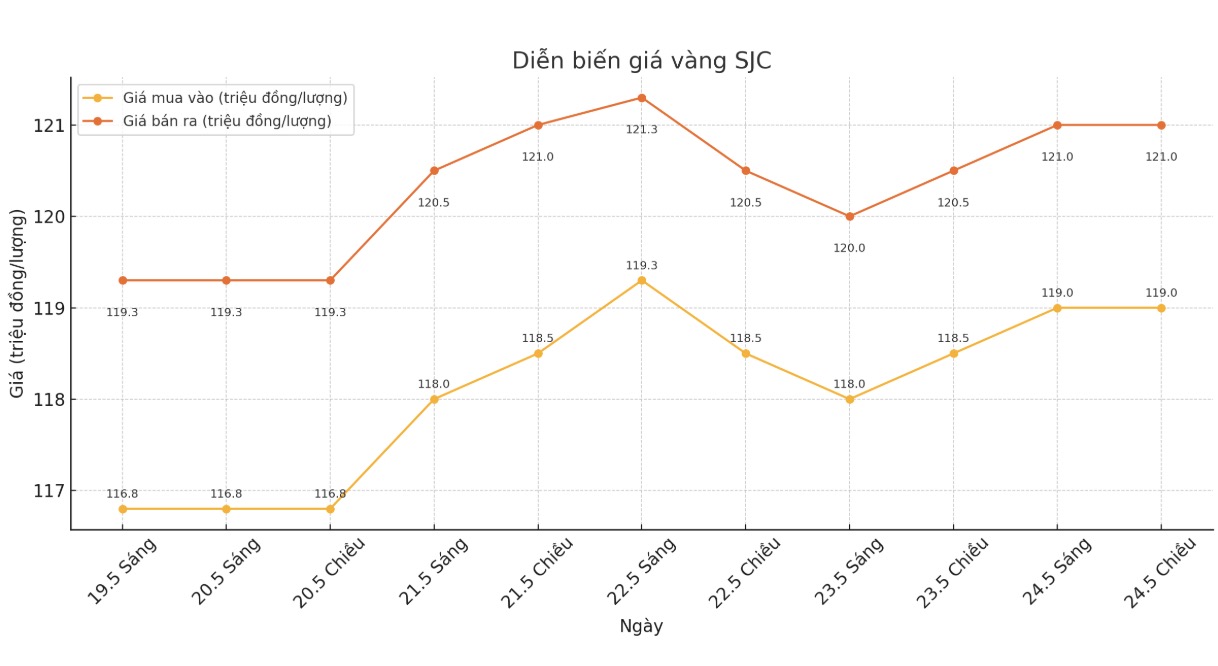

Updated SJC gold price

As of 6:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

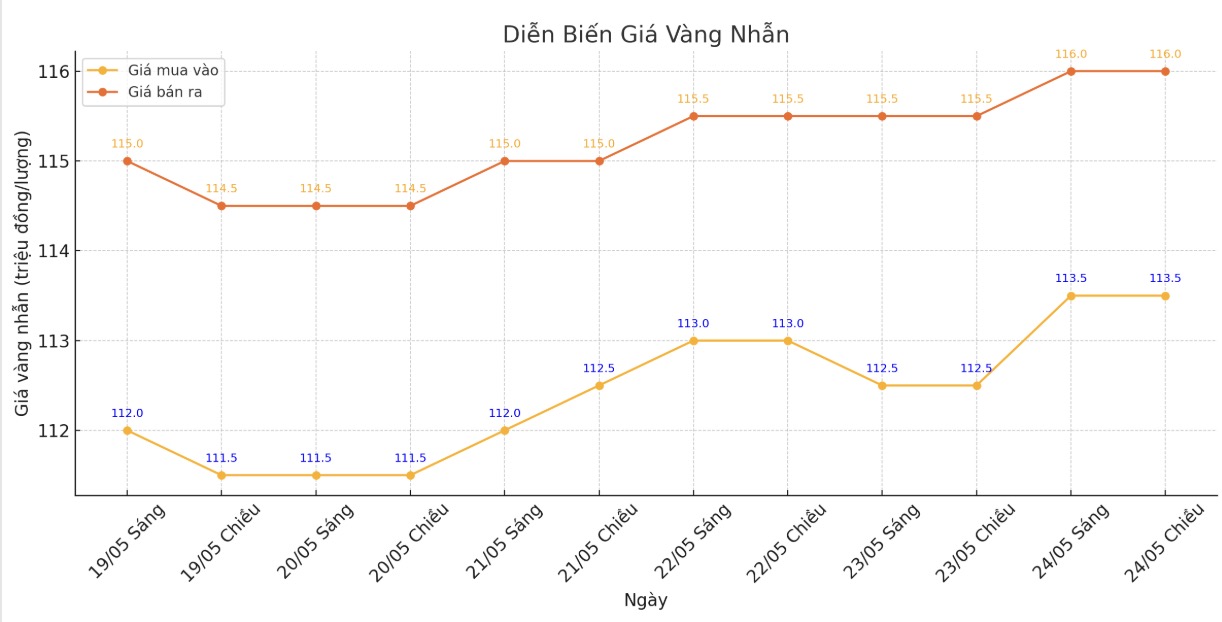

9999 round gold ring price

As of 7:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113-116 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

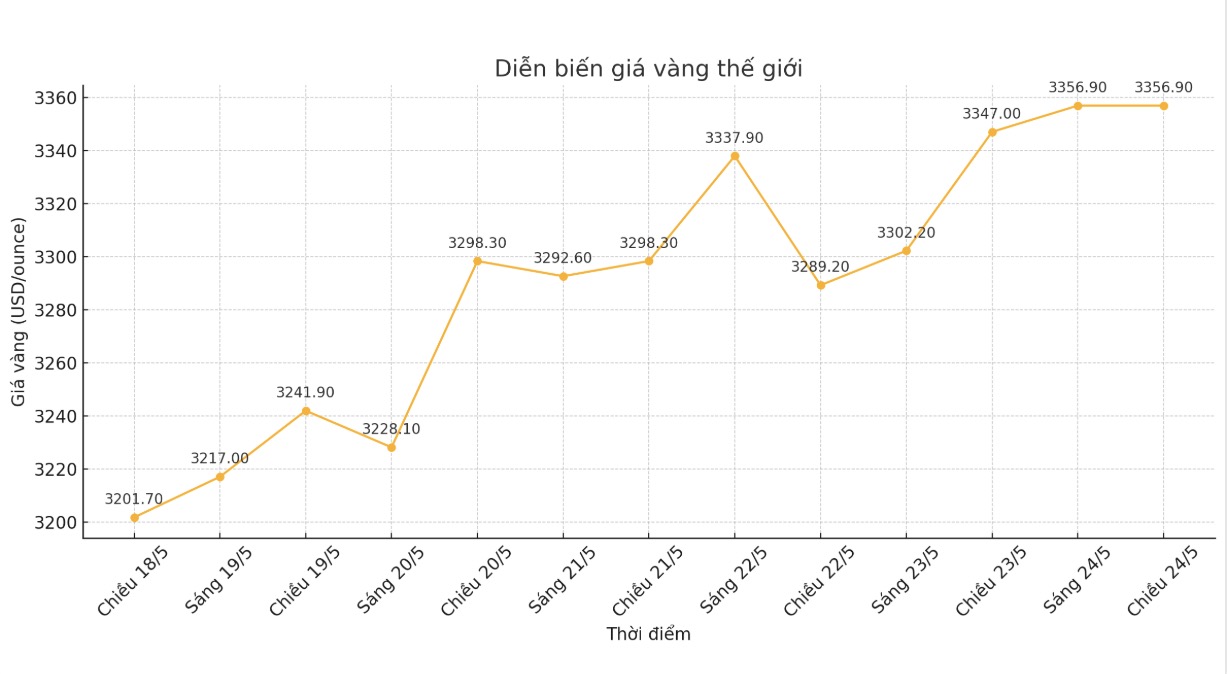

World gold price

At 6:45 p.m., the world gold price listed on Kitco was around 3,356.9 USD/ounce, up 99 USD/ounce.

Gold price forecast

Despite negative forecasts from experts, world gold prices this week recorded an impressive increase. Looking at the price chart, it can be seen that the precious metal recorded many reversals, but still closed the best week of increase since the beginning of April.

Gold prices increased over the weekend as investors stepped up their risk-off gold purchases ahead of the three-day holiday.

Many investors are concerned about increased trade tensions as US President Donald Trump issued a warning to Apple and recommended applying stricter tariffs on the European Union (EU).

Mr. Trump also said that Apple will have to pay a 25% tax on iPhones not made in the US.

Foxconn, Apple's main supplier, previously planned to build a $1.5 billion component manufacturing plant near Chennai in Tamil Nadu, India. This means that Apple's supply chain in the world's most populous country will continue to expand despite President Donald Trump's call for the US technology giant to shift production to his home country.

Speaking on CNBC, Tai Wong, an independent metals investor, said President Donald Trump has taken strong action in the past 24 hours. The threat of imposing a 50% tax on the EU since June 1 and Apple has caused the stock market to sink into a gloomy mood, which is very good for gold.

David Morrison, senior analyst at Trade Nation, said the weak USD continues to support gold. However, he recommends that investors be cautious because the current momentum is quite neutral and gold prices can fluctuate in both directions.

With the US dollar under pressure, and as investors away from US bonds due to concerns about excessive public debt, there is still a compelling case to hold gold as a safe asset. However, like many times in the past, a story is not guaranteed. The possibility of gold prices adjusting further is still un ruletable, he said.

Some analysts note that the US Memorial Day holiday could help ease global market stress, creating short-term profit-taking pressure on gold.

Notable economic data next week

Tuesday: Long-term US orders, US consumer confidence, monetary policy decision of the Reserve Bank of New Zealand.

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...