Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-121 million/tael (buy - sell); an increase of VND 2 million/tael for buying and an increase of VND 1.5 million/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

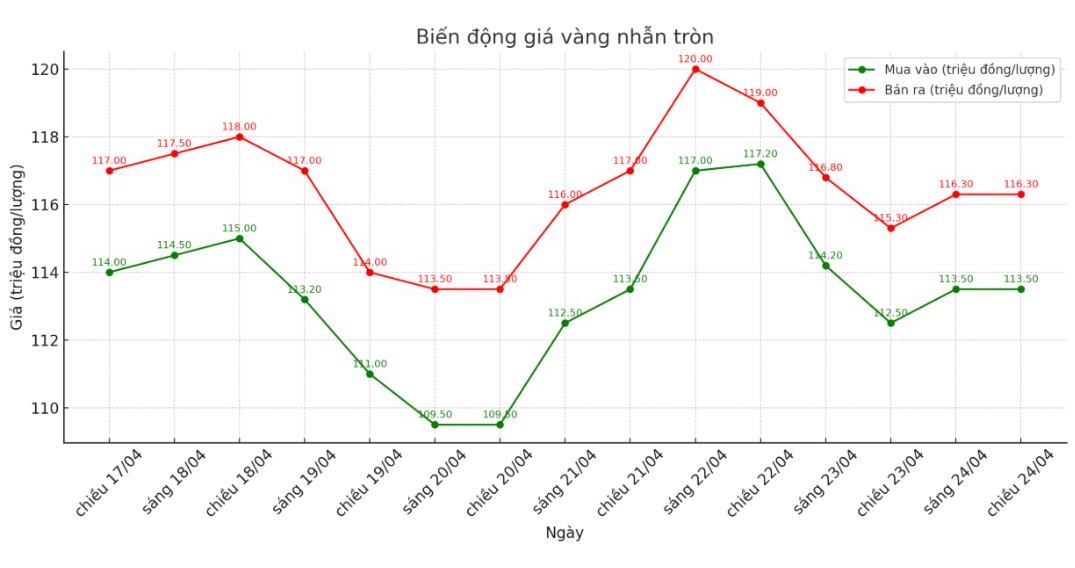

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116.3 million VND/tael (buy in - sell out); an increase of 1 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); increased by 2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of round gold rings at 115-118 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

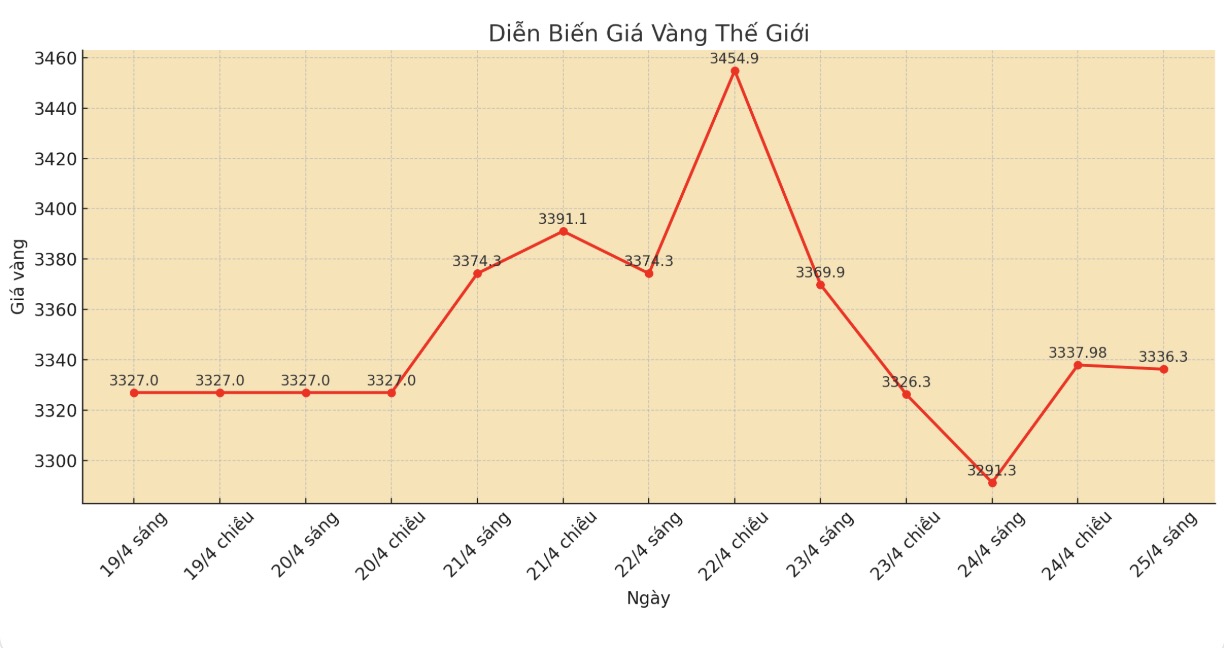

World gold price

As of 0:30 am, the world gold price was listed at 3,336.3 USD/ounce.

Gold price forecast

According to Kitco, world gold prices increased sharply again thanks to buying power after yesterday's sharp decline. Consultants took the opportunity to buy when prices fell and maintained their upward momentum despite the continued improvement of the US stock market.

June gold contract increased by 48.7 USD to 3,342.7 USD/ounce. Meanwhile, the price of silver delivered in May decreased slightly by 0.067 USD to 33.48 USD/ounce.

The US stock market continued to increase strongly, extending the increase of the previous two sessions, reflecting the optimistic sentiment of investors. US-China trade relations have shown signs of "growing up" after the latest statements from US President Donald Trump and US administration officials. Mr. Donald Trump said that the US and China are resuming negotiations.

Meanwhile, China announced that it will pump more liquidity into the financial system on Friday, showing that monetary policy is loosening slightly.

Technically, June gold futures are holding a solid near-term technical advantage. The next upside target for buyers is to close above the resistance level of $3,509.9/ounce. On the contrary, the target for the sellers is to push the price below the support level of 3,200 USD/ounce.

The immediate resistance level is 3,377 USD/ounce, then 3,400 USD/ounce. The first support level is 3,325 USD/ounce, followed by 3,300 USD/ounce.

Overseas markets saw the USD index fall, Nymex crude oil prices traded around 62.5 USD/barrel. There is information that OPEC is considering increasing oil production in June. The yield on the 10-year US Treasury note was 4.319%.

Note: Compare the article with the same previous version.

See more news related to gold prices Here ...