Forecasting the potential decline of gold, Ms. Ipek Ozkardeskaya - Market Strategist at Swissquote - said that the price may test the support zone around 4,600 USD/ounce.

However, price adjustments are likely to be seen as an opportunity to consolidate purchasing positions, because the main drivers of the increase - such as unsustainable but still increasing G7 public debt, the decline in demand for the USD, trade and geopolitical instability, the need to seek supernational assets to preserve value in the context of geopolitical chaos and the possibility of price pressure returning remains unchanged" - she said.

Meanwhile, Mr. Alex Kuptsikevich - Head of Market Analysis at FxPro - said that he is monitoring the initial support zone around 4,700 USD/ounce.

In the end, I still expect silver to return to the 50-60 USD/ounce zone, and gold to reach 4,399 USD/ounce" - Mr. Mark Leibovit, publisher of VR Metals/Resource Letter, said.

Mr. Marc Chandler - Managing Director of Bannockburn Global Forex - said that only when it rises above 5,200 USD/ounce, will gold prices create confidence that has bottomed out for investors.

In my opinion, the direct factor is the upward momentum of the USD and bond yields, as the market begins to value the possibility that the Fed will have a "hawkish" Chairman, specifically Mr. Kevin Warsh, succeeding Mr. Powell. However, this is only an immediate reaction. The market also understands that to be nominated, Mr. Warsh must please President Donald Trump - who always wants low interest rates" - Chandler said.

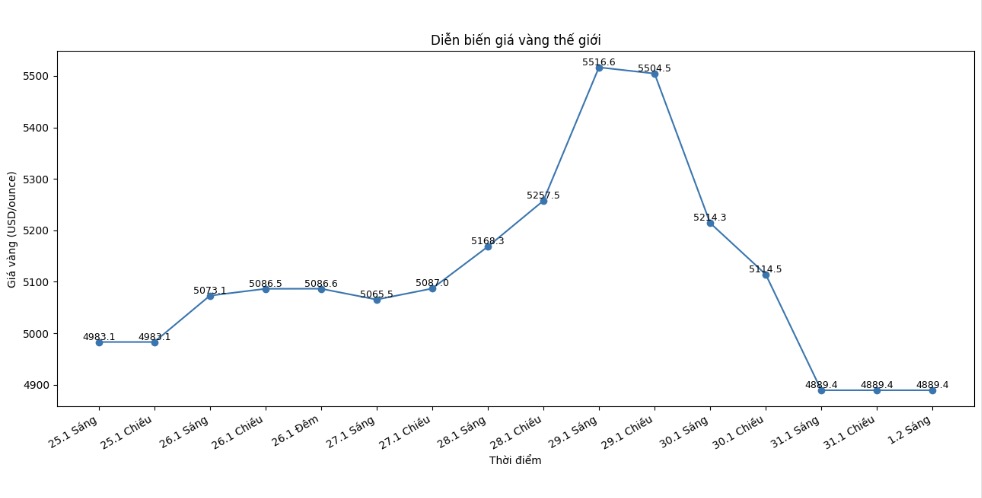

The Fed interest rate futures market is reflecting the possibility of two interest rate cuts this year. Gold's correction has pulled prices back to the mid-range of January trading, around the 4,935 USD/ounce mark. After this mark is broken, gold prices may retreat to the next correction zone around 4,780 USD/ounce. Conversely, only when it rises above 5,200 USD/ounce, will the market have more confidence that a short-term bottom has been formed" - this expert said.

Notably, Mr. Alex Kuptsikevich - senior market analyst at FxPro - believes that gold prices may fall to the 3,600 - 4,000 USD/ounce range.

This week, we witnessed a long-awaited drop, as strong selling pressure swept away the remaining short selling positions. It is noteworthy that although the price decreased by a total of about 10% compared to the peak, it still revolved around the opening level of the week. However, we believe that the peak price has been established, clearly shown through the wave of simultaneous sell-offs across the entire metal market after setting new peaks.

According to Mr. Kuptsikevich, the first adjustment target for gold is the 4,700 USD/ounce zone, equivalent to a technical correction of 61.8% of the increase since August.

With the sharp decline and previous overheating, the market can completely touch this zone right next week. In the medium to long term to one year, we do not rule out the possibility of gold falling further, to the 3,600 - 4,000 USD/ounce range, thereby adjusting the entire increase since 2022" - this expert said.

See more news related to gold prices HERE...