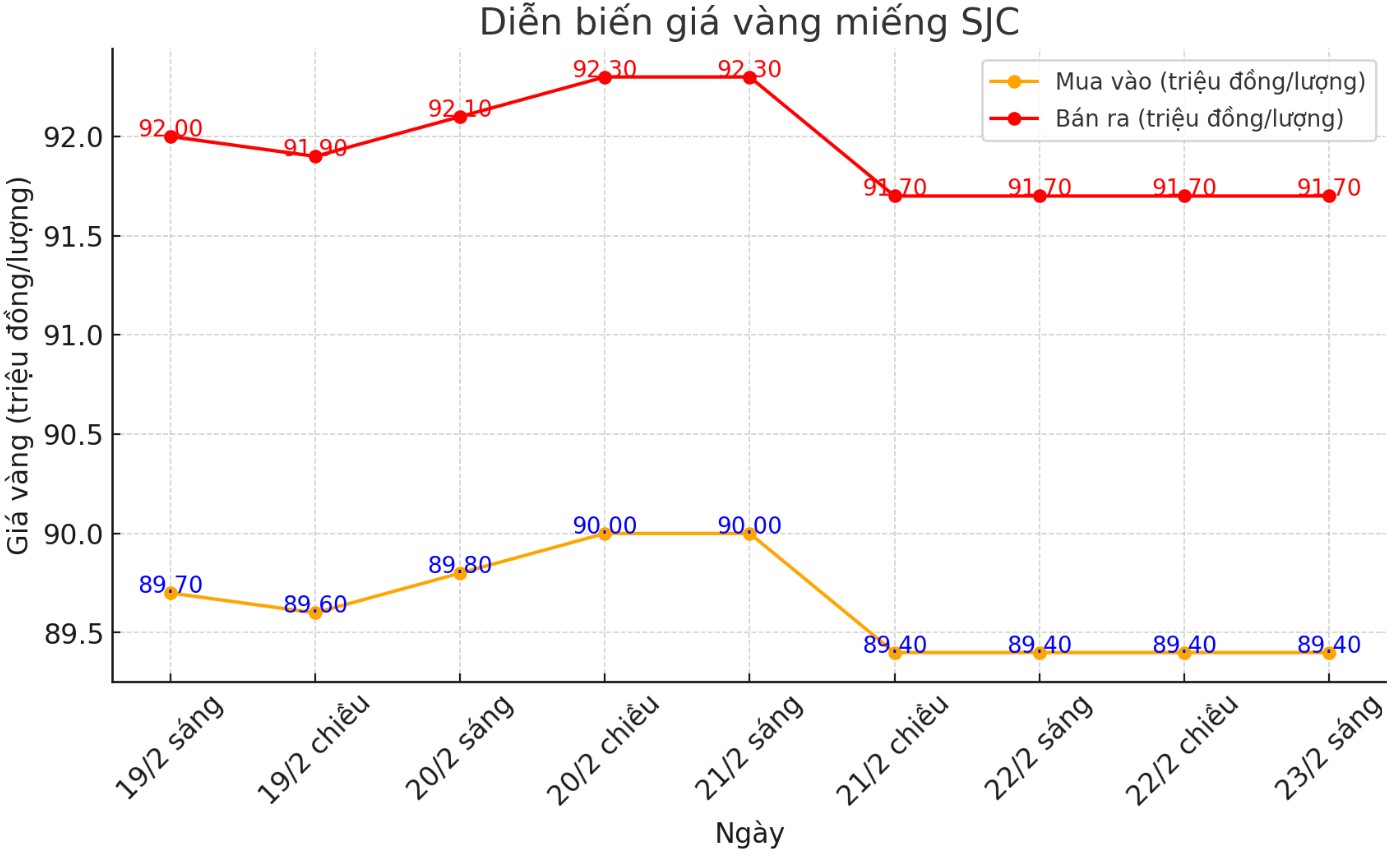

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.4-91.7 million/tael (buy in - sell out), unchanged in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND89.6-91.7 million/tael (buy - sell), down VND200,000/tael for buying and kept the same for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.1 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND89.4-91.7 million/tael (buy in - sell out), unchanged in both directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

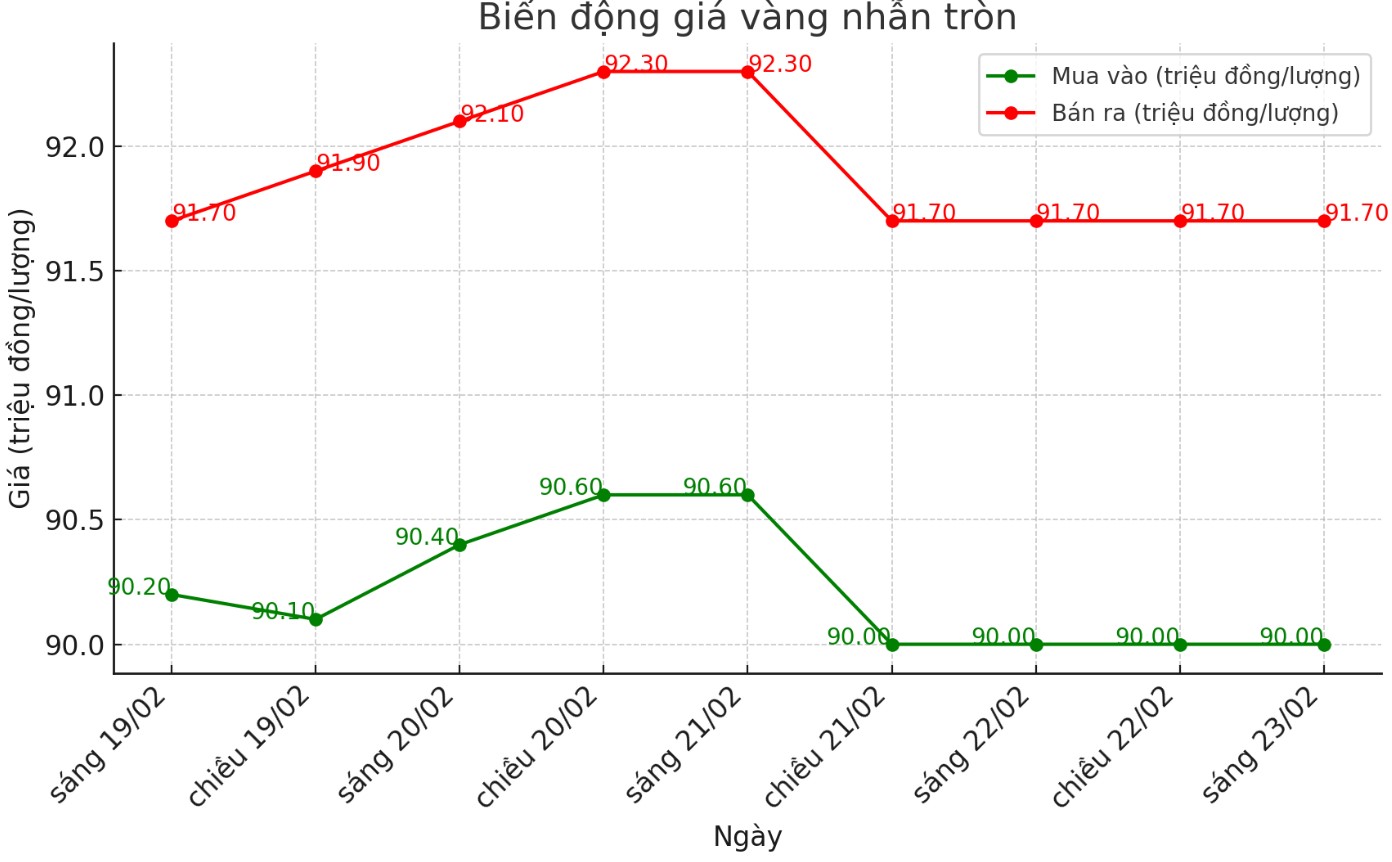

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 90-91.7 million VND/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is listed at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.2-91.8 million VND/tael (buy - sell); increased by 150,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 6:00 a.m. on February 23, the world gold price listed on Kitco was at 2,936.2 USD/ounce, down 2.1 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices decreased slightly in the context of a high USD. Recorded at 6:00 a.m. on February 23, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.520 points (up 0.24%).

Kitco News' weekly gold survey shows that industry experts are increasingly cautious about gold's short-term prospects, while individual investors are more optimistic about the possibility of price increases.

17 experts participated in the Kitco News gold survey, with optimism on Wall Street continuing to be restrained. 9 experts (53%) predict gold prices will increase next week. Four (24%) see prices falling, while the other four see gold moving sideways.

Meanwhile, 204 individual investors participated in Kitco's online survey, with an increasingly optimistic sentiment. 144 people (71%) expect gold prices to rise next week, 34 people (17%) predict gold will fall, and 26 people (13%) expect gold prices to move sideways in the short term.

Ole Hansen - an expert at Saxo Bank - commented: "The strong momentum of gold price increase, along with the "fear of missing opportunities" mentality, is being reinforced by demand from central banks and investors wanting to protect their assets against an increasingly unstable world".

This is clearly demonstrated through capital flows into gold ETFs, when the world's largest gold ETF recorded the strongest holding increase since 2023, with more than 20 tons of gold purchased in just three trading days.

Philip Newman, managing director of precious metals consulting firm Metals Focus, said: High demand for safe havens, driven by President Donald Trumps tax strategy and new developments in Ukraine, has been a key factor supporting the recent increase in gold prices.

This expert said that market concerns increased after US President Donald Trump made controversial statements about Ukrainian President Volodymyr Zelensky and Russia's war in Ukraine, further straining relations between the US and some European countries.

In addition, although plans to impose tariffs on Canada and Mexico were postponed after agreements in early February, Mr. Trump's trade policy still creates a cautious mentality in the market.

Economic event schedule next week may affect gold prices

Investors will closely monitor the results of Germany's parliamentary elections on Sunday. On Tuesday morning, the US Consumer Confidence report for February will be released, followed by the New Homeowned Sales data for January on Wednesday.

Thursday, the market will receive a preliminary report on US Q4 GDP, January long-term goods orders and weekly unemployment claims, followed by US home purchase contract data pending processing late in the morning.

However, the most important event of the week will be the US core PCE index on Friday, along with the January personal income and spending report. This is the FED's preferred inflation measure, helping gold traders assess the interest rate outlook in the coming time.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...