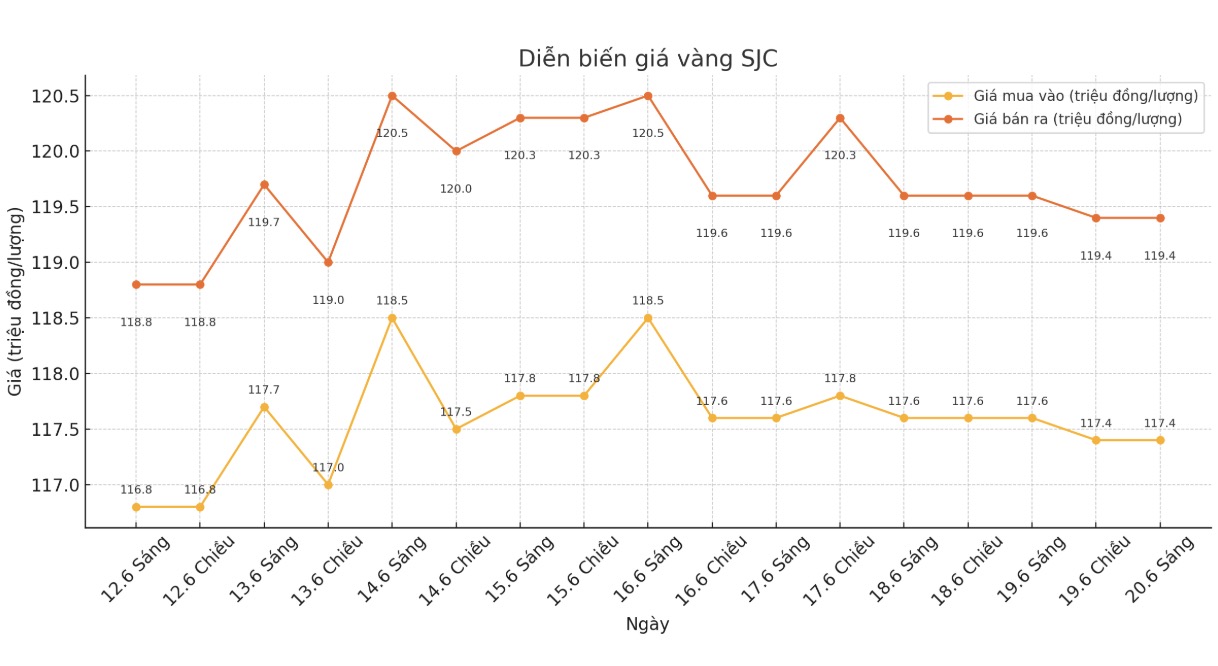

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-1194 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-1194 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.7-1194 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-116.5 million/tael (buy in - sell out), down VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

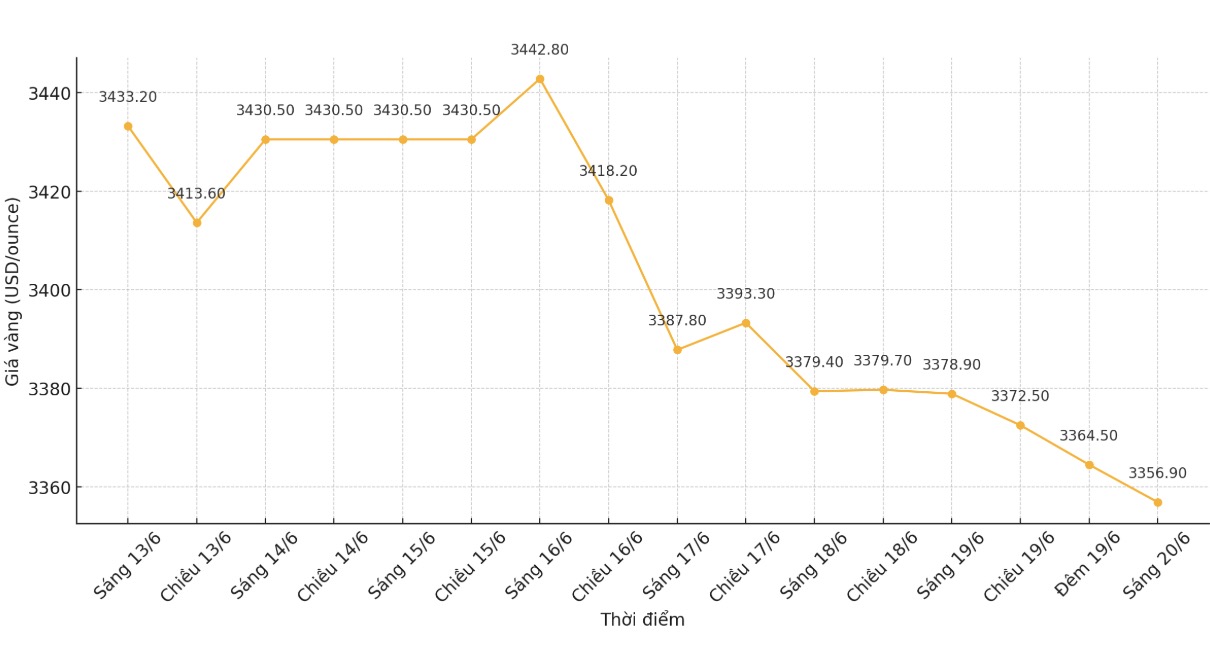

World gold price

At 9:03, the world gold price was listed around 3,356.9 USD/ounce, down 22 USD compared to 1 day ago.

Gold price forecast

Although gold prices are falling, many experts say that the fundamental factors are still intact. Central banks around the world continue to accumulate gold strongly; tensions in Ukraine and the Middle East play a key role, strengthening gold's position as a hedge against instability.

In addition, expectations of falling interest rates in the future are also beneficial for gold as they reduce opportunity costs compared to other profitable assets.

The latest policy announcement from the US Federal Reserve (FED) further complicates the story of gold. The Fed kept the reference interest rate unchanged at around 4.25% - 4.50%, maintaining a cautious data-based approach, while continuing to monitor the impact of President Donald Trump's trade policies, especially tariffs.

The Fed forecasts inflationary pressures to increase in the next few months, but still maintains plans to cut rates by two more rates before the end of the year, as oriented in March.

Fed Chairman Jerome Powell stressed caution, saying policymakers are in a good position to wait for more information on the economic outlook before adjusting policy.

The Fed's statement also admitted that "the level of uncertainty about economic prospects has decreased", but is still "high", reflecting many intertwined factors that the Fed is facing.

According to Soni Kumari - commodity strategy expert at ANZ, the FED's clear cautious stance on inflation has reduced expectations of interest rate cuts, thereby putting pressure on gold prices.

"Inflation risks remain. When the Fed is not in a hurry to ease monetary policy, gold will have a hard time getting strong," she said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...