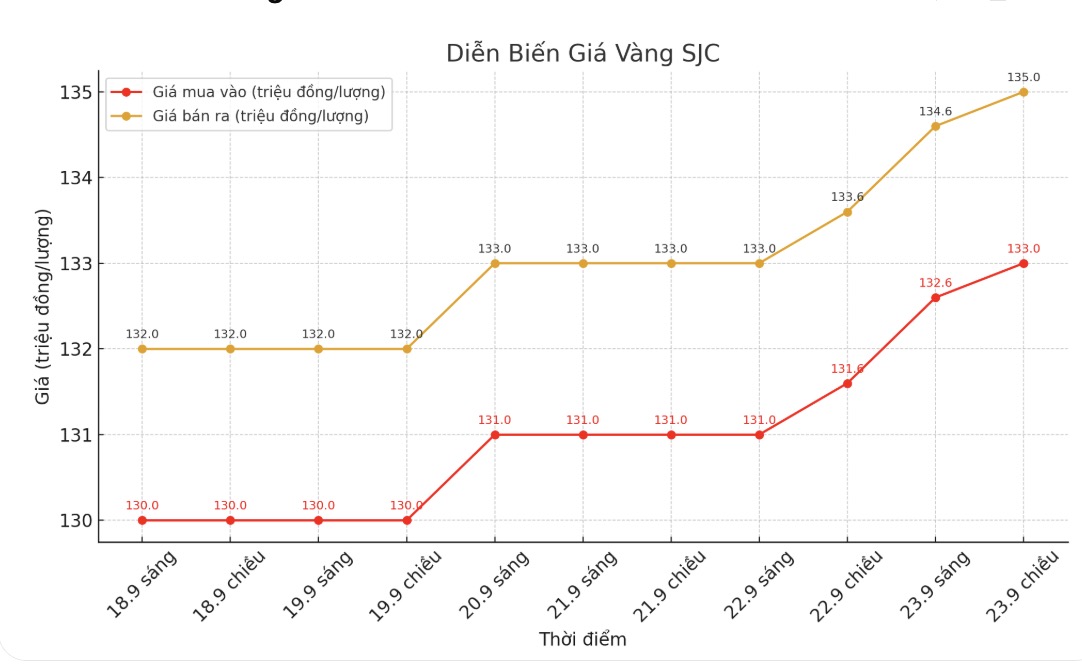

SJC gold bar price

As of 6:00 a.m. on September 24, the price of SJC gold bars was listed by DOJI Group at VND133-135 million/tael (buy in - sell out), an increase of VND1.4 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.4 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

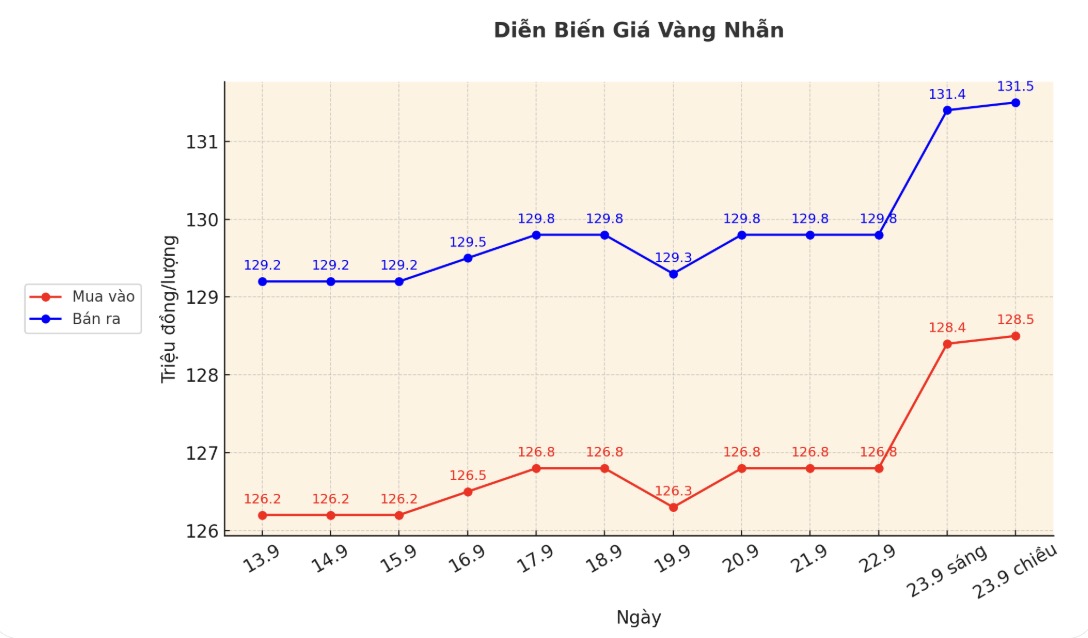

9999 gold ring price

As of 6:00 a.m. on September 24, DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.3-132.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

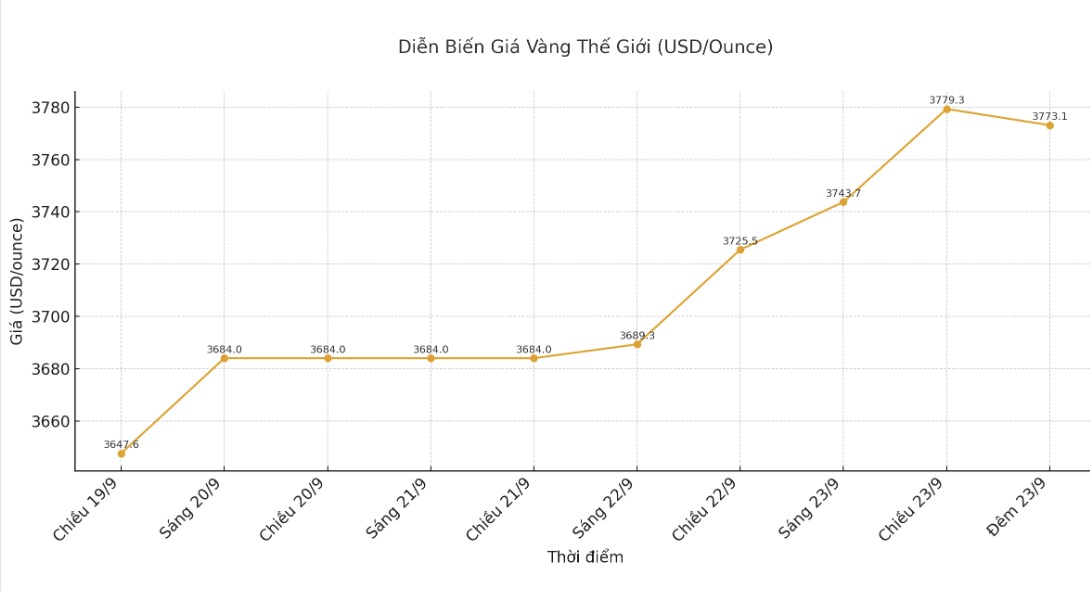

World gold price

The world gold price was listed at 11:45 p.m. on September 23 at 3,773.1 USD/ounce, up 36.6 USD/ounce.

Gold price forecast

World gold prices are on a strong upward trend, continuously setting new records. Silver prices also rose and hit a 14-year high.

The increase in gold and silver has been going on for a long time and is now accelerating strongly. This shows that, in terms of time, the market can soon reach a peak. However, in terms of price, these two metals still have room to increase during the acceleration phase before cooling down for a while.

Currently, December gold contract increased by 38.4 USD to 3,811.6 USD/ounce; December silver contract increased by 0.331 USD to 44.45 USD/ounce.

Overnight news, Bloomberg said that China aims to become a gold reserve haven of sovereign countries to strengthen its position in the global gold market.

The People's Bank of China is using the Shanghai Gold Exchange to invite central banks in countries to buy gold and store it in China. This move will enhance Beijing's role in the global financial system, according to Bloomberg.

In another development, the market is paying attention to the information of US Federal Reserve Chairman Jerome Powell speaking about the economic outlook at " Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon". Ms. Michelle bowman, FED's vice president in charge of supervision, spoke at the 134th Annual Meeting of the Kentucky Banking Association.

Technically, December gold futures bulls are still holding a big advantage in the short term. The next upside target for buyers is to close above the strong resistance zone at $3,900/ounce. The next short-term bearish target for the bears is to pull prices below the strong technical support zone at $3,650/ounce.

The first resistance was at 3,825 USD/ounce and then 3,850 USD/ounce. First support was at the bottom of $3,772.4 an ounce last night, followed by a low of $3,718.1 an ounce this week.

Key outside markets today showed the USD index moving sideways, while crude oil prices rose and traded around 63.75 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.13%.

Schedule of announcing economic data affecting gold prices

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...