Alex Kuptsikevich - Senior Analyst at FxPro - commented that gold has regained its upward momentum since hitting the 50-day moving average early last week. He assessed this as a signal to end the adjustment period that has lasted since the end of December 2024.

We expect gold to surpass $3,500/ounce in the short term. Currently, the price is about 60% higher than the 200-week moving average. If it reaches $3,540 an ounce, the difference would be 70% equivalent to the peak in 2011 before entering the market, he said.

With the same optimism, Jim Wyckoff - an expert at Kitco, said that there is no factor hindering the current uptrend, as the technical chart maintains a positive signal and the demand for gold as a safe haven is still very strong.

Darin Newsom - market analyst at Barchart.com - sees the recent increase coming from algorithmic transactions responding to the attention-grabbing statements of the US President. According to him, shocking statements, even if not enforced, are still capable of creating press headlines, thereby activating gold buying algorithms.

The US presidents view is that the stock market reflects the health of the economy. But in fact, the index has peaked and may be poised to enter a downtrend.

Meanwhile, Federal Reserve Chairman Jerome Powell has made it clear that he will not be pressured by President Donald Trump in his interest rate decisions, Newsom stressed.

He also warned that recent inconsistent statements and tax policy controversies are causing investors to lose confidence in the US economy. They are withdrawing capital from the US dollar and US stocks to seek safer haven such as gold.

According to him, Asia and Europe are now the leading regions in global cash flow. I dont think the upward trend in gold will end anytime soon. When there is still instability, gold is still king, he concluded.

Meanwhile, CPM Group - an independent research firm based in New York - recommends that investors continue to hold gold and take advantage of buying opportunities when short-term adjustments appear. They predict gold could reach $3,500 an ounce in just the next two weeks.

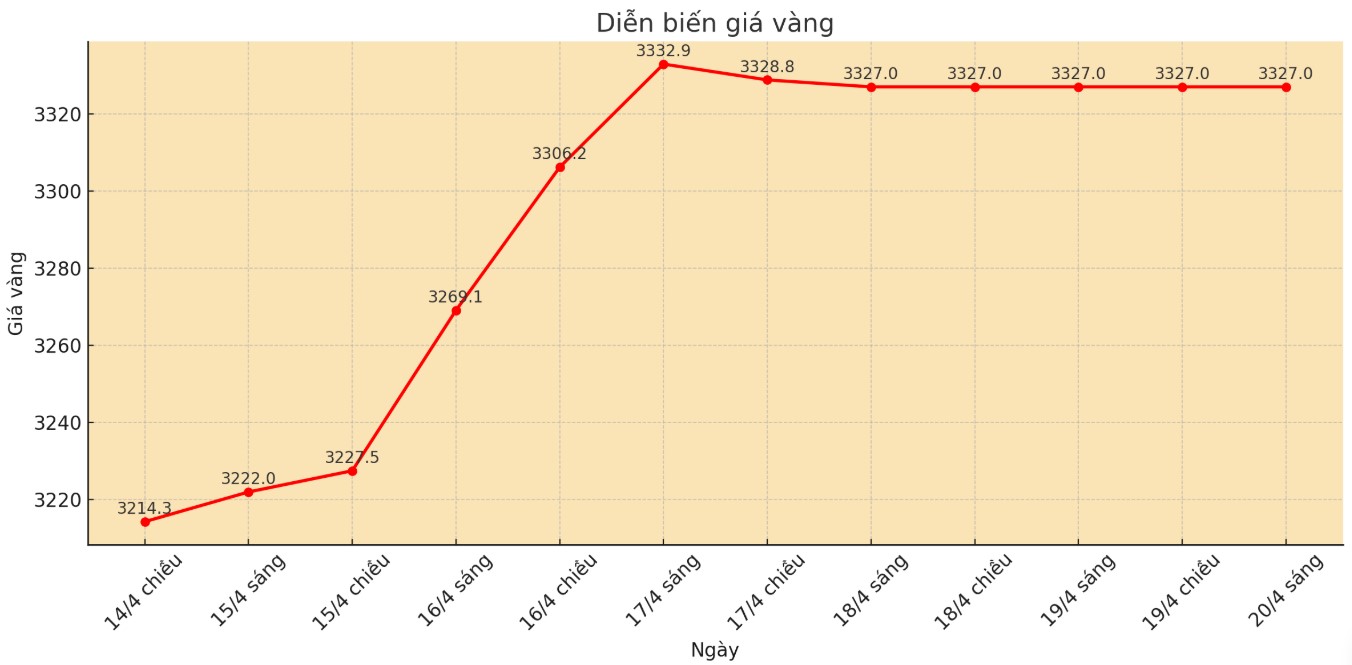

Since the beginning of 2025, gold prices have increased by about 700 USD, with the last 9 sessions alone increasing by half. CPM warns short-term investors to be cautious about taking profits, but still maintain a positive view in the medium and long term.

From a technical perspective, Michael Moor Moor - founder of Moor Analytics - said that gold is getting closer to the end of its long-term uptrend since August 2018, when the current increase has far exceeded his previous forecast.

I used to set a maximum target of $954 from $2,148/ounce, but now the price has increased by more than $1,220. The increase has completed the target and temporarily stopped monitoring in the short term. However, technical signals from the beginning of March show that gold is still attracting strong cash flow, he said.

With the resonance of technical analysis, political factors and Shelter psychology, experts believe that gold is still an attractive investment channel in the context of global uncertainty without a stop.