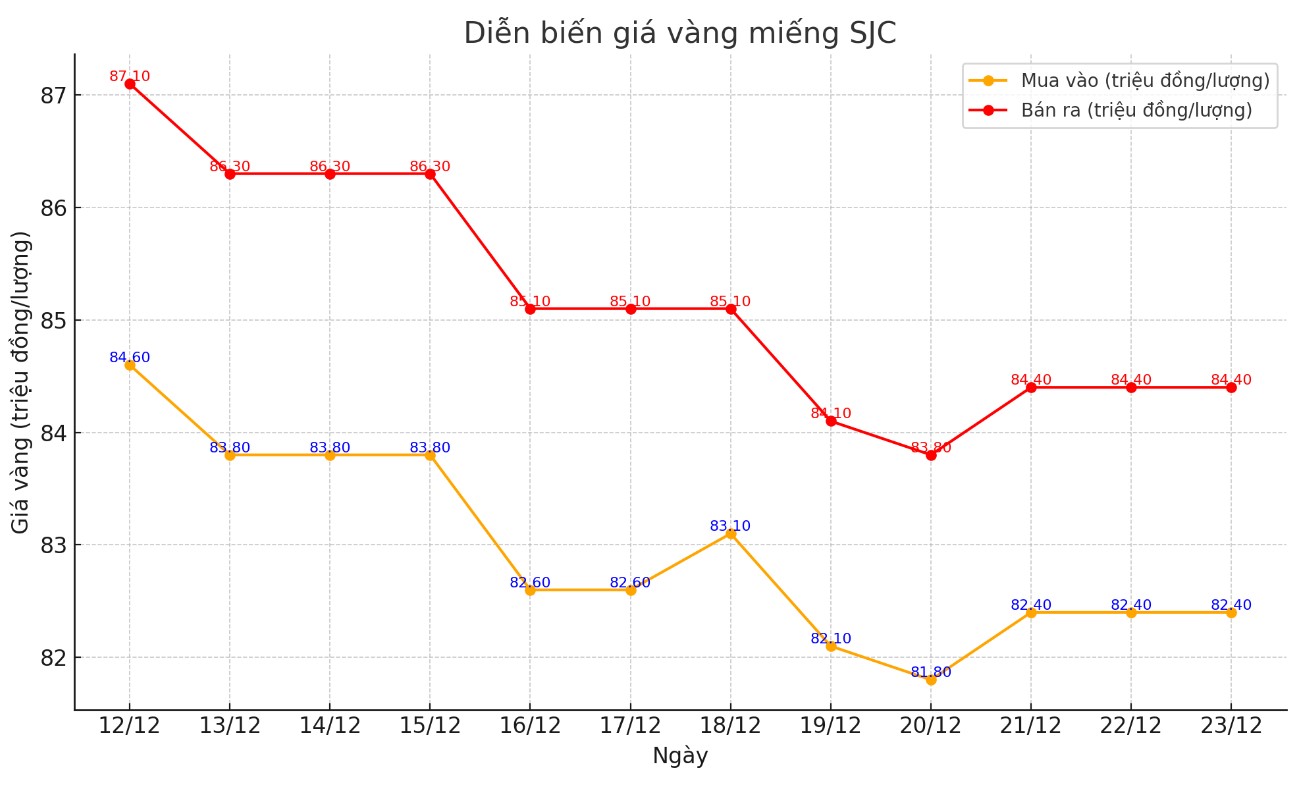

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 81.8-83.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

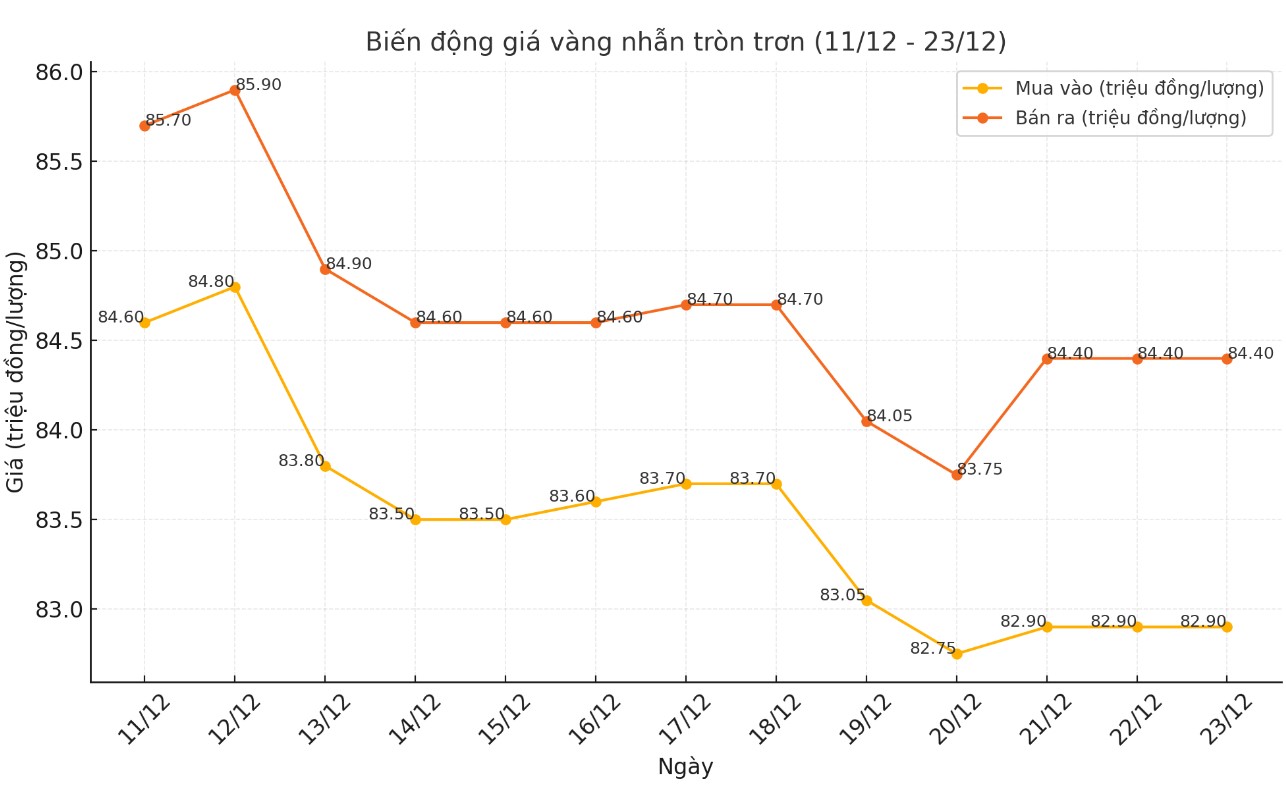

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.9-84.4 million VND/tael (buy - sell).

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.4 million VND/tael (buy - sell).

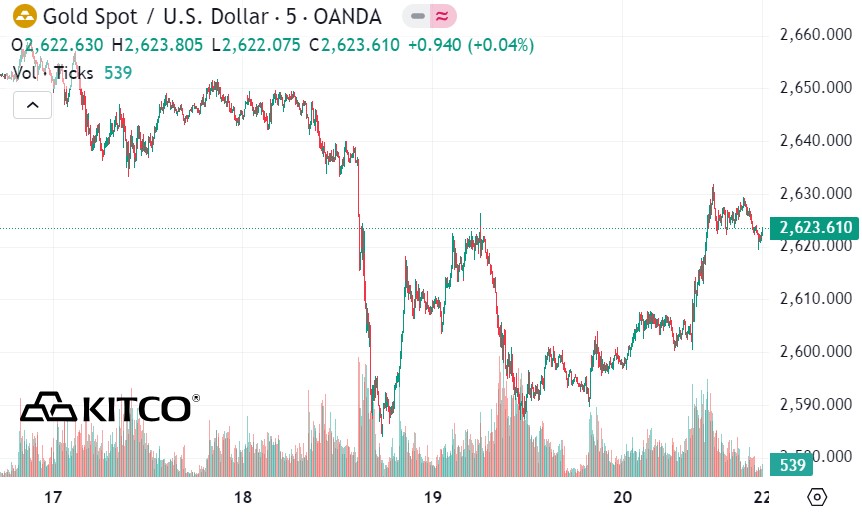

World gold price

As of 6:00 a.m. on December 23 (Vietnam time), the world gold price listed on Kitco was at 2,623.6 USD/ounce.

Gold Price Forecast

World gold prices are still receiving support as the USD index falls sharply. Recorded at 6:00 a.m. on December 23, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.350 points (down 0.74%).

“The path of least resistance for gold is likely to be lower in the short term,” commodity analysts at TD Securities said in a note last week.

“While we do not expect a collapse in the gold market, given the uncertainty surrounding Fed policy, particularly if inflation continues to be higher than expected (e.g. due to tariffs) and the economy begins to slow, coupled with renewed geopolitical risks and a renewed round of central bank gold buying, there is still room for gold to fall slightly in the short term. It would not be surprising to see prices fall to the November low of $2,537/oz,” the analysts said.

However, some other experts see gold being caught in a tug-of-war between the Fed's monetary policy and geopolitical uncertainty.

Gold held key support on Friday after the U.S. Congress failed to pass a spending bill before the holiday break. The government is again on the brink of a partial shutdown that could affect everything from border security to national parks and furlough up to two million workers.

“The prospect of another government shutdown shows how much geopolitical uncertainty there is,” said Chris Mancini, portfolio manager at Gabelli Gold Fund (GOLDX). “This will continue to support gold as a safe-haven asset.”

Ryan McIntyre, managing partner at Sprott Inc., said he is looking beyond gold's short-term volatility, stressing that geopolitical and financial market uncertainty will continue to fuel long-term demand for gold as a safe-haven asset.

“The Trump administration hasn't even started yet, and we're already dealing with this,” he said.

During the Christmas week, although most traders will put their work aside to enjoy the festive atmosphere, the market is still waiting for a series of important economic data to be released, and according to analysts, a sharp drop in trading volume could cause the gold market to face major fluctuations.

Economic data to watch this week

Monday: US Consumer Confidence

Tuesday: US durable goods orders and new home sales

Wednesday: Christmas

Thursday: US weekly jobless claims

See more news related to gold prices HERE...