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.8-114.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

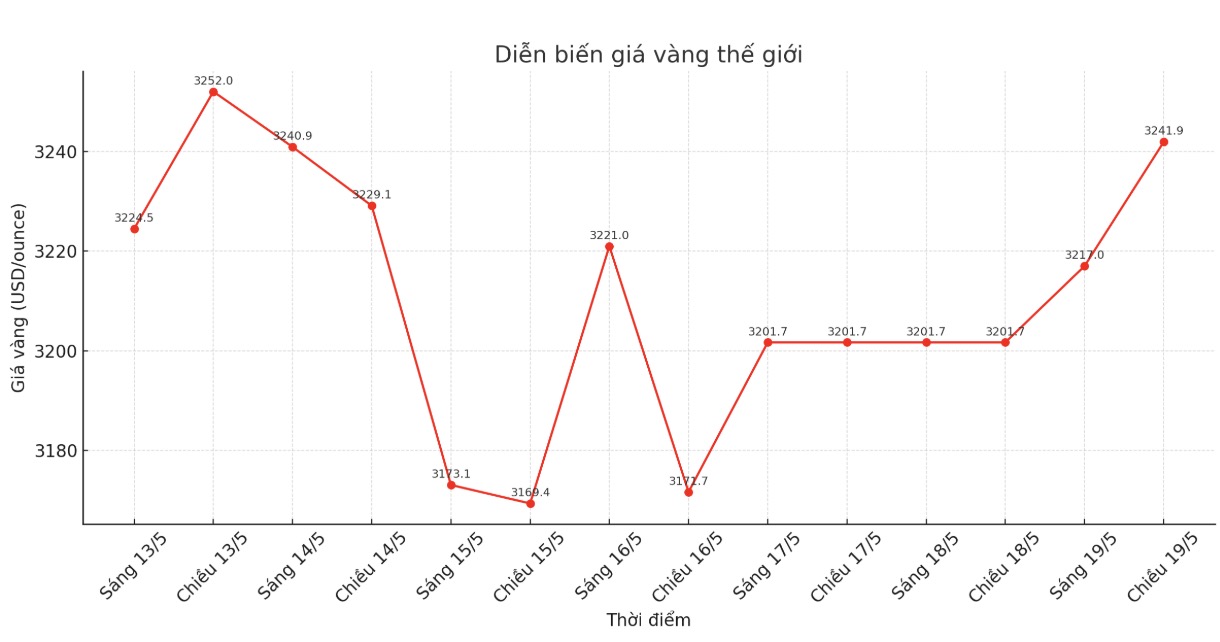

World gold price

At 6:30 p.m., the world gold price listed on Kitco was around 3,241.9 USD/ounce, up 40.2 USD/ounce.

Gold price forecast

Kitco News' survey on gold prices this week shows that experts are leaning towards pessimism. While individual investors are also gradually giving up the optimistic trend after a sharp decline in gold prices.

However, in the first session of the week, world gold prices turned to increase sharply. According to Reuters, gold prices increased as the US dollar weakened and new concerns about trade returned after US Treasury Secretary Scott Bessent reaffirmed that President Donald Trump would impose tariffs on partners who did not negotiate "competently", increasing demand for safe havens.

Gold prices fell more than 2% last Friday and recorded the biggest decline since November last year, as investor risk appetite increased after the US-China trade deal.

The USD (.DXY) index fell 0.5% in the second session, making USD-denominated gold cheaper for foreign investors.

Moodys downgrading US credit ratings and market risk avoidance has helped gold prices recover somewhat, said Tim Waterer, market analyst at KCM Trade.

Moody's just lowered a level of US national credit last Friday - the final rating agency in the group of three major companies that made this decision, citing concerns about the US's ever-increasing mountain of debt.

Trump will impose the same tariffs as he threatened last month on non- goodwill trading partners, Bessent stressed in a series of TV interviews on Sunday.

The trade wars under Trump have caused serious disruptions to global trade flows and caused strong fluctuations in the financial market, as investors face what Mr. Bessent called " Strategic uncertainty" in an effort to reshape US economic relations.

Gold - a traditional safe haven asset in times of political and economic instability often benefits in a low interest rate environment.

Last week's data showed that US manufacturing prices in April unexpectedly decreased, retail sales increased slowly and consumer inflation was also lower than expected.

I think the possibility of a rate cut is possible in July or September, but the outcome of Mr. Trumps trade negotiations in the coming time could decide when the US Federal Reserve will take action, Mr. Waterer added.

See more news related to gold prices HERE...