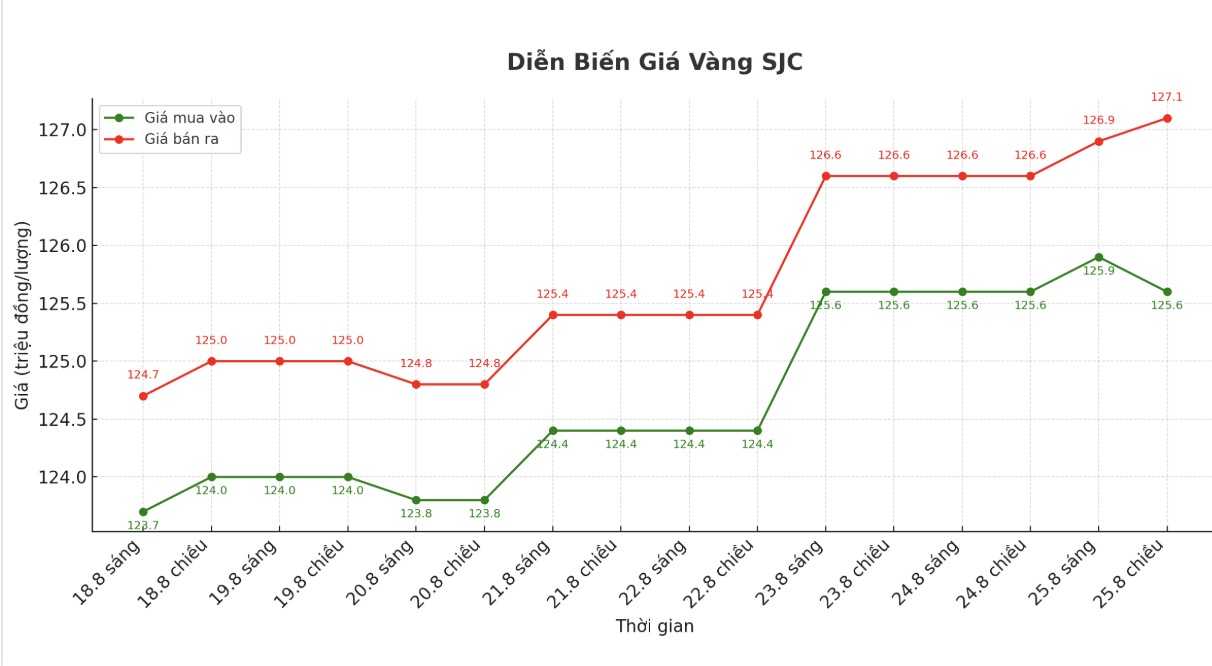

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND125.6-127.1 million/tael (buy - sell), unchanged for buying but increased by VND500,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-127.1 million VND/tael (buy - sell), keeping the same for buying but increasing by 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.1-127.1 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119.2-122.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

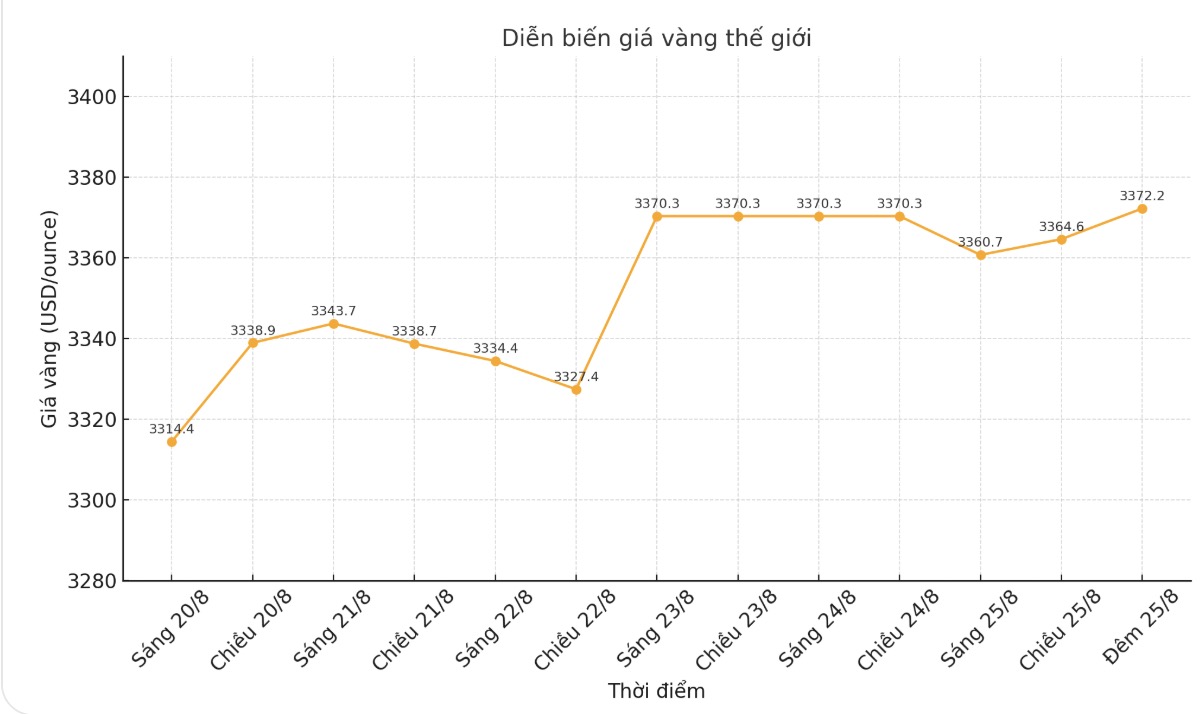

World gold price

The world gold price was listed at 6:00 a.m. at 3,372.2 USD/ounce.

Gold price forecast

World gold prices stagnated to increase in the first trading session of the week in the US, due to adjustment activities after a strong increase last Friday.

At the Jackson Hole conference, Federal Reserve Chairman Jerome Powell signaled on Friday that the agency could cut interest rates at its September meeting. However, there are still conflicting opinions within the FED about this decision.

Mr. Powell admitted that the US economy is putting the FED in a difficult position: inflation is higher than the 2% target and tends to increase, while the labor market shows signs of weakening. Powell's speech helped US stocks increase strongly and put pressure on the USD index, but by last night, US stocks cooled down and USDX pushed up again.

December gold futures fell $2.3 to $3,416.20 an ounce.

In another development, the People's Bank of China (PBOC) net inflated 600 billion yuan this month through its medium-term tool and open-end market operations, the largest level since January.

According to Mr. Wang Qing - macro expert at Golden Credit Rating, PBOC will continue to maintain long-term cash flow to support the issuance of government bonds and credit growth, thereby strengthening confidence in monetary policy to support growth.

Although not loosening strongly, the PBOC affirmed that there will be targeted support measures. At the same time, after the USD weakened by Powell's statement, the PBOC raised the yuan reference rate to 7.1161 CNY/USD, the strongest level since November last year.

China's economy continues to be pressured by US tariffs and the real estate crisis, but the stock market continues to rise, raising concerns about sustainability.

Bloomberg quoted experts as saying that the increase is mainly due to cash investors lacking other options, while the risk of a bubble is appearing. Weak domestic demand and the risk of decline are eroding the profitability of businesses.

Technically, December gold delivered the short-term upward advantage. The next target for buyers is to surpass the solid resistance level of 3,500 USD/ounce. Meanwhile, the sellers want to pull prices below the strong support level at the bottom of July at 3,319.2 USD/ounce.

The immediate resistance level was at the peak last week at 3,423.4 USD, then up to 3,450 USD. The most recent support was $3,400/ounce, followed by last week's low of $3,353.4/ounce.

In foreign markets, USDX increased slightly, WTI crude oil prices also increased around 63.75 USD/barrel. The yield on the 10-year US Treasury note was at 4.337%. Today, the US will release the Fed Chicago national performance index, new home sales figures and a survey of Texas manufacturing outlook.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...