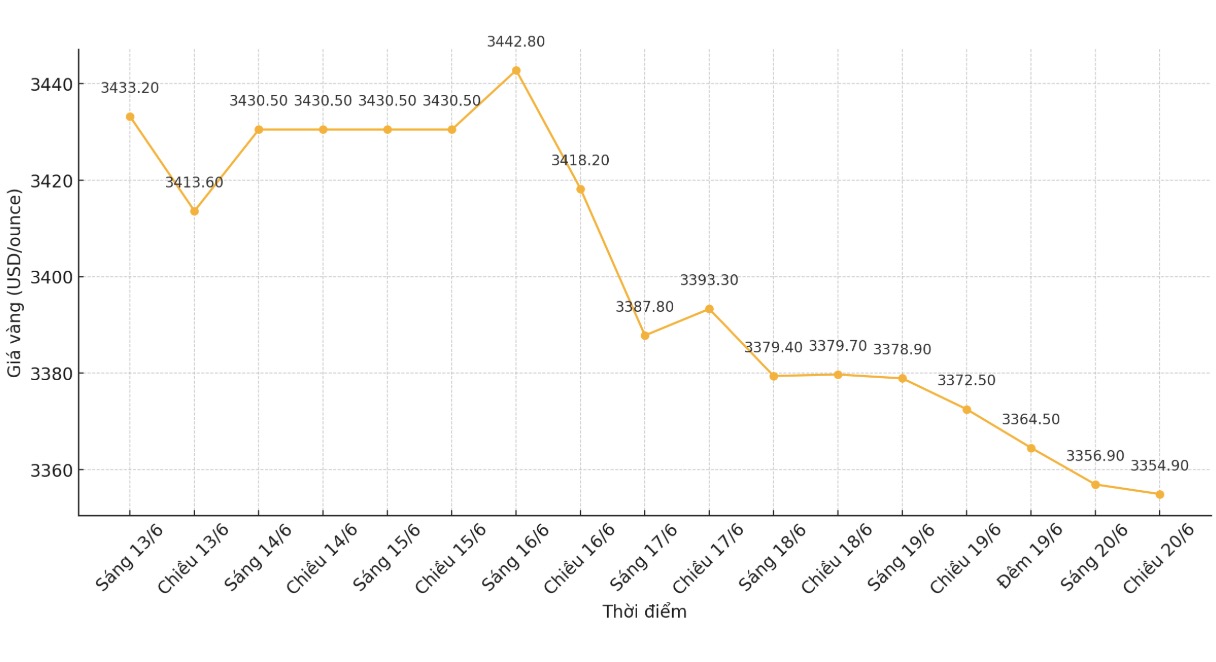

The bank's market strategists said that they will maintain a 7% stake in the multi-asset investment portfolio until the end of the third quarter of 2025, considering gold both an investment channel for price increases and a "shield" against geopolitical instability.

In its just-issued portfolio strategy report, SocGen affirmed that it is not in a hurry to take profits as gold prices have not yet reached the target of 4,000 USD/ounce. Experts continue to be optimistic as central banks of many countries step up buying, reducing dependence on the USD.

Protecting foreign exchange reserves and cutting off the US dollar is accelerating de-dollarization, the analysis team wrote. They estimate that gold prices could reach $4,200/ounce in the second quarter of next year.

SocGen expects gold to continue to accumulate in the summer, with an average price of around $3,450/ounce. The increase is forecast to strengthen in the fourth quarter and last until the first half of 2026.

Notably, gold was once the only commodity in SocGen's portfolio. However, before the third quarter, the bank had added a 3% position for crude oil to hedge against risks from the Israel-Iran conflict.

While oil supplies are not immediately interrupted, further Israeli strikes on Iranian economic assets could threaten oil infrastructure. We predict that Brent prices will reach 60 USD/barrel by the end of 2025, an average of 55 USD/barrel in 2026 - SocGen commented.

Other adjustments include reducing the proportion of UK stocks, increasing allocations to listed stocks in Japan and global emerging markets. The bank has also sold out 10-year UK government bonds and US and European low-end corporate bonds, instead switching to buying 10-year US anti-inflation bonds.

Although consumer price pressure has recently cooled down more strongly than expected, SocGen warned that the risk of inflation is still high because economic uncertainty has not decreased significantly.

A series of opposite scenarios are happening rapidly, causing potential inflation risks. Concerns about a declining recession, a weakening US dollar, and rising oil prices due to geopolitical tensions, especially if there is disruption in the Hormuz Strait and the impact of the new tariffs is still unclear. All of these factors reinforce deflation protection needs, taking advantage of the current low expectations as a buying opportunity, SocGen noted.

Although they do not directly call gold an anti-inflation tool, many experts still consider gold an attractive monetary asset. When inflation increases, real interest rates fall, dragging the cost of holding gold, an unyielding asset, lower.