Mr. Neil Welsh - Director of Metals at Britannia Global Markets - is neutral: "Recent fluctuations are more of a positive correction than a trend reversal. There is a feeling that the market is just taking a break to consolidate before continuing to move up.

Sharing the same view, Mr. Colin Cieszynski - Chief Strategist at SIA Wealth Management - also said that he is neutral, but not because the market will be flat but because it is difficult to predict a clear direction at this time.

He assessed the CPI report as not a major driver: CPI 3%, while the forecast is 3.1%. With the US government shut down, data could be distorted. I didn't expect much and there was actually nothing remarkable."

According to him, the recovery of gold is mainly due to technical factors: The USD is not fluctuating strongly, the digital currency is also quite quiet. The recent sell-off seems to have ended and gold is bouncing back.

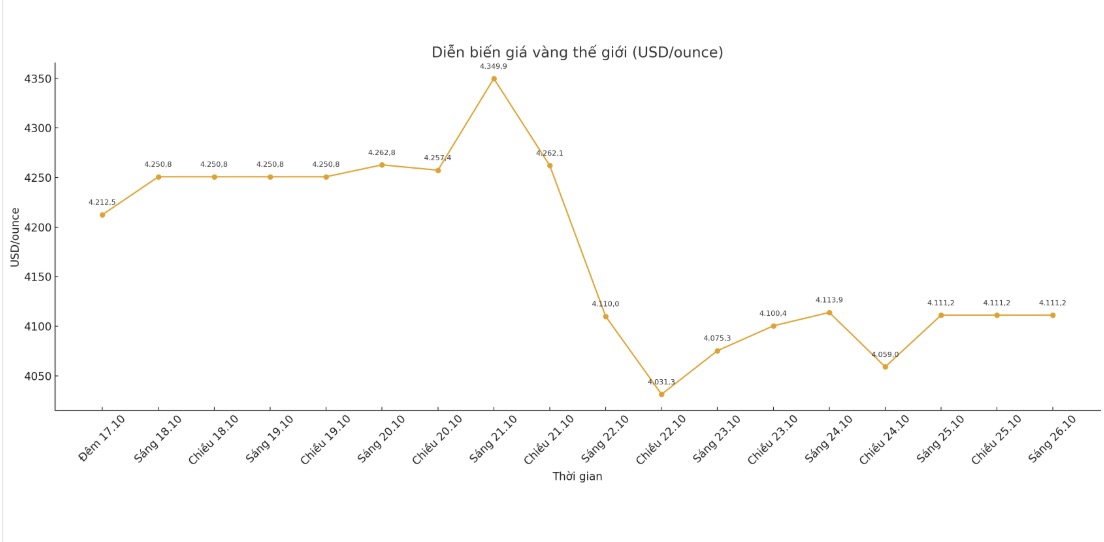

He believes gold could move sideways in the $4,000-$4,300-ounce range in the near term: Gold has risen too fast. Now the market is waiting for a new signal. Recent news has reflected enough in prices.

He added: The positive thing is that the $4,000/ounce mark remains strong. Gold's long-term upward momentum has not been broken. The market needs to rest to absorb the recent strong increase, completely in accordance with technical rules".

He also noted the psychological factor associated with the holiday season: "The sell-off takes place right after the Diwali festival - a rumored way of buying and selling when it is announced".

Meanwhile, Adrian Day - Chairman of Adrian Day Asset Management - predicted that gold could fall further before creating a new bottom: "I don't think this correction will be prolonged or too deep and the low could appear this week."

He stressed that there were no concerns about the long-term outlook for gold: All factors that have driven gold prices over the past three years remain unchanged.

Mr. Sean Lusk - Co-Director of Trade Defense Strategy at Walsh Trading - commented: "The adjustment process is necessary. But it is difficult to predict a clear direction now.

He said that US stocks are performing very well, the USD is not weakening, causing gold to face a challenge: " Prices have decreased from the overbought zone but still remained high. Investors are taking profits over the weekend, especially as geopolitical risks return from energy tensions and sanctions on Russia.

According to Mr. Lusk, the metal market shows signs of fatigue after a series of consecutive threshold breaks: "Everyone is waiting for gold to adjust deeply to buy back".

He warned that gold is entering the most negative crop season of the year - from late October to the end of the first half of December: "Gold is a commodity. Prices may be affected by ETFs, but that does not ensure that futures contracts remain high.

He also did not rule out the bubble factor: Since the bottom of August, prices have increased by nearly 1,100 USD/ounce. Some investors will take profits, withdraw from the market, and wait until 2026 to re-evaluate.

He predicted: " Prices may fall to $3,690/ounce while still in a long-term uptrend. But it could also increase to $4,589 an ounce by the end of the year.

Mr. Marc Chandler - CEO of Bannockburn Global Forex - said that gold has just ended its 9-week increase streak: "The decline was mainly due to trading position, not macro factors. I expect gold to surpass $4,200 and best go up to $4,240/ounce to confirm bottoming.

Meanwhile, Mr. Rich Checkan - Chairman and COO of Asset Strategies International - said that gold prices will increase again: "The correction has been awaited for a long time, but the recent decline was inflated by the fear of weak investors. A lower CPI than expected, combined with expectations of a Fed rate cut next week, will be enough to bring gold prices back to the uptrend.

See more news related to gold prices HERE...