The trading week ended on October 26 witnessed a sharp decline in the domestic gold market, while the difference between buying and selling continued to be stretched. This has caused many investors to "pay" at the right price, now having to bear a loss that could be up to 8.5 million VND/tael.

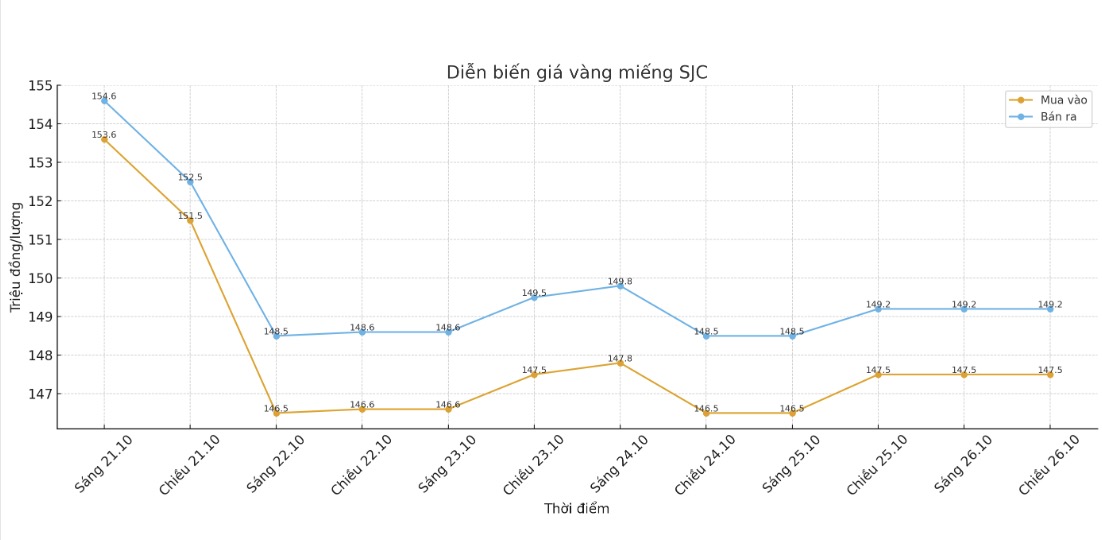

At the end of the trading week on October 26, Saigon Jewelry Company SJC listed the price of SJC gold bars at VND 147.2-149.2 million/tael (buy - sell), down VND 2.3 million/tael for buying and VND 1.8 million/tael for selling compared to the session on October 19. The two-way difference here continues to remain high at 2 million VND/tael, increasing the risk for short-term traders.

At the same time, the price of SJC gold bars at Bao Tin Minh Chau stood at 148.2-149.2 million VND/tael (buy - sell), down 2.3 million VND/tael for buying and 1.8 million VND/tael for selling compared to last week. The difference between the buying and selling prices at this enterprise is lower, but still at 1 million VND/tael.

If buying gold bars last week and selling in today's session, investors will suffer a loss of about VND3.8 million/tael at SJC and VND2.8 million/tael at Bao Tin Minh Chau.

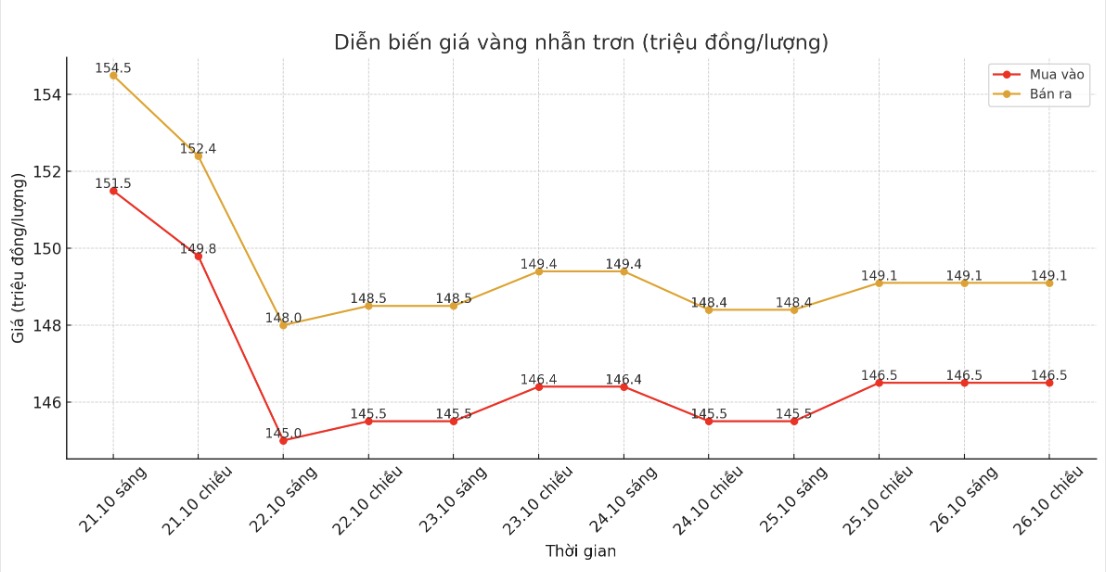

The most unfavorable development was recorded in 9999 gold rings. At Bao Tin Minh Chau, the price of gold rings is currently traded at 150-153 million VND/tael (buy - sell), down 5.5 million VND/tael in both directions compared to last week, with a buy - sell difference of up to 3 million VND/tael.

In Phu Quy, the listed gold ring price was 146.2-149.2 million VND/tael (buy - sell), down 1.8 million VND/tael in both directions and the difference was 3 million VND/tael.

If buying gold rings in the session of October 19 and selling in today's session, the loss that investors have to bear is up to 8.5 million VND/tael at Bao Tin Minh Chau and 4.8 million VND/tael at Phu Quy. This is considered the heaviest loss in the gold product group at the present time.

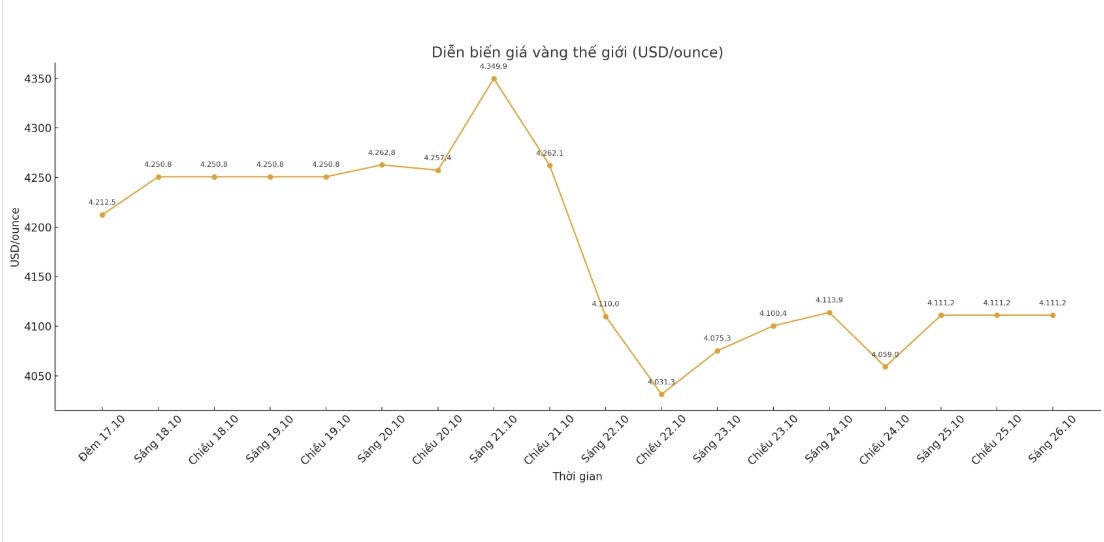

Domestic gold prices fell sharply in the context of the world market also entering a strong correction. At the end of the week, the world gold price was anchored at 4,111.2 USD/ounce, down 139.6 USD/ounce compared to a week before.

This decline comes right after a long series of increases, causing increased cautious sentiment and promoting profit-taking activities globally. Pressure from the international market has spread rapidly to the domestic market, attracting strong selling pressure and contributing to the deepening of domestic gold prices in the weekend sessions.

The difference between buying and selling is currently being pushed up too high, causing the risk for investors to increase significantly. If prices are adjusted slightly, losses will immediately appear and if prices fall as deeply as in the previous sessions, losses can "huge" in just a short time.

Many domestic investors have been caught up in FOMO psychology when witnessing gold prices rising sharply, while the buy-sell gap has continuously widened, leading to petting money at too high prices.

However, a survey on gold price forecasts next week shows that the majority of Wall Street experts have shifted to a pessimistic or neutral view.

Some opinions warn that if the world gold price breaks through the 4,000 USD/ounce mark, the market may experience a deeper sell-off and last for many weeks, because this is considered the strongest correction in the past 12 years.

In the context of the great risk, investors need to be very cautious, avoid chasing the crowd and consider carefully before making any buying decisions, especially when the market is currently fluctuating strongly.