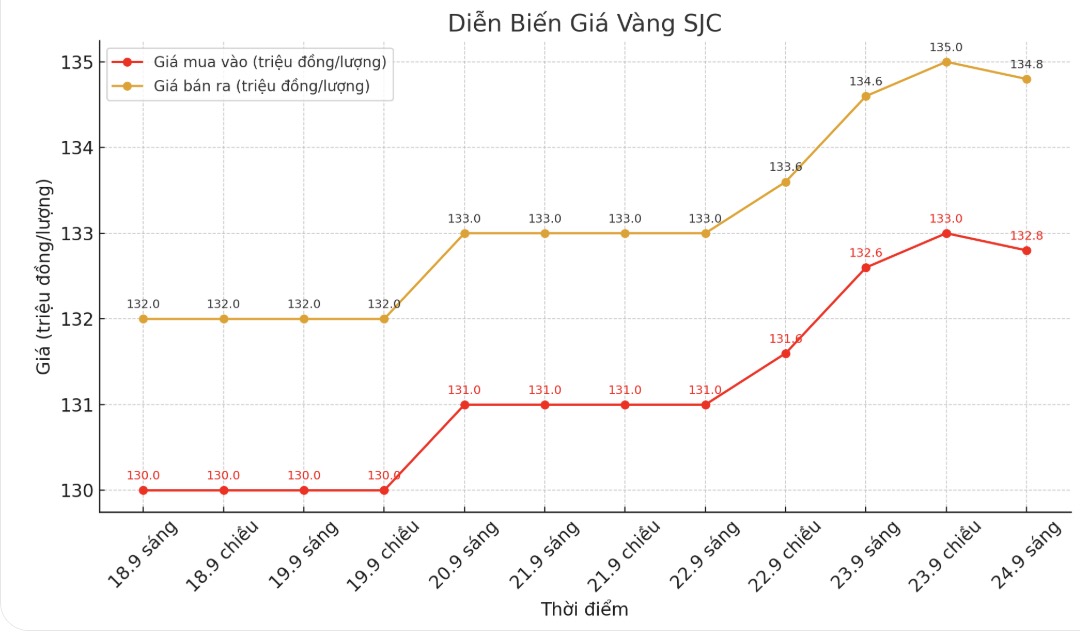

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 132.8-134.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.8-134.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 132.3-134.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

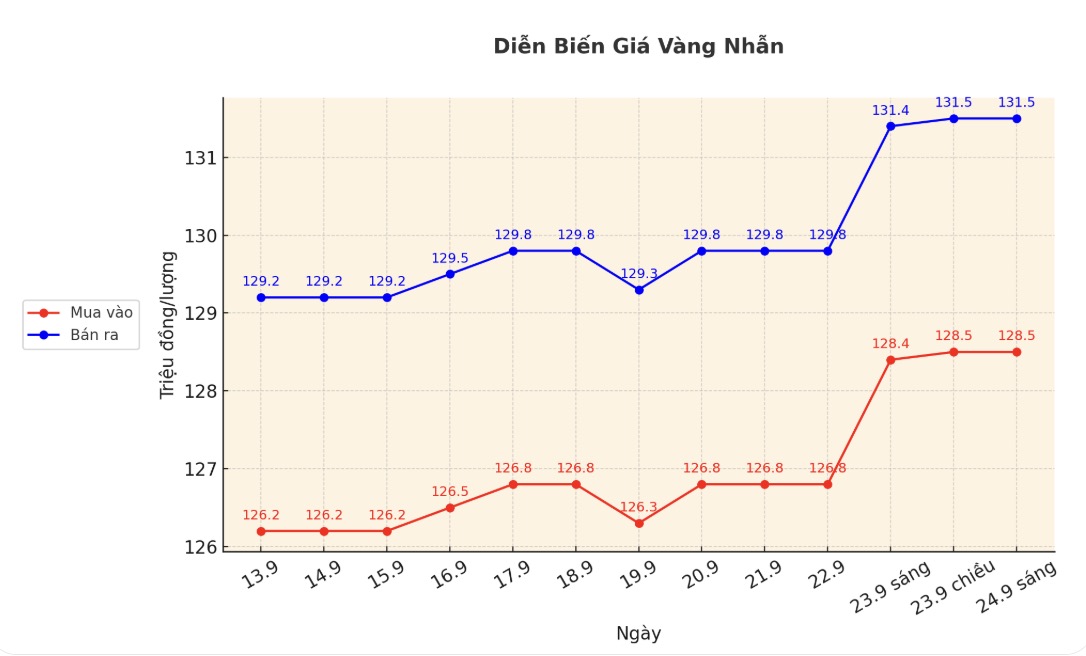

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.2-132.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

Although it increased compared to a day ago, domestic gold prices are showing a downward trend compared to yesterday's closing price. This decrease is consistent with the decrease in the world gold market.

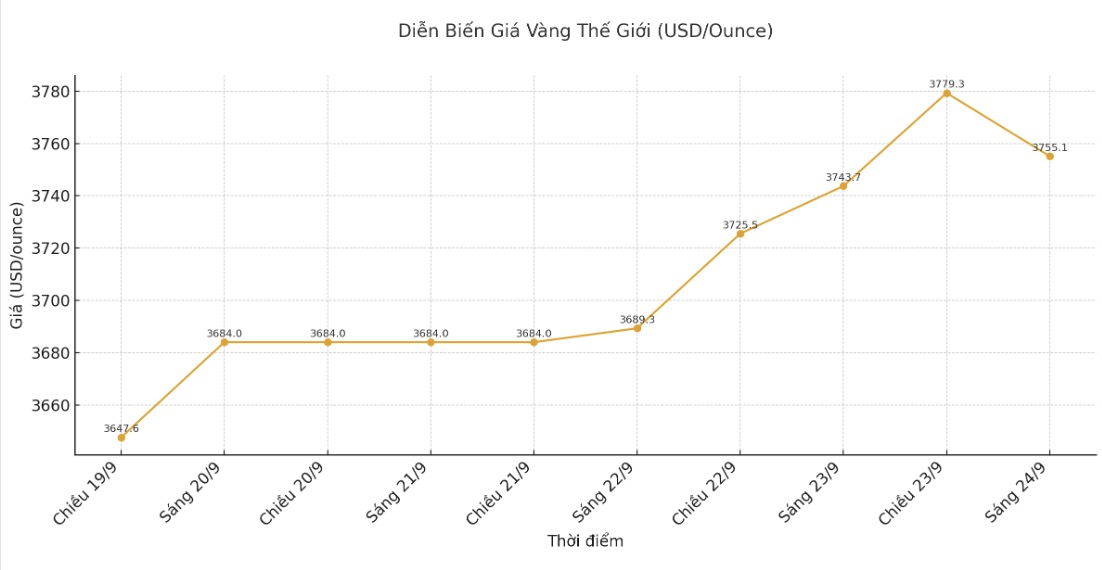

World gold price

At 9:00 a.m., the world gold price was listed around 3,755.1 USD/ounce. Similar to the Vietnamese gold market, although it increased slightly compared to the same time the previous day, the world gold price is still in a downward trend.

Gold price forecast

Gold prices turned slightly lower after Federal Reserve Chairman Jerome Powell told the business community in Providence, Rhode Island that the weakening of the labor market is overwhelming concerns about persistent inflation, leading to the Fed's decision to lower interest rates last week, according to Reuters.

However, the Fed Chairman is satisfied with the Fed's current policy direction, while leaving open the possibility of further interest rate cuts if the FOMC finds it necessary to support the economy.

Mr. Powell assessed that the declining employment situation has changed the balance of risks in achieving the FED's targets.

On the other hand, the current tight policy stance gives the Fed enough room to cope with potential economic developments.

Although the increase has slowed down, gold prices are still receiving many supporting factors. Commerzbank said in a note that strong buying from ETF investors - driven by expectations of interest rate cuts, concerns about the Fed's independence and geopolitical developments - could also boost gold prices.

World gold prices received support as the People's Bank of China continued to accumulate gold regularly, despite the sharp increase in prices. According to the assessment of Societe Generale Bank (France), China will still be the "player" dominating the gold market for many years to come, despite high prices that may further limit purchasing power.

Commodity experts from Societe Generale cited data from the International Monetary Fund (IMF) as saying that the People's Bank of China (PBoC) currently holds 2,300.000 tons of gold, accounting for about 8% of total foreign exchange reserves.

This rate is still low compared to the average of 21.7% of global central banks. If China sets a target of raising the rate to 20%, it will need to accumulate 5,337 tons of gold, an increase of about 3,036 tons compared to the current gold price.

At that time, China will become the world's second largest gold holding country, after the US (8,133.5 tons, accounting for 77.9% of reserves) and surpassing Germany (3,350 tons, 77.6%).

Schedule of announcing economic data affecting gold prices this week

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...