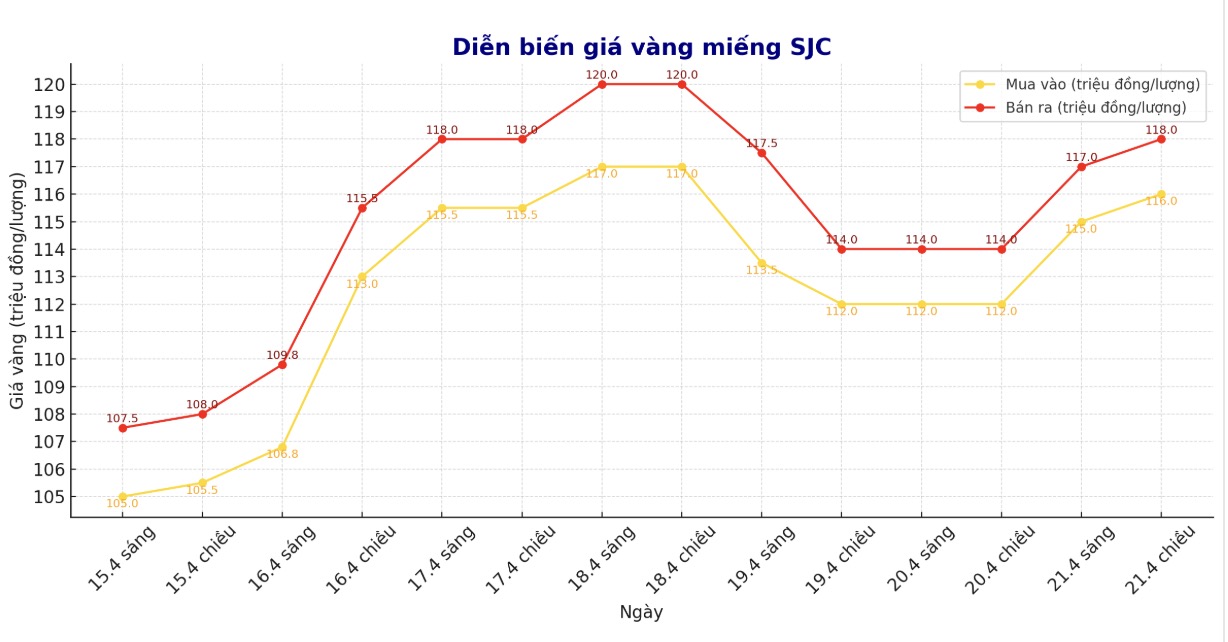

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116-118 million/tael (buy in - sell out); increased by VND4 million/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116-118 million VND/tael (buy - sell); increased by 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116-118 million VND/tael (buy - sell); increased by 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

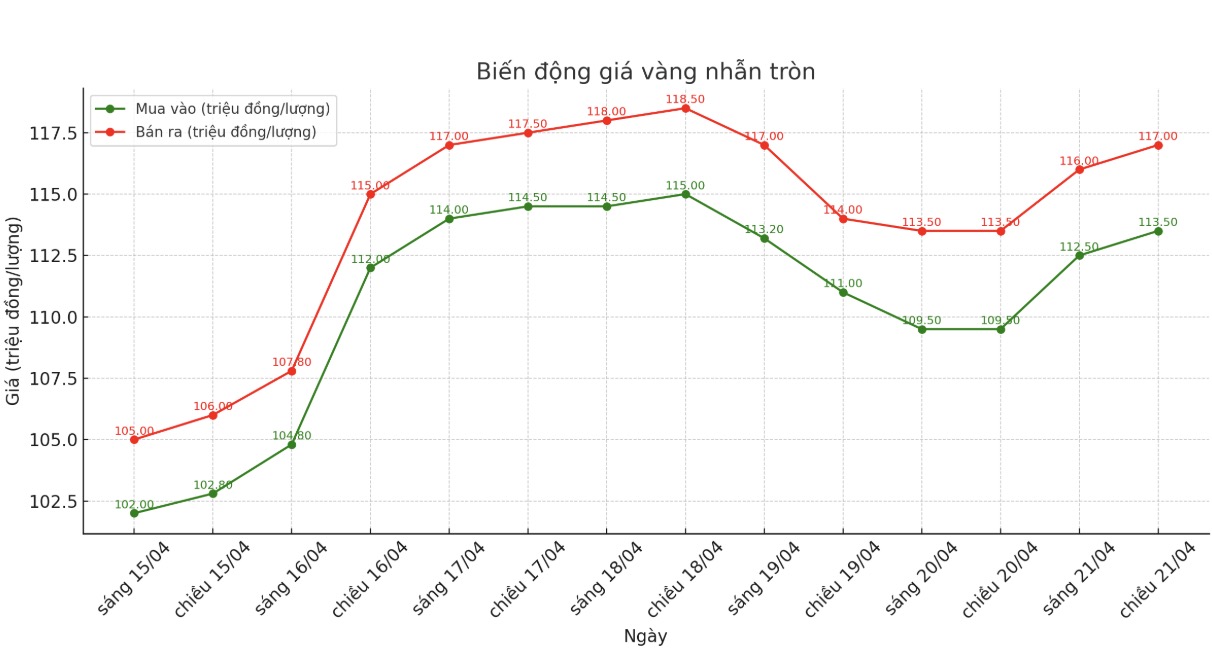

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-117 million VND/tael (buy - sell); increased by 4 million VND/tael for buying and increased by 3.5 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-118 million VND/tael (buy - sell); an increase of 3.7 million VND/tael for buying and an increase of 4 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

Huge profits after a month of investment

After a month, domestic gold investors have earned impressive profits. From March 21 to April 21, the interest rate recorded in major gold and silver systems was 16.5 million VND/tael for SJC gold bars at Saigon Jewelry Company Limited - SJC, 16.2 million VND/tael for SJC gold bars at DOJI Group and Bao Tin Minh Chau.

9999 round gold rings at DOJI bring a profit of 13.6 million VND/tael, while at Bao Tin Minh Chau is 14.1 million VND/tael.

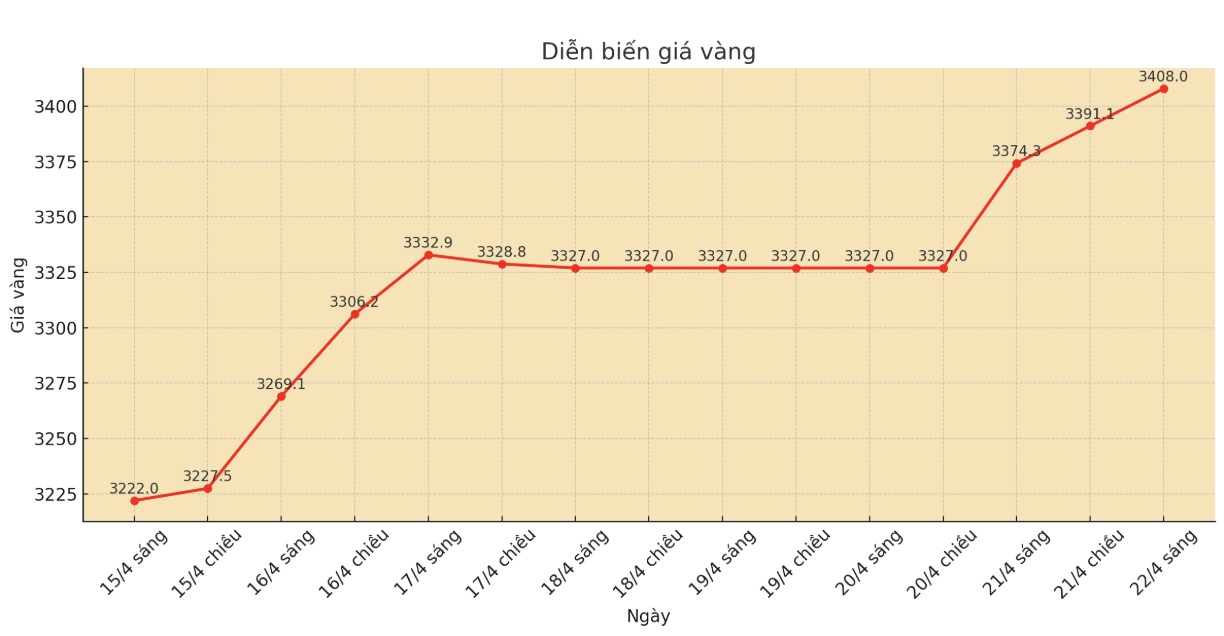

World gold price

As of 0:10, the world gold price was listed at 3,408 USD/ounce, up 8.9 USD.

Gold price forecast

Gold prices have risen nearly 25% since the beginning of the year, many experts warn that this could be a short-term peak. Investing in gold at this time is considered to have potential risks.

NS Ramaswamy, head of commodities in Ventura, recommends not buying gold at this time. He said that buying should only be considered when there is a short-term correction, with the price zone waiting at 3,150 USD/ounce and 3,080 USD/ounce. In the medium term, gold prices may reach $3,450 - $3,550/ounce, but each rally has the potential to take profits and adjust down.

He also warned that gold prices may be at their peak and should not allocate too much to gold, as the possibility of the Fed cutting interest rates has been reflected in gold prices.

However, some experts believe that the outlook for gold prices is still positive. Prolonged trade tensions, inflationary pressures and central banks continuing to buy gold are factors supporting the price increase.

Navneet Damani - Senior Vice President in charge of commodity and currency research at Motilal Oswal Financial Services (a diversified financial services company based in Mumbai, India) commented: "In the context of a world full of policy instability, high inflation and geopolitical tensions, gold is still a safe haven.

As central banks increase reserves and investors seek safety, gold will continue to be a popular asset. Unless there is a major breakthrough in global trade negotiations, we still maintain a buying position when prices adjust in the medium and long term.

Alex Kuptsikevich - Senior Analyst at FxPro - commented that gold has regained its upward momentum since hitting the 50-day moving average early last week. He assessed this as a signal to end the adjustment period that has lasted since the end of December 2024.

We expect gold to surpass $3,500/ounce in the short term. Currently, the price is about 60% higher than the 200-week moving average. If it reaches $3,540 an ounce, the difference would be 70% equivalent to the peak in 2011 before entering the market, he said.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...