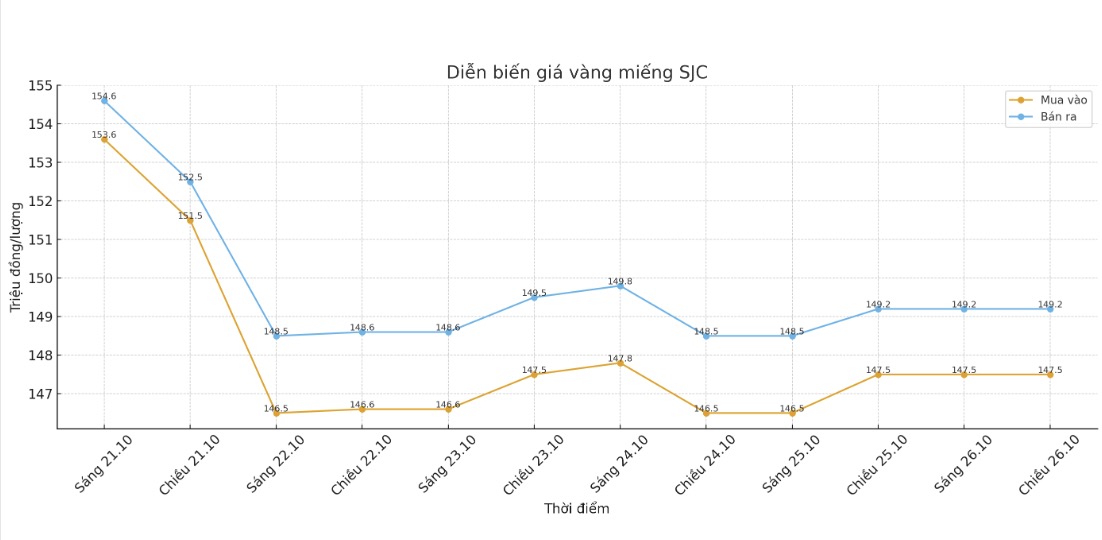

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 147.5-149.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.7 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.2-149.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.7/49.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

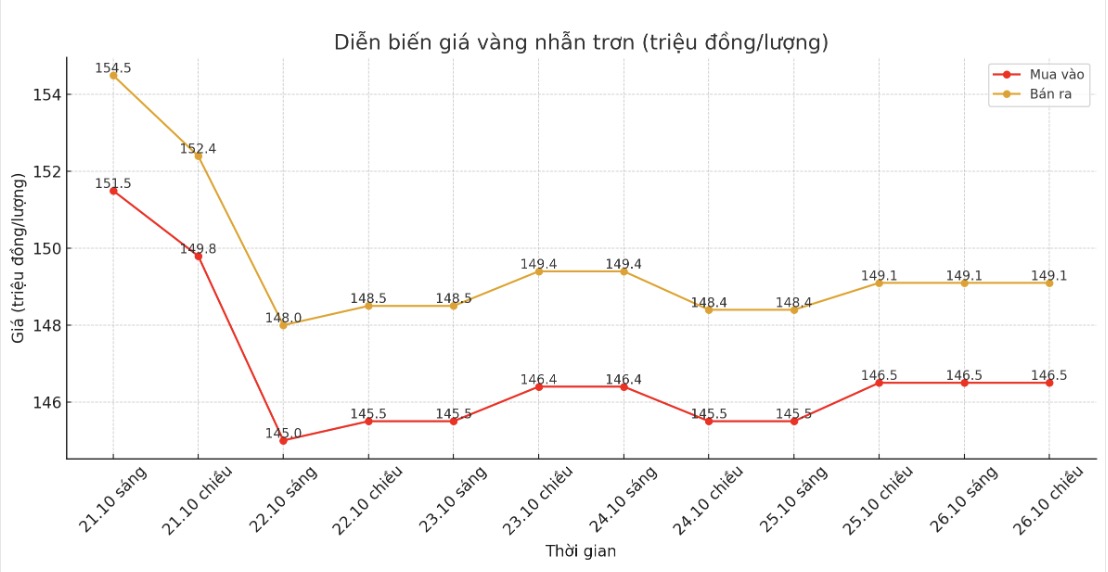

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.5-149.1 million VND/tael (buy in - sell out). The difference between buying and selling is 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

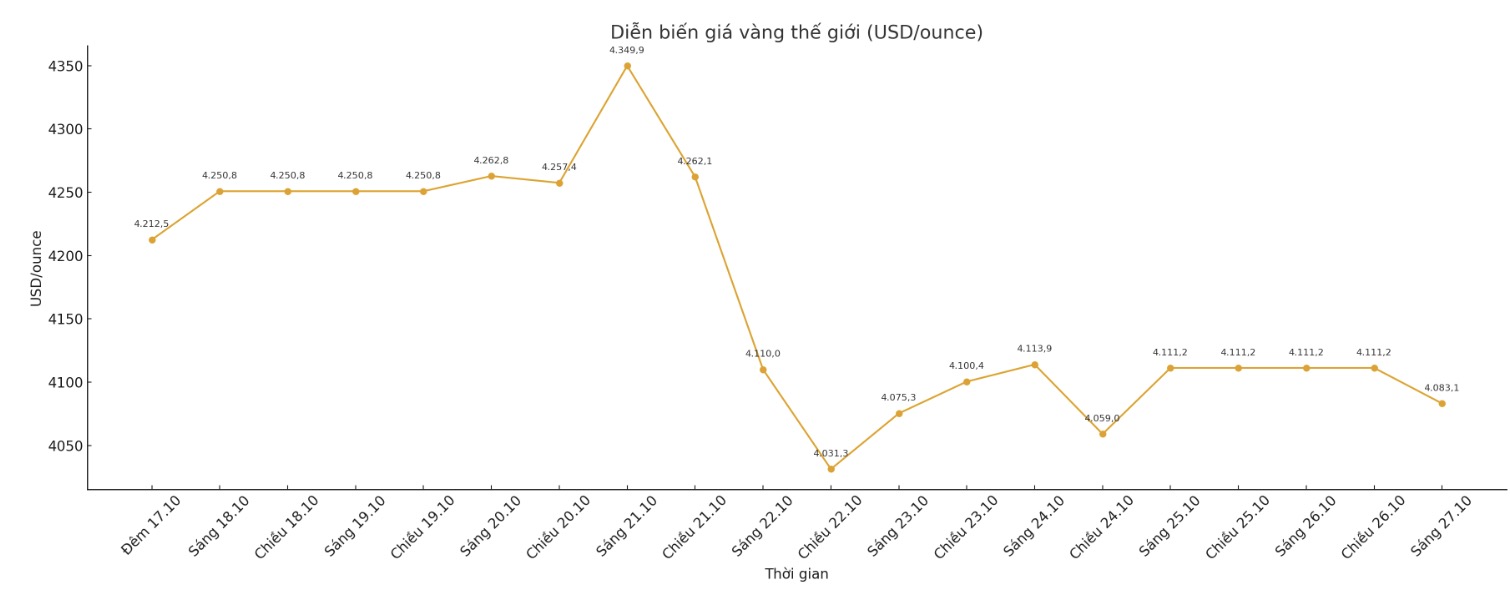

World gold price

The world gold price was listed at 6:00 a.m. at 4,083.7 USD/ounce, down 27.5 USD/ounce.

Gold price forecast

Lukman Otunuga - Director of Market Analysis at FXTM - commented: "Gold prices recovered in the last session of the week, after lower-than-expected inflation data, reinforcing expectations that the US Federal Reserve (FED) will cut interest rates next week. However, technical signals are still in favor of the selling side, as weak prices below the 4,050 USD/ounce mark could open the way back to 4,000 USD/ounce or lower".

Michael Brown - Senior Analyst at Pepperstone - expects gold prices to fluctuate in the range of 4,000 4,400 USD/ounce in the short term, with the risk of increasing as global public debt continues to escalate and central banks increase gold purchases.

"The upward trend in the market has not ended, but is only "resting to regain strength". The recent adjustment is the result of a steady, too fast and too strong increase, forcing the market to cool down when the new cash flow is more cautious and long-term investors take advantage of taking profits" - he said.

Neil Welsh - Head of metals at Britannia Global Markets - also said that the market has not yet reached a peak and emphasized the need for a cooling pace.

Recent fluctuations are more like a constructive correction than a reversal. Long-term factors such as persistent inflation, central banks net buying gold, geopolitical instability and expectations of the Fed continuing to cut interest rates remain strong.

Prices may fluctuate between $4,000-$4,200/ounce to create a foundation, but the factors driving gold up in the long term are still convincing. The journey from $4,100 to $5,000 an ounce may take more time, but this correction could attract bottom-fishing buying power, he said.

Notable economic data this week

Tuesday: US consumer confidence.

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...