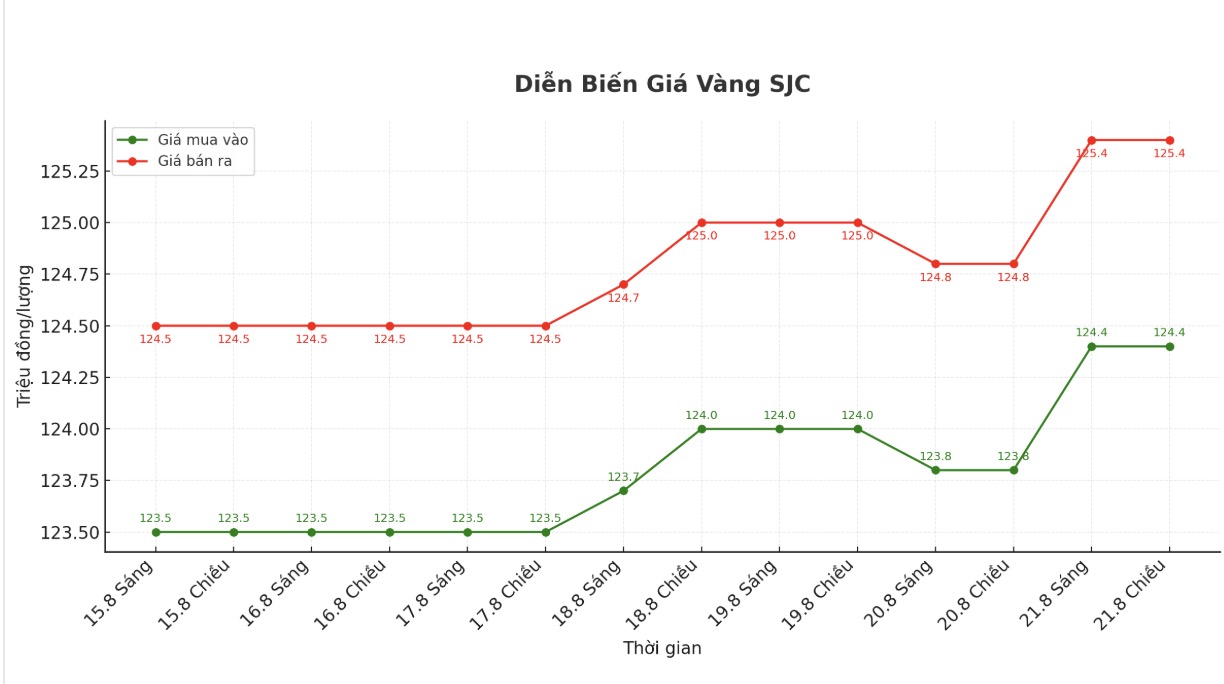

SJC gold bar price

As of 6:00 a.m. on August 22, the price of SJC gold bars was listed by DOJI Group at VND124.4-125.4 million/tael (buy in - sell out), an increase of VND600,000/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

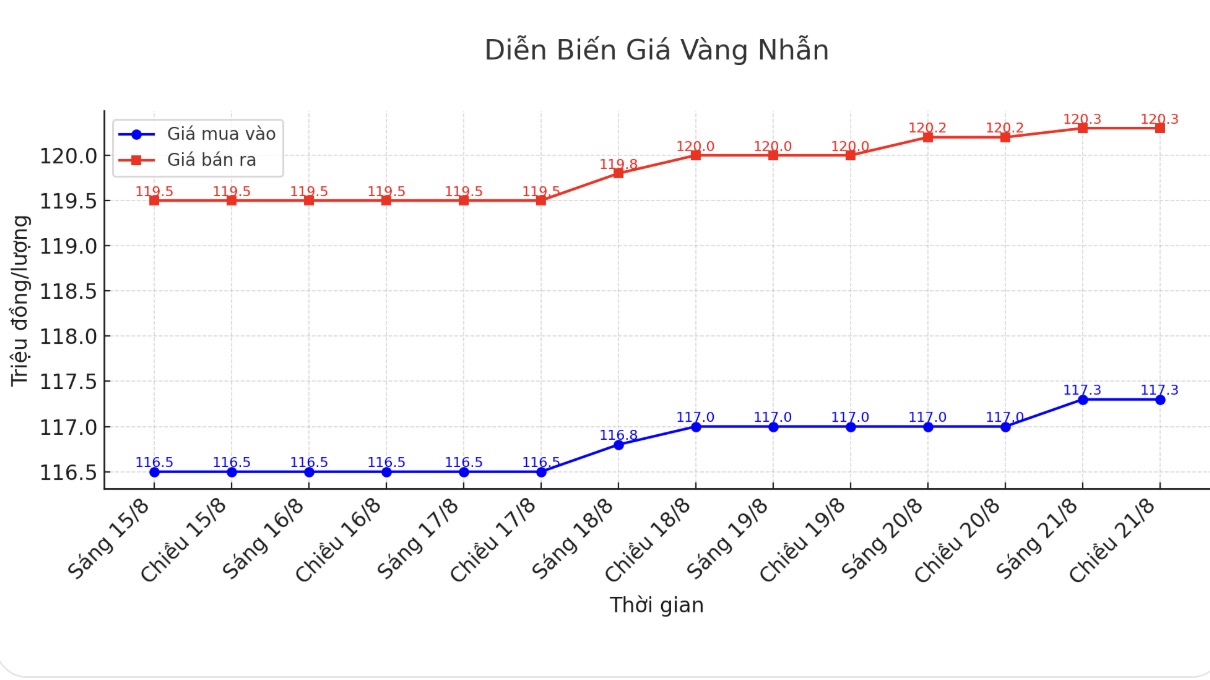

9999 gold ring price

As of 6:00 a.m. on August 22, DOJI Group listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

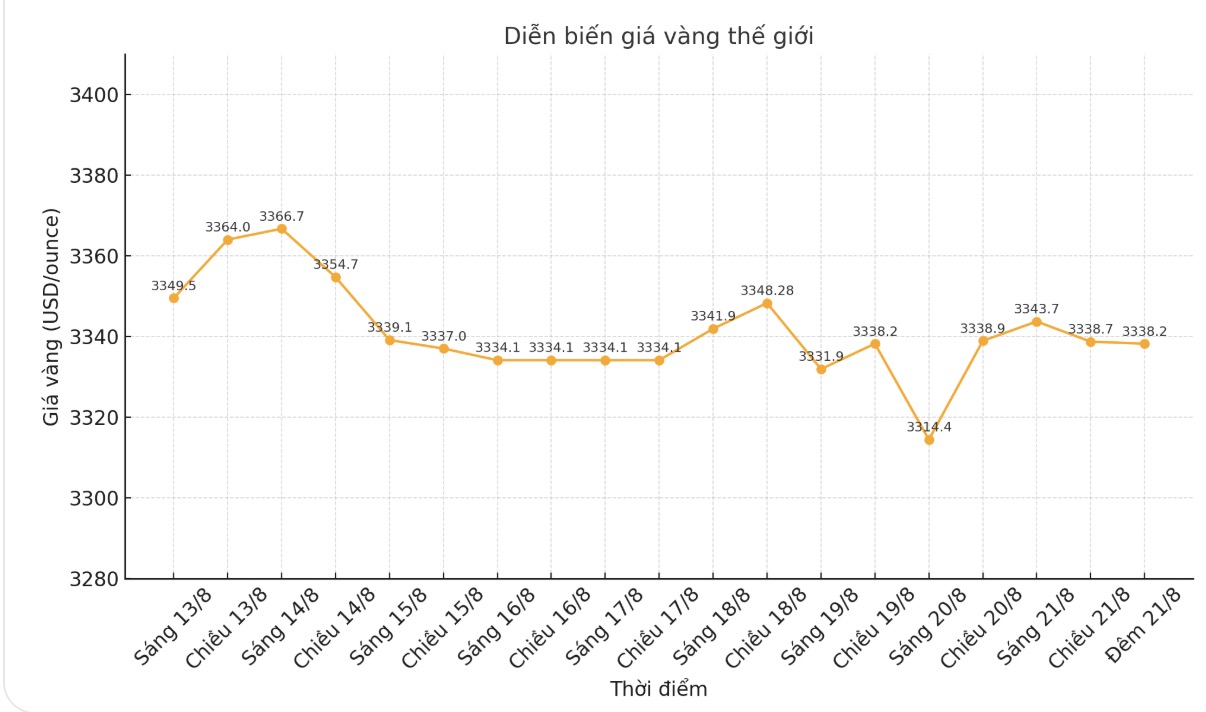

World gold price

The world gold price was listed at 11:35 p.m. on August 21 at 3,338.2 USD/ounce, down slightly compared to a day ago.

Gold price forecast

World gold prices decreased slightly while silver maintained its upward momentum. December gold contract decreased by 3.5 USD to 3,385 USD/ounce, while September silver contract increased by 0.302 USD to 38.075 USD/ounce.

Investors are focusing on the Jackson Hole annual conference organized by the US Federal Reserve (FED) Kansas City branch, which opened today in the US. Fed Chairman Jerome Powell will speak on Friday morning, which is expected to reveal monetary policy orientation and the possibility of a rate cut in September.

Minutes from the July FOMC meeting released yesterday afternoon showed that most Fed officials were still concerned about the risk of inflation exceeding the level rather than the labor market.

Some members emphasized that inflation has remained above 2% for a long time and there is a risk of inflation expectations losing anchor if the impact of tariffs continues.

In other news, Switzerland's gold exports to the US in July surged to nearly 51 tons, the highest since March. The total value of gold exports of more than 36 billion USD accounted for 2/3 of the trade surplus between Switzerland and the US in the first quarter. However, the Swiss National Bank believes that this figure does not accurately reflect the trade balance between the two economies.

Technically, December gold delivered the short-term advantage with a market rating of 6.5 points (up 1-10). The most recent resistance level was at 3,400 USD/ounce and 3,403.6 USD/ounce, while the important support was at 3,353.4 USD and 3,350 USD/ounce.

The target for buyers is to break the $3,500/ounce mark, while the sellers will aim to pull prices down to the bottom of July at $3,319.2/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...