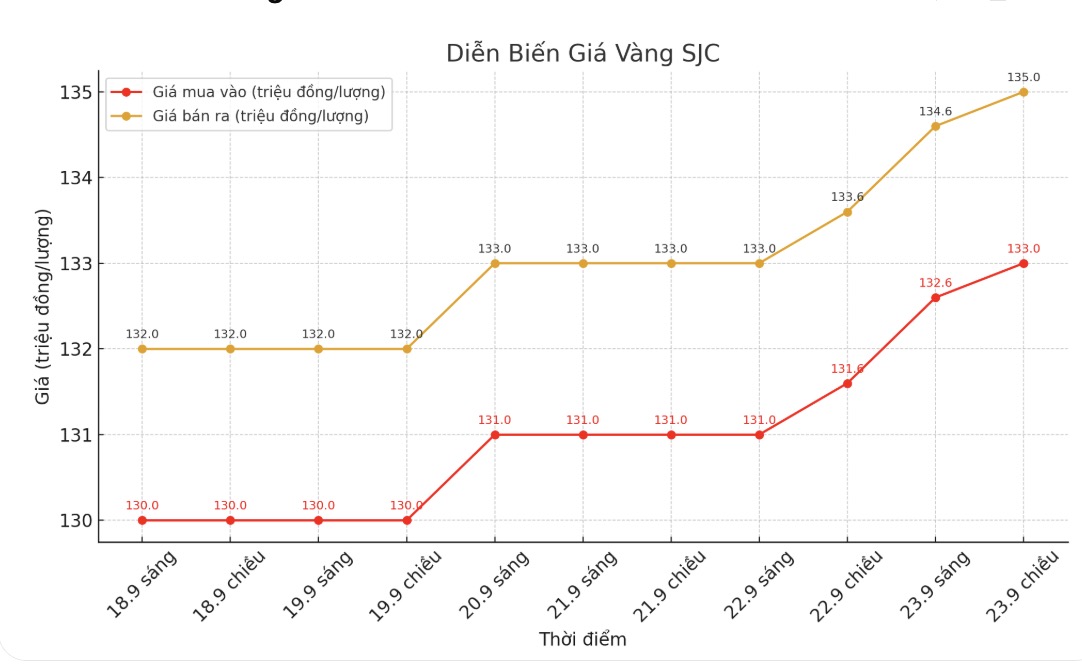

SJC gold bar price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at VND133-135 million/tael (buy in - sell out), an increase of VND1.4 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.4 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

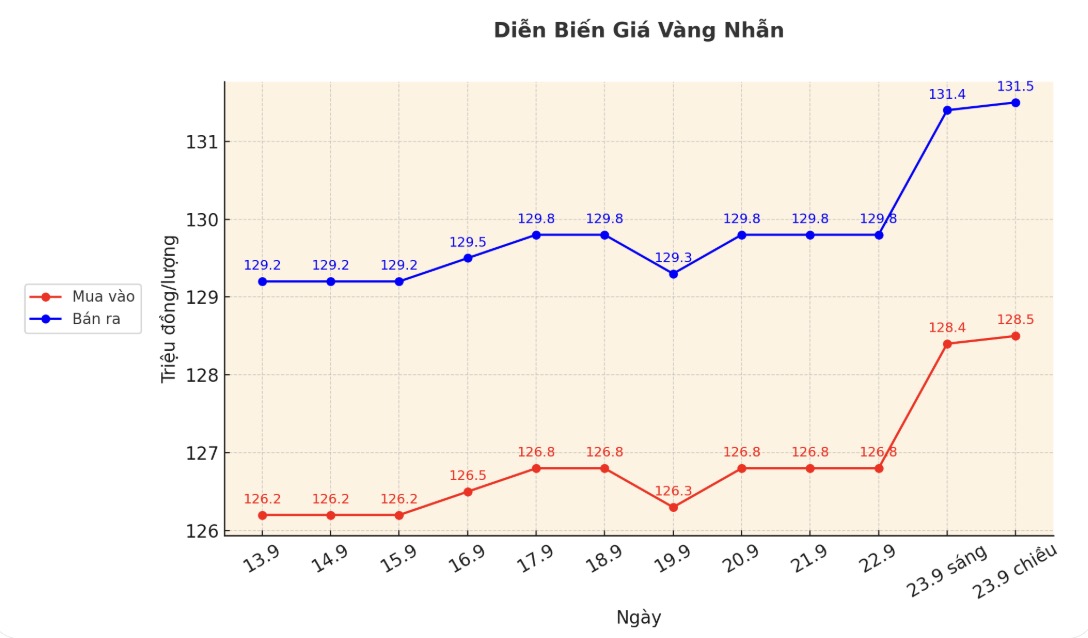

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.3-132.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

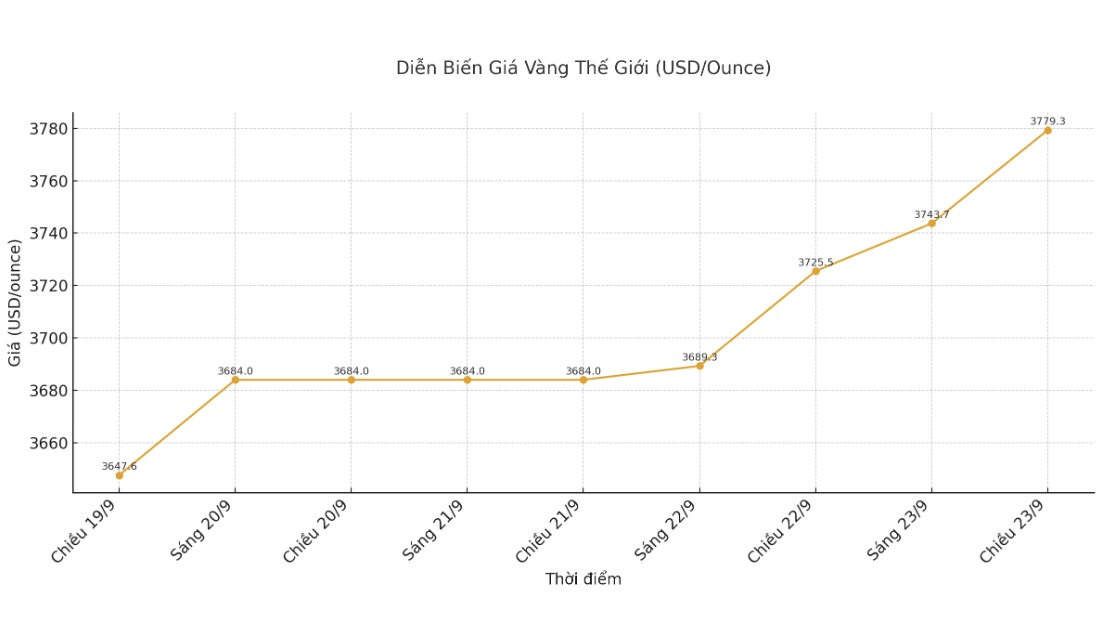

World gold price

The world gold price was listed at 5:00 p.m. at 3,779.3 USD/ounce, up 53.8 USD.

Gold price forecast

The world gold market increased sharply due to expectations that the US Federal Reserve (FED) will soon cut interest rates in the context of a weakening USD, helping gold cheaper for investors holding other currencies.

The main drivers of the increase come from monetary policy expectations, the possibility of the Fed cutting interest rates and inflation risks, said Kyle Rodda, an analyst at Capital.com.

From a technical perspective, Kelvin Wong, senior expert at OANDA, said that the uptrend remains strong but there may be a short-term correction.

In the new report, Michael Hsueh - Analyst of Deutsche Bank said he raised his gold price forecast and expected the average price to reach 4,000 USD/ounce in 2026. Gold has previously hit the target of $3,700/ounce set by the bank for 2025.

He said that although gold prices have increased by more than 40% since the beginning of the year, this precious metal has not been overvalualized. Although gold appears to be above reasonable value, the majority of the reason comes from central bank buying and this trend will continue, Hsueh said.

According to him, the easiest way to explain the $4,000/ounce forecast is to see the impact of formal demand (net buying from central banks) on the unadjusted gold price model.

According to consulting firm Metals Focus, from 2022 to now, each year, central banks have net bought more than 1,000 tons of gold. In 2025, this figure is expected to be about 900 tons, double the average of 457 tons/year in the 2016-2021 period.

Several developing countries seek to diversify away from the US dollar after the West froze nearly half of Russia's foreign exchange reserves in 2022.

German bank experts said that since 2022, gold prices have been higher than the unadjusted model by an average of 13% per year. Applying this increase to the 2026 forecast (11% + 13%) will average the price of 4,000 USD/ounce, with the assumption that official demand is still strong.

Regarding central bank demand, Michael Hsueh predicts that purchases will remain double the average annual 400 tons in the period 2011-2021, in which China plays a leading role.

The market is paying attention to Fed Chairman Jerome Powell's speech at 11:35 p.m. tonight (Vietnam time) and the PCE personal consumption expenditure price index report released on September 27.

The CME FedWatch tool tool now reflects a high probability of the Fed cutting 25 basis points at its October meeting and is likely to continue cutting in December.

Schedule of announcing economic data affecting gold prices this week

Tuesday: US S&P Flash PMI.

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...