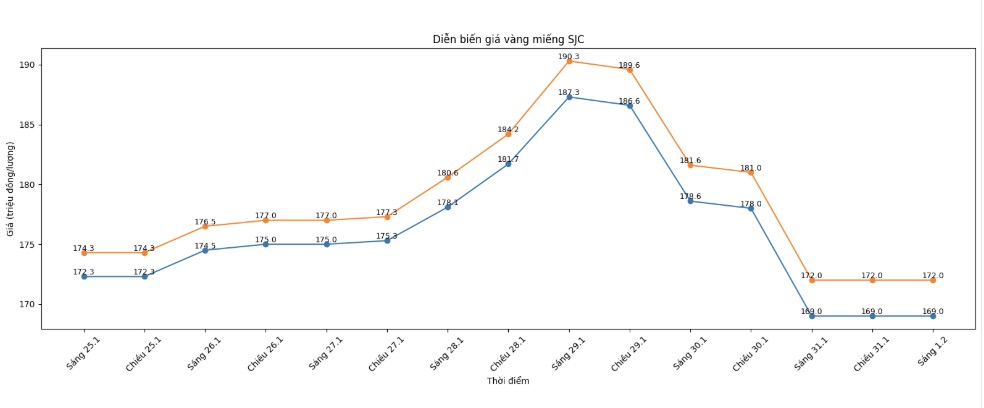

SJC gold bar price

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 169-172 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (January 25), the price of SJC gold bars at Saigon SJC Jewelry Company decreased by 3.3 million VND/tael on the buying side and decreased by 2.3 million VND/tael on the selling side.

Meanwhile, DOJI listed SJC gold price at 169-172 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (January 25), SJC gold bar price at DOJI decreased by 3.3 million VND/tael on the buying side and decreased by 2.3 million VND/tael on the selling side.

Thus, if buying SJC gold bars in the January 25th session and selling them in today's session (February 1st), buyers at Saigon SJC Jewelry Company and DOJI Group will both lose 5.3 million VND/tael.

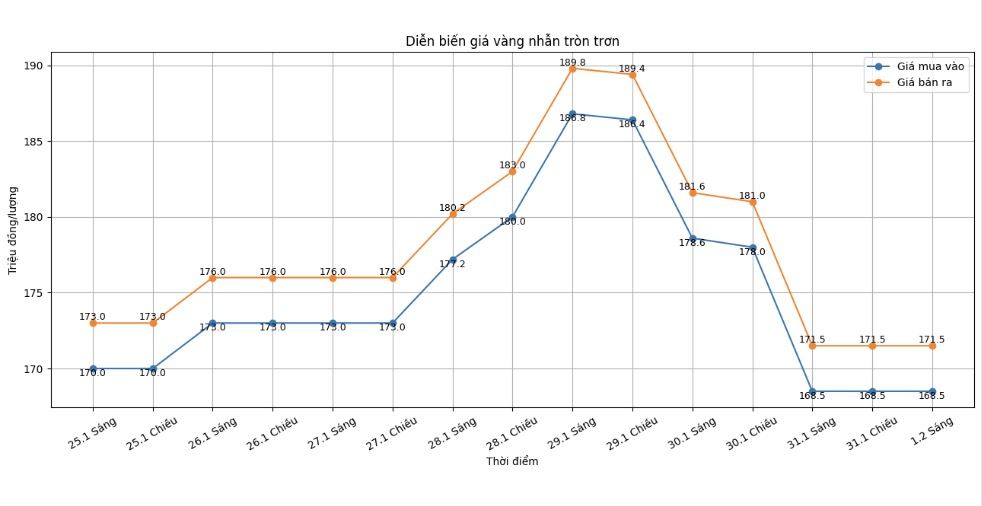

9999 gold ring price

At the same time, DOJI Group listed the price of gold rings at the threshold of 168.5-171.5 million VND/tael (buying - selling), down 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at the threshold of 168.8-171.8 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the session on January 25 and selling them in today's session (February 1), buyers at DOJI will lose 4.5 million VND/tael, while the loss for gold ring buyers in Phu Quy is 4.7 million VND/tael.

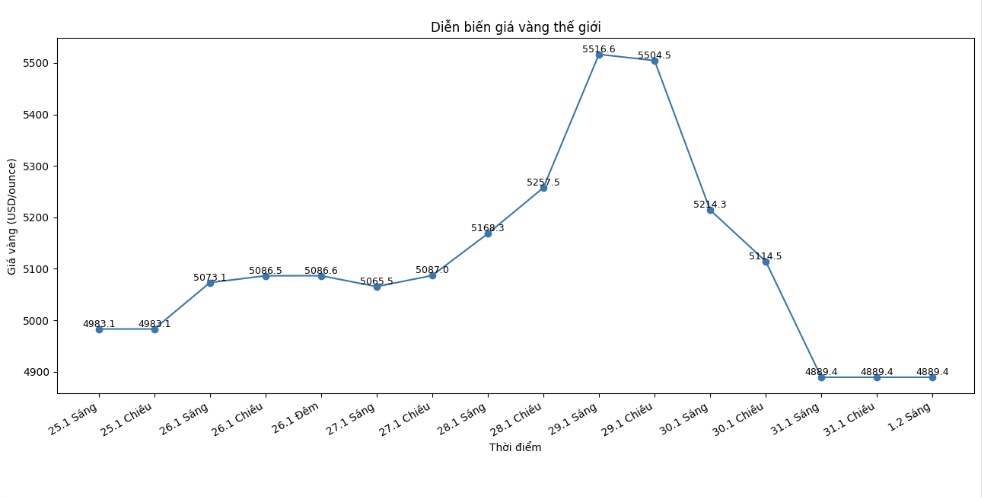

World gold price

Closing the week's trading session, world gold prices were listed at 4,889.4 USD/ounce, down 93.7 USD compared to a week ago.

Gold price forecast

According to Kitco, the strongest sell-off in gold history occurred just two days after the metal recorded its largest one-day gain ever. At the peak on Thursday, gold prices reached 5,602 USD/ounce, up 29.5% in January alone. Meanwhile, silver hit a day high above 121 USD/ounce, raising the increase from the beginning of the year to 68.5%.

Analysts believe that such an upward momentum, especially in the first month of the year, clearly cannot last long.

Mr. Neil Welsh - Head of Metals at Britannia Global Markets - commented: "The past few days have been extremely volatile for the entire metal market. For precious metals, this adjustment is not too surprising considering the speed and scale of the increase in January.

Gold and silver have fallen into a technical overbought state, with increases of nearly 20% and more than 40%, while investment positions, leverage and options activities are all at normal levels at short-term peaks".

I believe that the overall trend remains unchanged" - Mr. Welsh said - "The macroeconomic factors that have boosted gold, silver and copper are still present. This seems to be a position adjustment in an ongoing upward trend, not an end point. In my opinion, the precious metal will continue to be well supported until the end of 2026, although the trading range will be wider.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the strong increase in the month has made trading conditions increasingly difficult, contributing to increasing current volatility.

Marketmakers are increasingly hesitant to take risks, leading to thinner liquidity and wider buying-selling price differences" - he said - "Regarding daily developments alone, it is indeed quite crazy, but if it is pushed back by a week, this is completely normal for a gold market that has shifted from the role of "calm adults" to behaving like a "rebellious teenager", just like silver.

Mr. Matthew Piggott - Director of Gold and Silver at Metals Focus - described the price increase in January as "unreasonable excitement" and said that although very strong, the current sell-off is still a healthy correction.

See more news related to gold prices HERE...