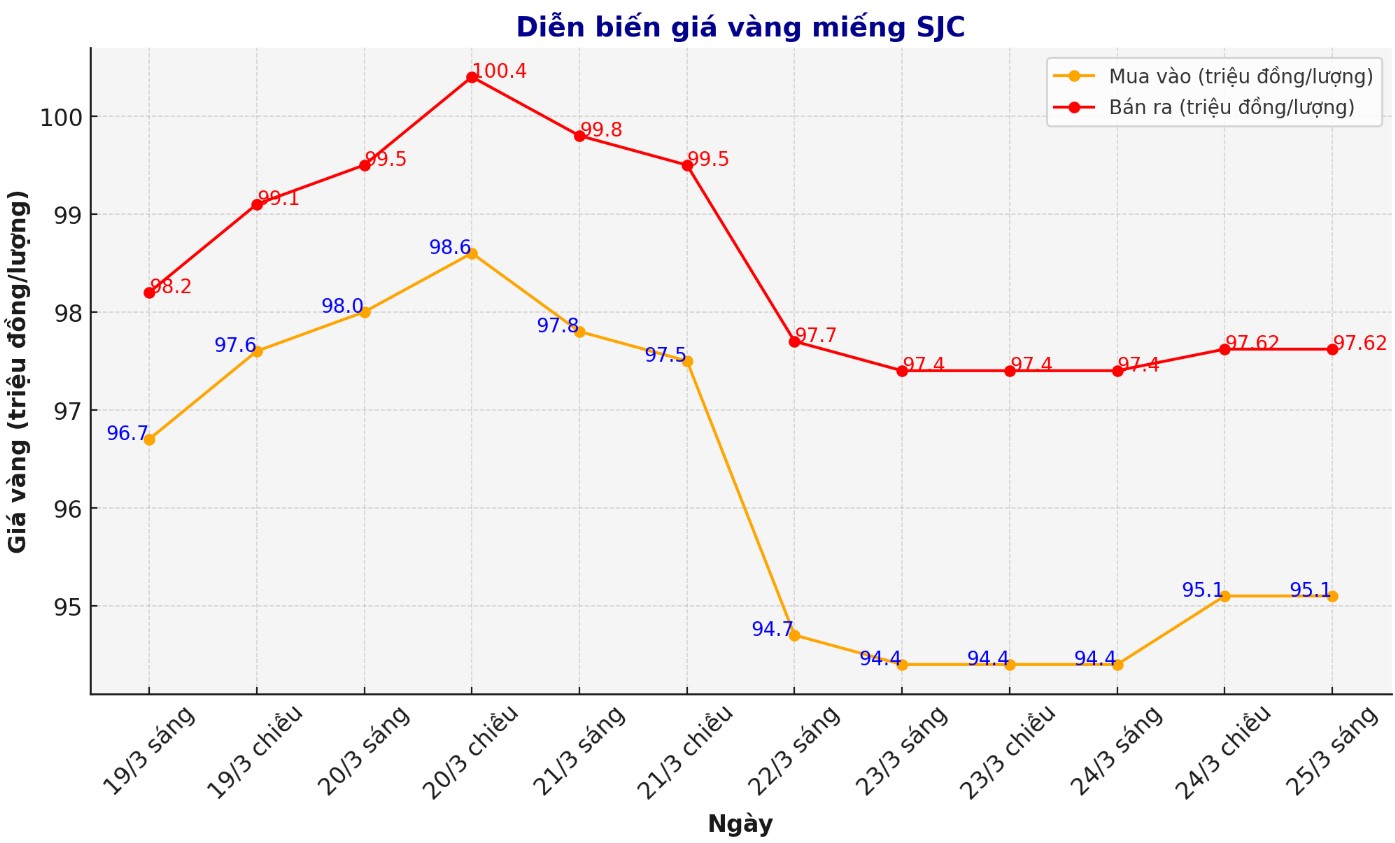

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND95.1-97.62 million/tael (buy - sell), an increase of VND700,000/tael for buying and an increase of VND220,000/tael for selling. The difference between buying and selling prices is at 2.52 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND95.1-97.6 million/tael (buy - sell), an increase of VND700,000/tael for buying and an increase of VND200,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND95.3-97.6 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND200,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

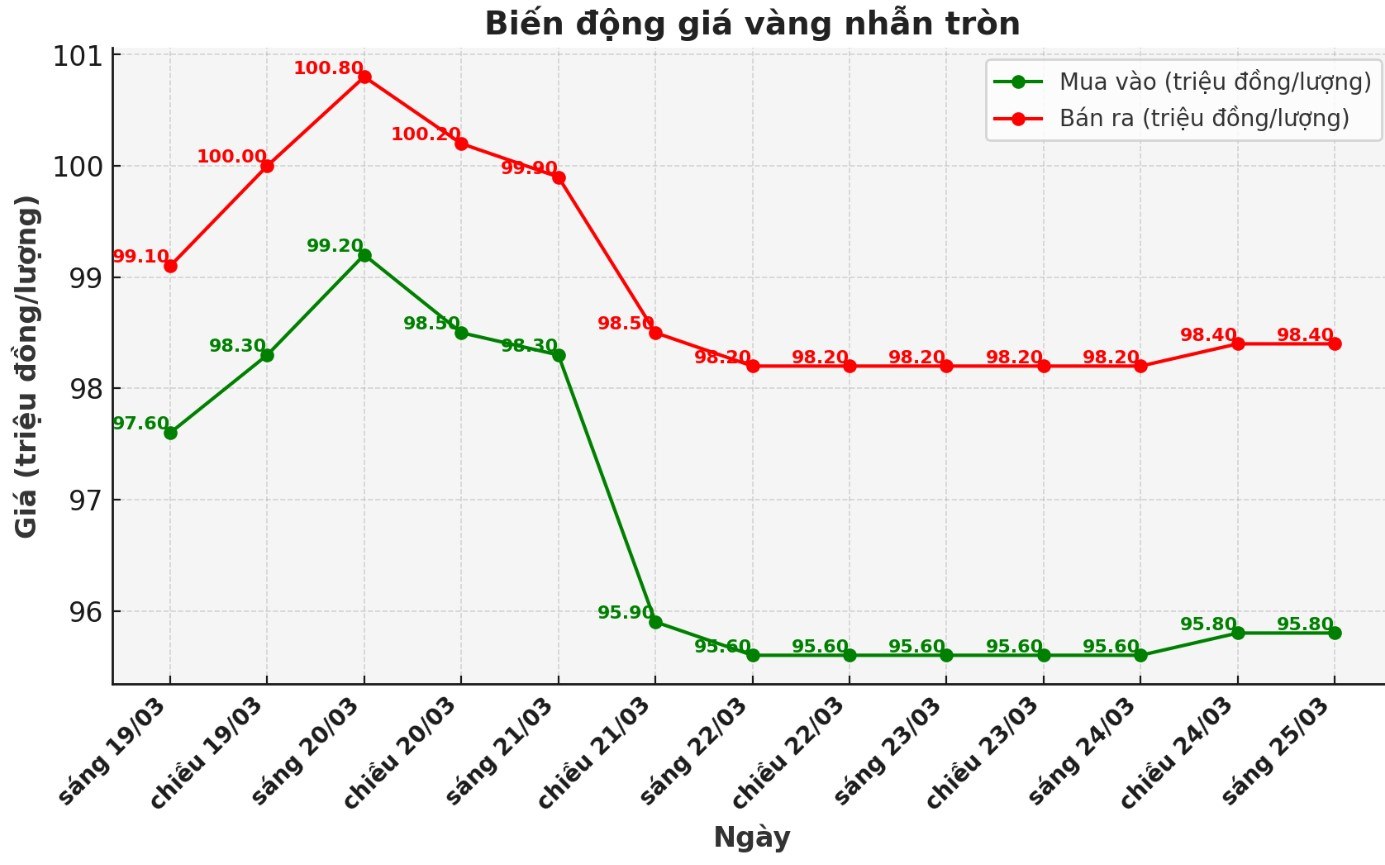

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.8-98.4 million/tael (buy in - sell out); increased by VND200,000/tael for both buying and selling. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96-98.6 million VND/tael (buy - sell); down 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 2.6 million VND/tael.

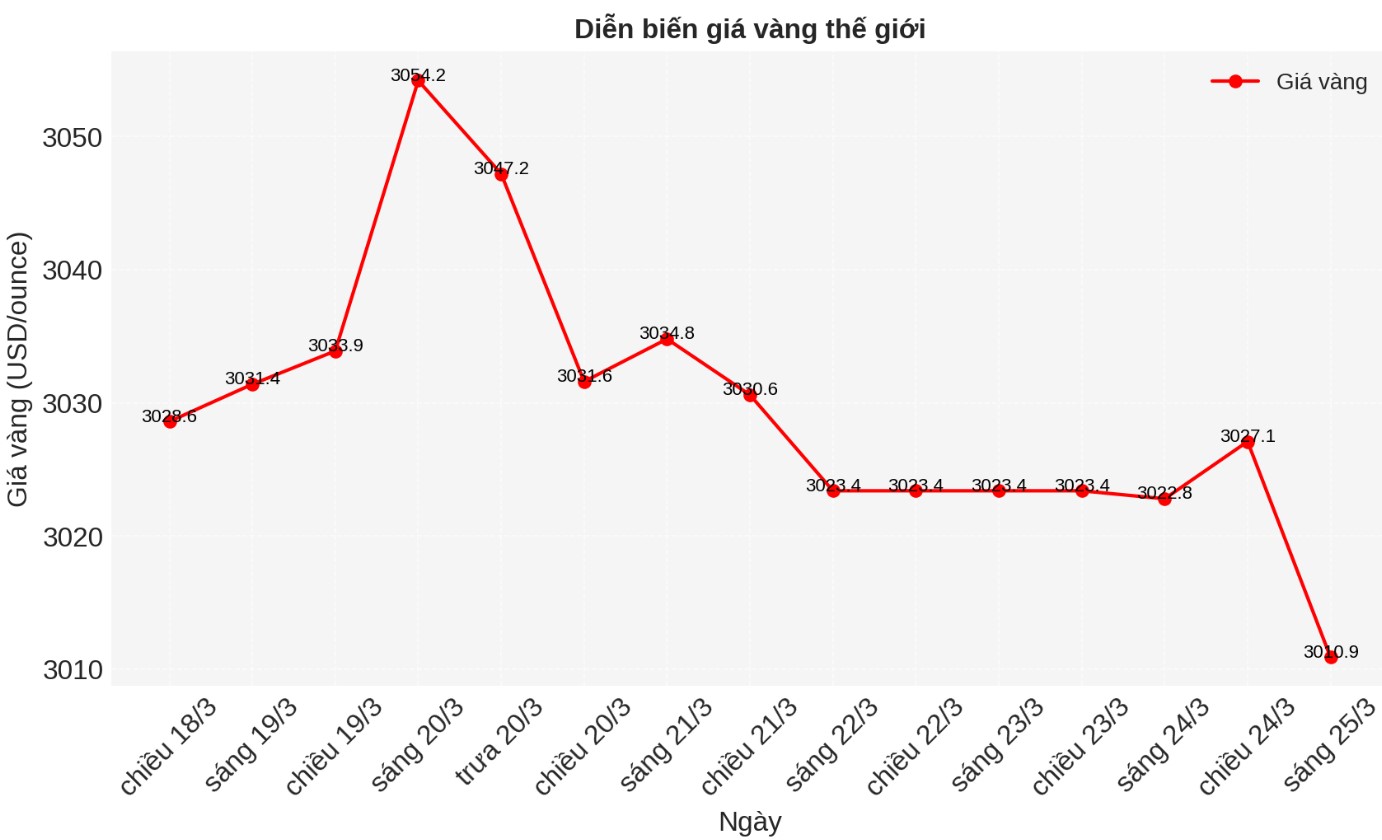

World gold price

As of 0:00 on March 25, the world gold price listed on Kitco was at 3,010.9 USD/ounce, down 12.5 USD/ounce.

Gold price forecast

World gold prices fell as the USD increased. Recorded at 0:00 on March 25, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.057 points (up 0.294%).

Despite the decline, the gold market remained firmly above $3,000/ounce as the US economy sent mixed signals, with production activities continuing to decline and the service sector growing.

S&P Global said on Monday that the preliminary Purchasing Managers' Index (PMI) of the service sector in March increased to 54.3, higher than the 51.0 in February. This data exceeded expectations, as economists forecast the index to be around 51.2%. The report said that activities in the service sector have reached their highest level in the past three months.

Meanwhile, manufacturing activity continued to decline, with the preliminary PMI falling to 49.8, down from the previous month's 52.7. Economists have expected a smaller decline, around 51.9. The report said that activity in the manufacturing sector has declined to a three-month low.

Although the US economy remains relatively stable, the report also shows that future growth sentiment continues to weaken.

At the same time, the report also highlighted rising price pressures, adding to concerns about prolonged inflation. Chris Williamson, chief economist at S&P Global Market Intelligence, said that although service sector operations have improved, overall growth is still slowing.

Some of the short-term risks appear to be leaning down. Growth is currently concentrated in the service sector when production fell into decline after temporary tax measures boosted factory output in the first two months of the year.

Similarly, part of the recovery in the service sector in March was due to a recovery in business operations after bad weather conditions reduced operations in many states in January and February, which could be just a temporary recovery," he said in the report.

Williamson also noted that US government policies and tariffs on imported goods are placing psychological pressure on growth.

A temporary recovery in the service sector may not be enough to prolong the growth momentum of the US economy, because if it is just a short-term recovery, the economy will still face many unstable factors. This makes investors tend to look to gold as a safe investment channel.

At the same time, imposing tariffs on imported goods is increasing costs for companies, meaning inflation could increase. As inflation increases, the value of the US dollar may decrease, creating a favorable environment for gold to increase in price, because gold is always considered a valuable protection asset during inflation.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...