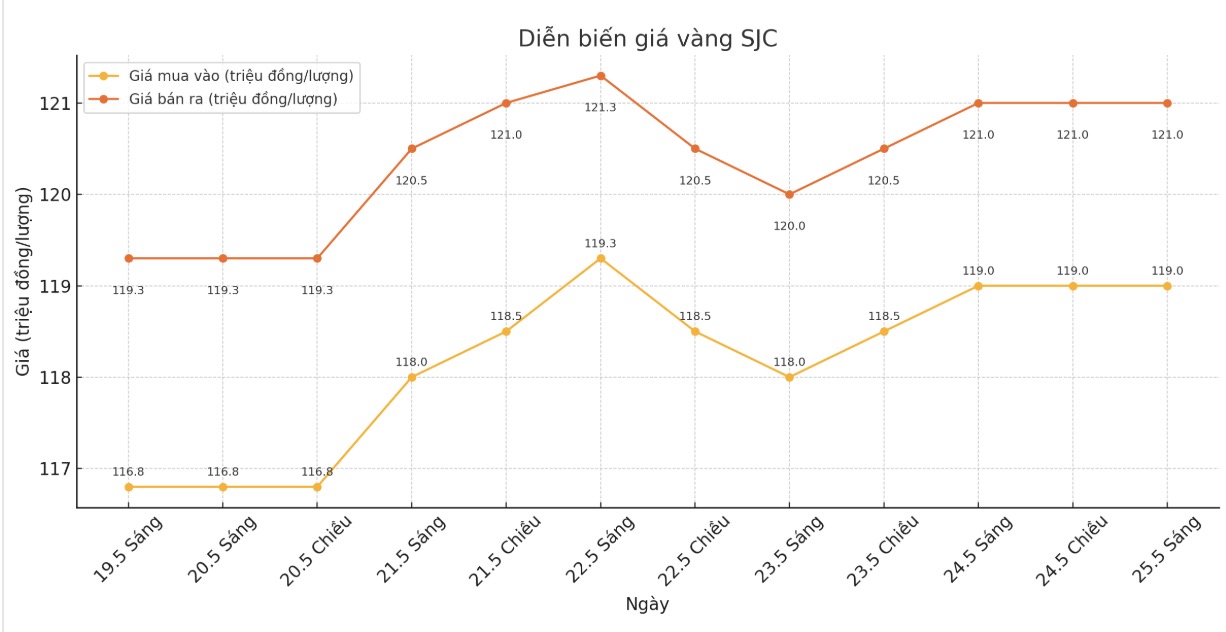

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

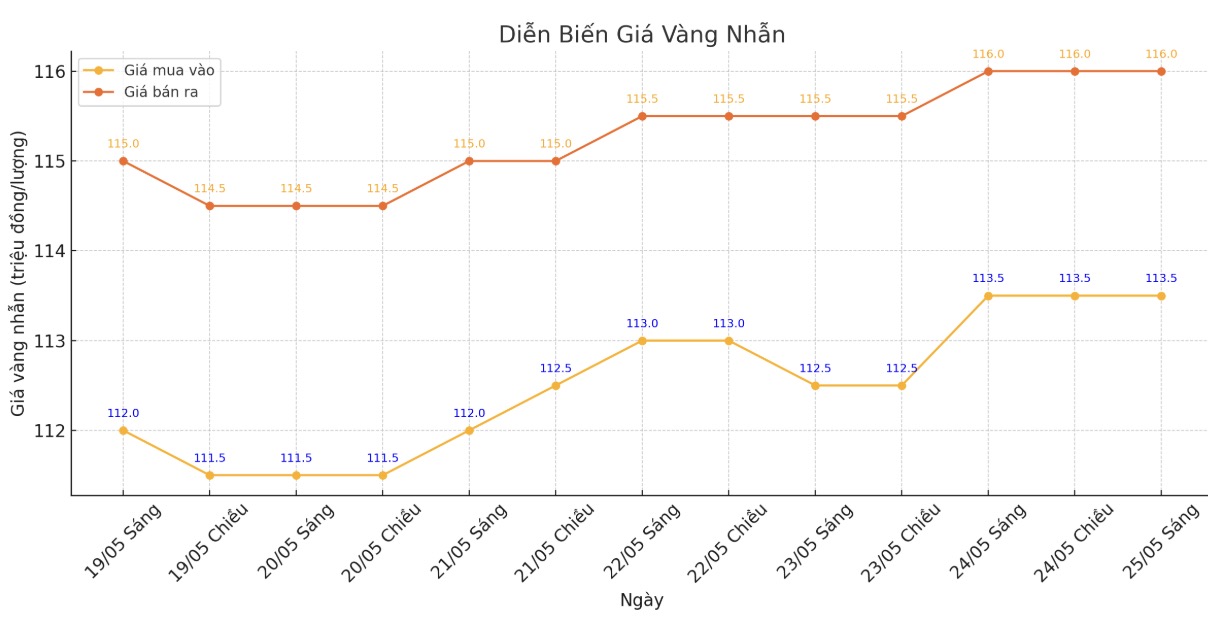

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113-116 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

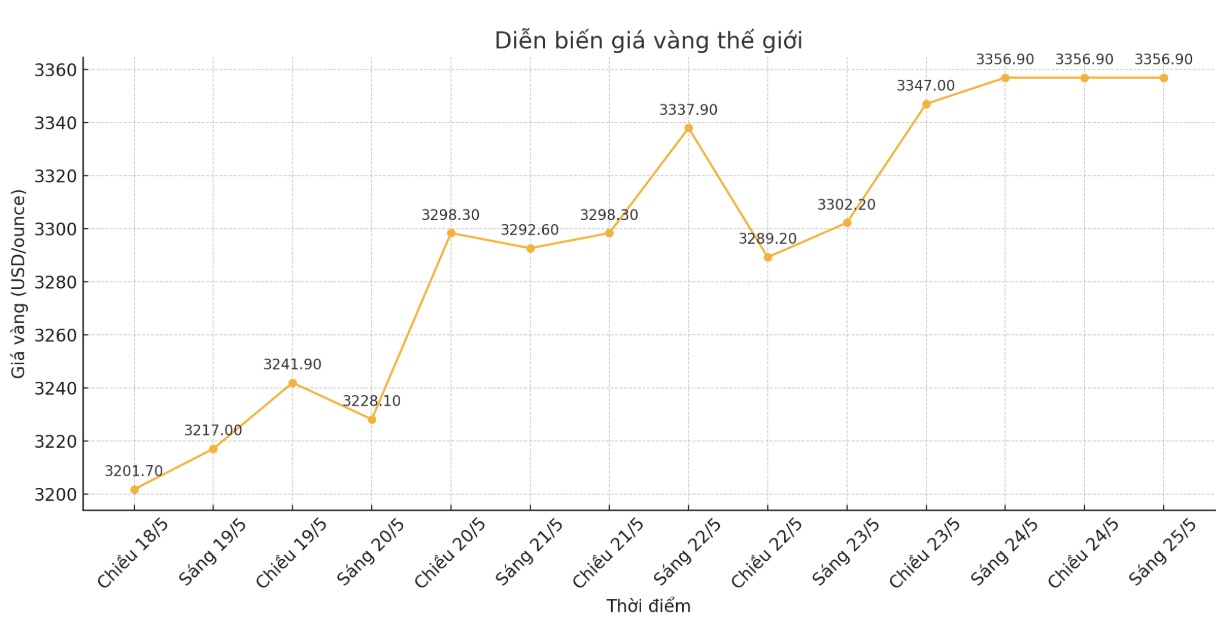

World gold price

At 6:00 a.m., the world gold price was listed on Kitco around 3,356.9 USD/ounce.

Gold price forecast

According to Kitco, gold prices increased as investors sought alternative safe-haven assets, due to concerns about the reliability of the USD and US bonds. The uncertainty began last weekend after Moody's downgraded its credit rating in the US debt. Gold prices have broken above the resistance level of $3,200/ounce and regained their position above $3,300/ounce.

Demand for shelter increased in midweek, as the 20-year US bond auction failed to meet expectations, causing the 30-year yield to surpass 5%. At the same time, the USD Index closed the week near the support level of 99 points - the lowest in three weeks.

Chris Weston - Research Director of Pepperstone - commented that increased US public debt, high bond issuance and high inflation have caused long-term bond yields to increase, putting pressure on US USD and stocks, boosting capital flows into gold and Bitcoin.

In the coming week, investors will focus on PCE core inflation data, 2, 5 and 7-year bond auctions, and developments in the Japanese bond market that could affect global liquidity.

Han Tan - Head of FXTM Analysis - warned that the gold rally could slow down if bond yields do not increase sharply and remain below 5%. The Fed's statements and PCE data will affect expectations of a rate cut, which could help gold surpass the $3,000 - $3,500/ounce range.

Ole Hansen - Chief Strategist of Saxo Bank - said that if gold exceeds 3,355 USD/ounce, the short-term correction period could end. He also noted that the pessimistic sentiment in the bond market could peak and trigger a risky return.

In addition, gold is also supported by trade tensions, when Mr. Donald Trump threatened to increase import tariffs to 50% on European goods from June 1, attracting market attention.

Adam turnquist - Strategist of LPL Financial - commented that concerns about trade, budget deficits and growth, although not clearly shown on the stock market, still put pressure on the USD. If the USD continues to weaken and fall out of the stable zone, this will be a negative signal for the US economy.

Notable economic data next week

Tuesday: Long-term US orders, US consumer confidence, monetary policy decision of the Reserve Bank of New Zealand.

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...