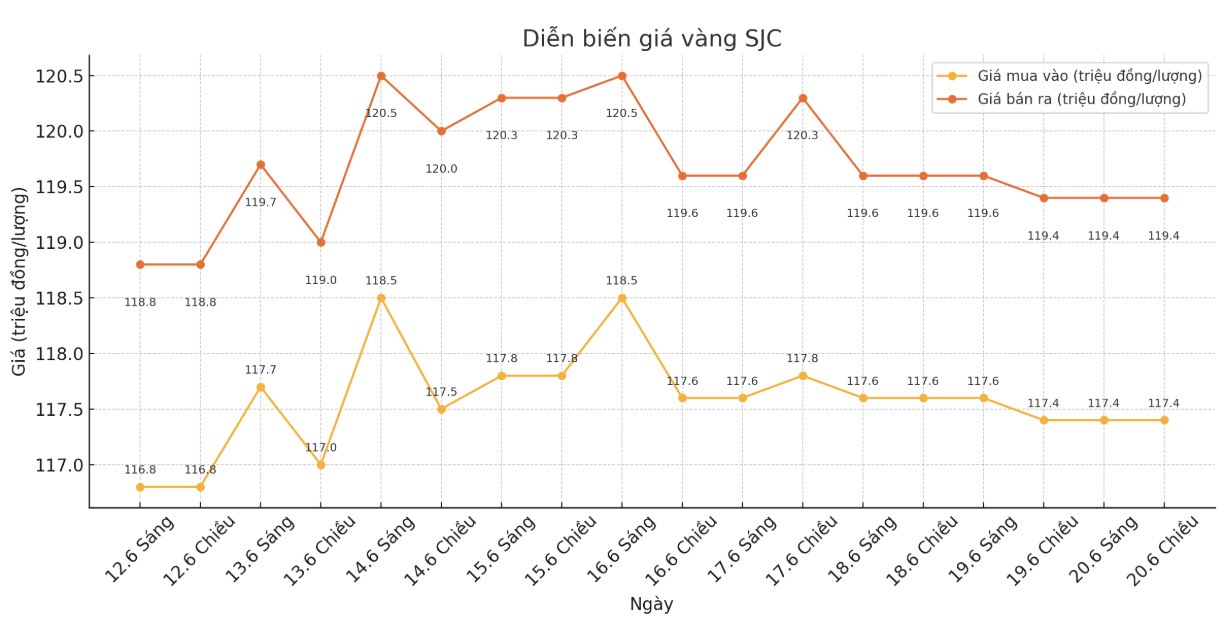

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.7-119 1.4 million VND/tael (buy - sell); down 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.3-117.3 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

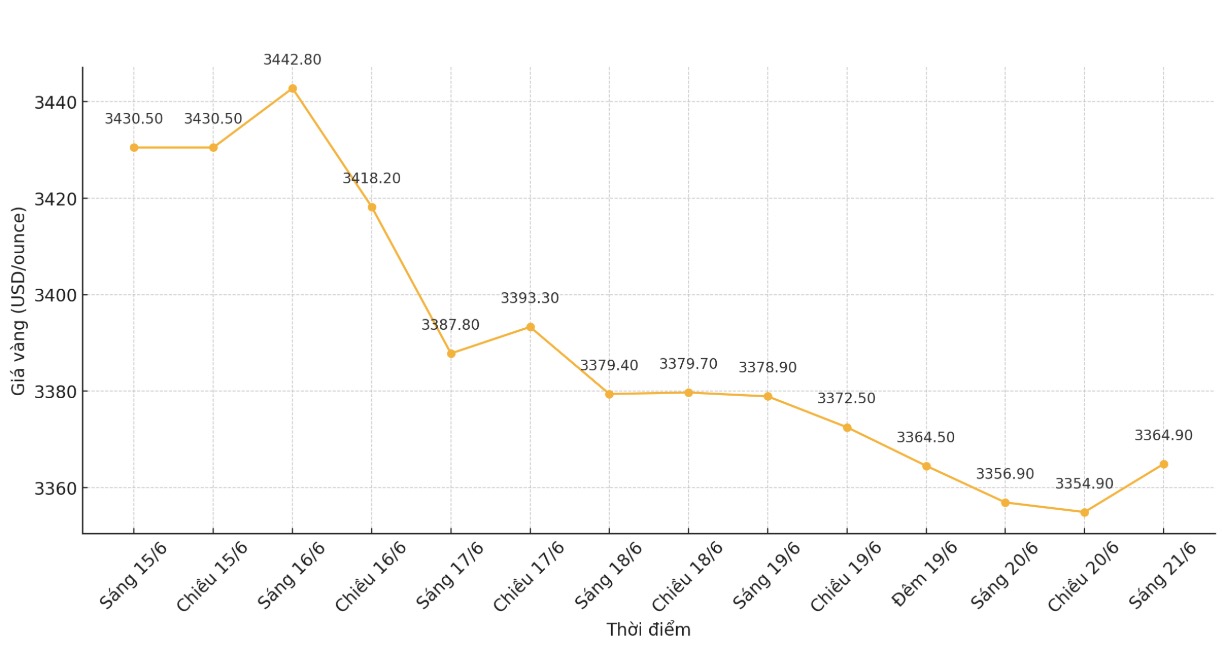

World gold price

The world gold price was listed at 1:30 at 3,364.9 USD/ounce, recovering slightly compared to a day ago.

Gold price forecast

World gold prices continued to decline as short-term futures traders felt uneasy as the weekend approached and began taking profits.

August gold futures fell $23.2 to $3,364 an ounce. July gold futures fell $0.305 to $26.055 an ounce.

The market largely received the FOMC decision on Wednesday and the press conference of Federal Reserve Chairman Powell. The Fed has not changed monetary policy and continues to worry about prolonged inflation in the US.

US President Donald Trump in a social media post said that US interest rates need to be cut by 2.5%. It is unlikely that the Fed will cut interest rates in the near future, which creates a negative scenario for the precious metals market.

Asian and European stocks had mixed movements overnight. US stock indexes are expected to open slightly lower today in New York. Investors' risk appetite was not strong at the end of the trading week.

President Trump has given Iran time to participate in negotiations on the country's nuclear weapons ambition. Trump said he would take a few weeks to think about US involvement in the war between Israel and Iran, while hoping Iran would make a concession.

Technically, August gold investors are having a short-term technical advantage. The next target for the bulls is $3,476.30 an ounce. The next target for the bearer is to push the price below $3,300/ounce. The first resistance level was seen at an overnight high of $3,387.2 an ounce, followed by $3,400 an ounce. The first support level was $3,350/ounce and then the June low of $3,313.1/ounce.

Key markets today showed the USD index falling. Nymex crude oil prices increased and are trading around $76/barrel. The yield on the 10-year US government bond is currently at 4.39%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...