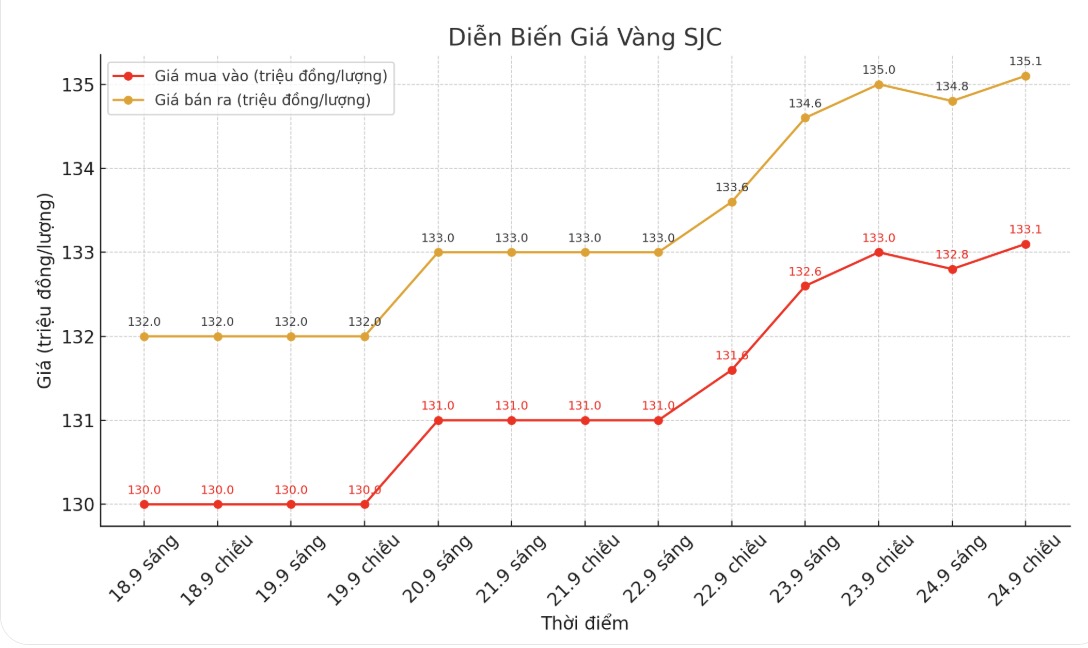

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND133.1-135.1 million/tael (buy in - sell out), an increase of VND100,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.1-135.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.6-135.1 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

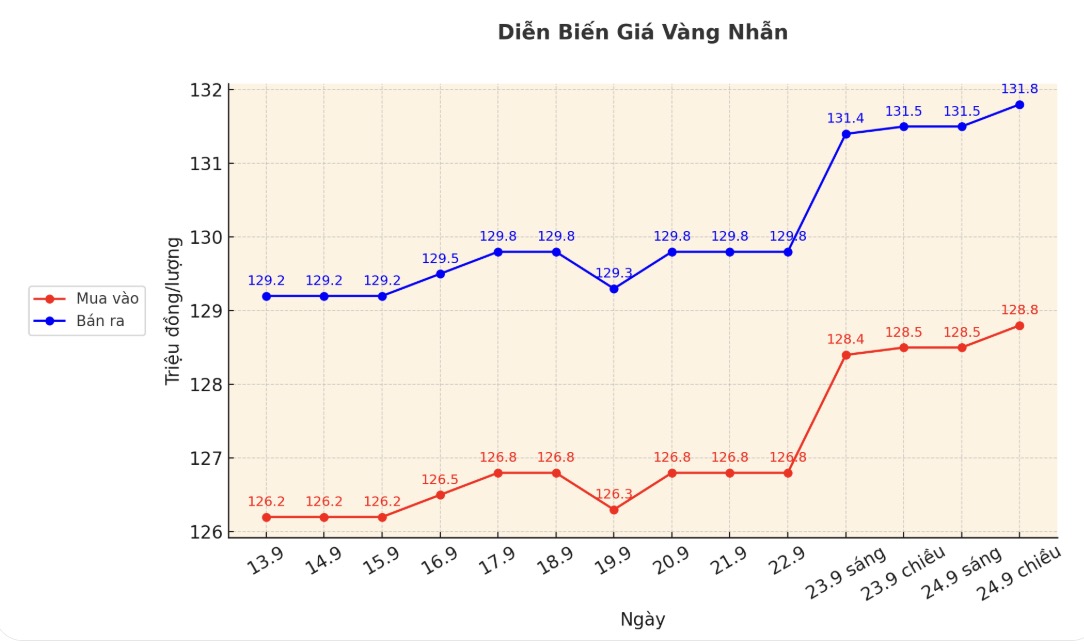

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.3-132.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

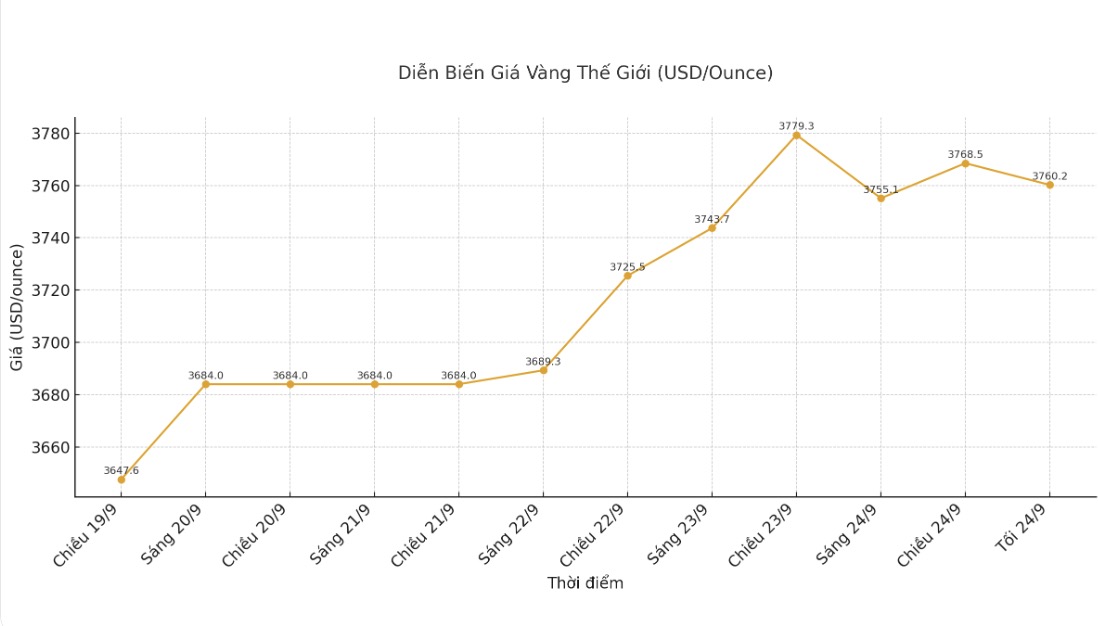

World gold price

The world gold price was listed at 9:20 p.m. on September 24 at 3,760.2 USD/ounce, down 12.9 USD/ounce.

Gold price forecast

World gold prices weakened due to profit-taking activities after gold set a new record for the week. December gold contract fell $17.5 to $3,798.2 an ounce. December delivery silver price decreased by 0.333 USD to 44.275 USD/ounce.

Global stocks fluctuated in different directions last night. The US stock index is expected to open up as the New York session begins, after setting a new peak on Monday.

In overnight news, Federal Reserve Chairman Jerome Powell said the US labor market and inflation outlook was facing risks, calling it a challenging situation.

He stressed upside inflation risks and downside employment risks a difficult situation and double-sided risks mean no perfectly safe path.

Mr. Powell denied that the Fed is politically dominated in its policy decisions, asserting that we only look at the best for the people we serve. He did not disclose his likely support for a rate cut at the October FOMC meeting.

Overseas markets showed a solid increase in the USD index, with crude oil prices rising around 64 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.10%.

Technically, December gold futures are still in a short-term strong uptrend. The next upside target for buyers is to close above the solid resistance level of $3,900/ounce. The nearest downside target for the bears is to push prices below support at $3,650/ounce.

The first resistance was at this week's peak of 3,824.6 USD/ounce, followed by 3,850 USD/ounce. First support was at the bottom of $3,772.40/ounce on Tuesday, followed by a low of $3,718.1/ounce this week.

Schedule of announcing economic data affecting gold prices

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...