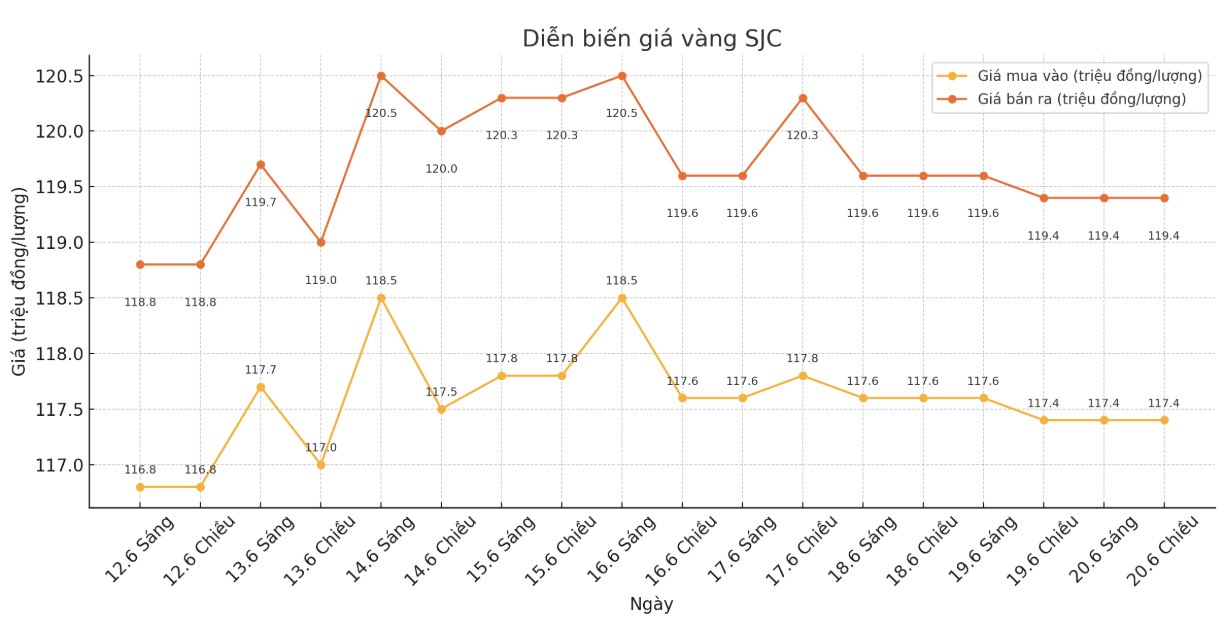

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-119 1.4 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.7-119 1.4 million VND/tael (buy - sell); down 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 gold ring price

As of 5:35 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.3-117.3 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

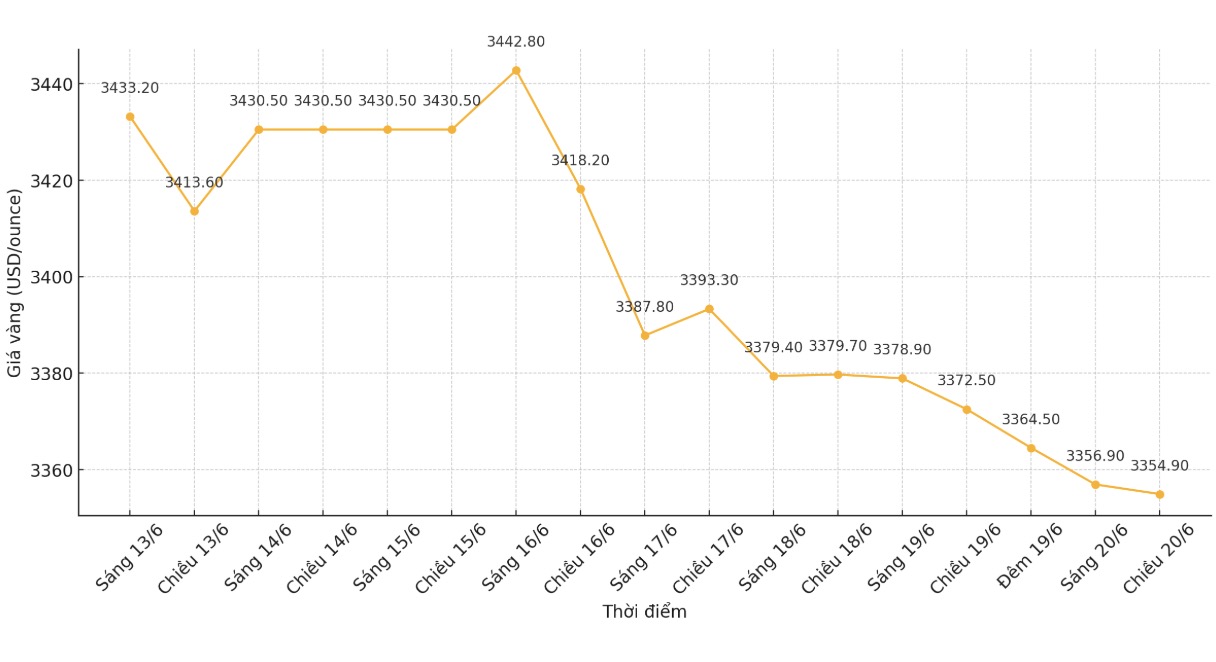

World gold price

The world gold price was listed at 6:35 p.m. at 3,354.9 USD/ounce, down 17.6 USD.

Gold price forecast

World gold recorded its biggest decline in more than a month this week, after the US Federal Reserve (FED) reduced expectations of a rate cut, along with concerns about the possibility of the US attacking Iran temporarily easing.

At 3:51 p.m. (Vietnam time), the US gold futures contract decreased by 1.2% to $3,366.3/ounce.

The US dollar rose 0.5% this week and is heading for its strongest week in more than a month, making gold more expensive for holders of other currencies.

The White House said President Donald Trump will decide in the next two weeks whether the US will participate in the air war between Israel and Iran. The conflict has entered its second week.

The two-week deadline given by Donald Trump gives hope that tensions can cool down before the US takes sides directly, thereby reducing market concerns and cooling gold prices, said Nitesh Shah, commodity strategist at WisdomTree.

Gold is often considered a safe haven asset in the context of political and economic instability and tends to increase in price when interest rates are low.

On June 19, the FED kept interest rates unchanged at 4.25%-4.50% but adjusted the outlook for interest rate cuts due to the more challenging economic situation.

Mr. Donald Trump on June 20 continued to call on the FED to cut interest rates further, saying that the current interest rate should be at least 2.5 percentage points lower.

Ole Hansen - Commodity Strategy Director of Saxo Bank said: "Gold, silver and platinum are all under profit-taking pressure after the FOMC meeting on June 19. Gold is likely to continue moving sideways, with support around $3,320/ounce, followed by $3,245/ounce.

In other markets, spot silver prices fell 1% to 36.01 USD/ounce, and inflation increased slightly by 0.1% to 1,051.53 USD/ounce. platinum fell 1.4% to $1,289.52 an ounce, after hitting a more than 10-year high in the previous session.

See more news related to gold prices HERE...