Update SJC gold price

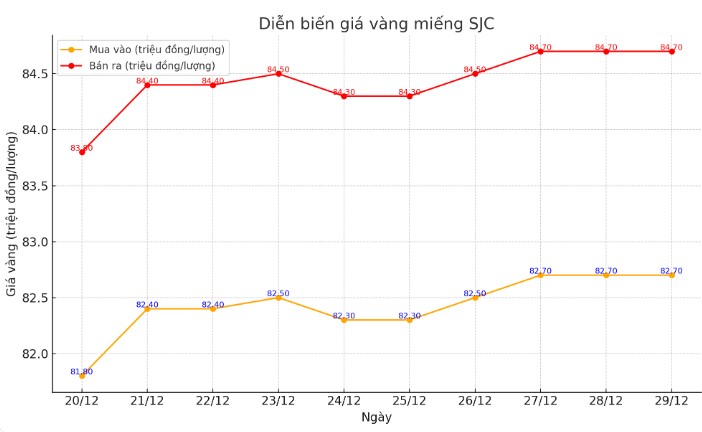

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.7-84.7 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.7-84.7 million VND/tael (buy - sell), unchanged.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.7 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

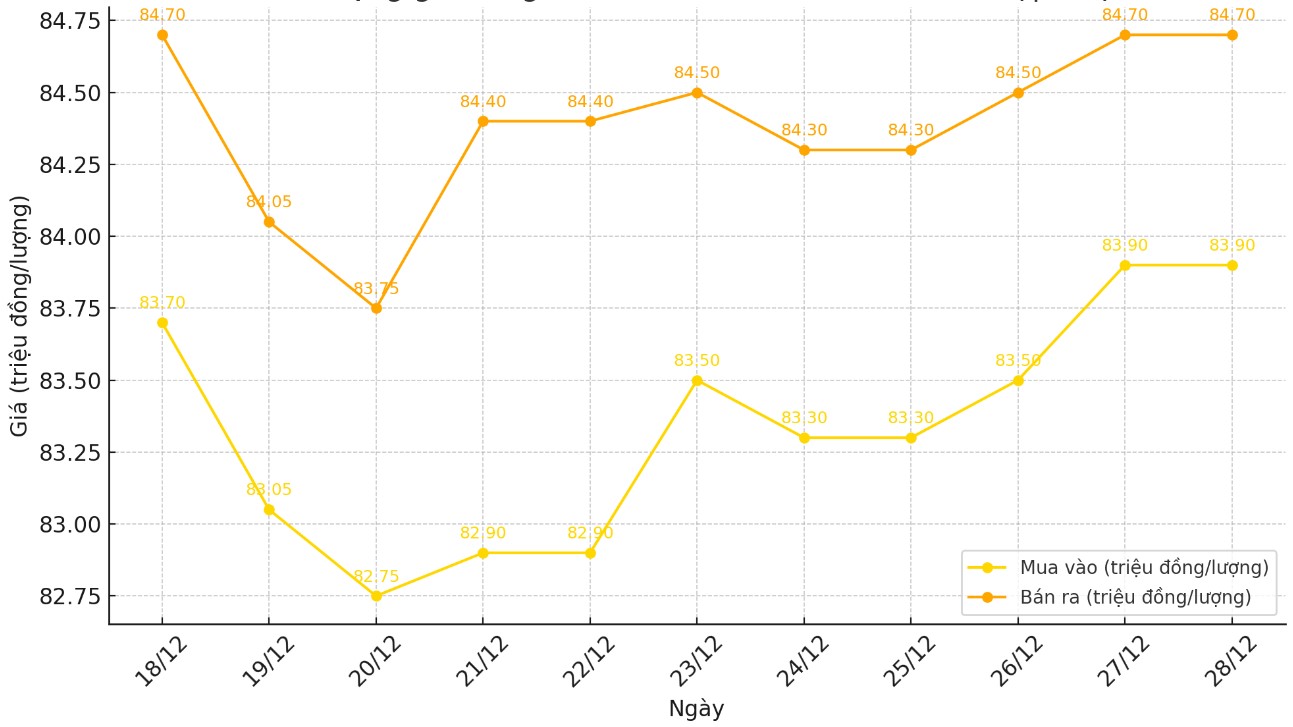

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.85-84.7 million VND/tael (buy - sell); down 50,000 VND/tael for buying and unchanged for selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.1-84.7 million VND/tael (buy - sell), unchanged in both directions.

World gold price

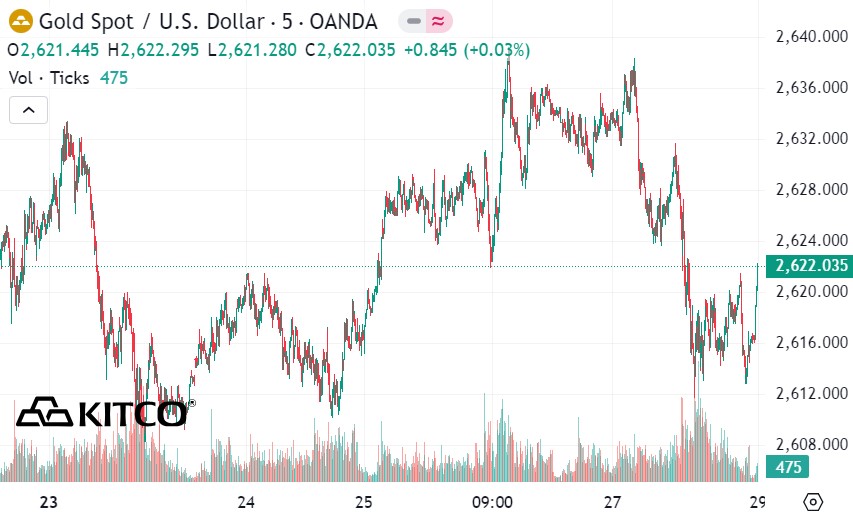

As of 6:00 a.m. on December 29 (Vietnam time), the world gold price listed on Kitco was at 2,622 USD/ounce.

Gold Price Forecast

World gold prices fell despite a slight decrease in the USD index. Recorded at 6:00 a.m. on December 29, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.790 points (down 0.13%).

Some analysts believe that low trading volumes during the 2024 holiday season are expected to keep gold prices in a narrow range. Gold prices will continue to maintain a "calm" state next week.

James Hyerczyk, market analyst at FX Empire, said the key support level to watch next week will be $2,607 an ounce. He added that gold needs to break $2,665.65 to regain bullish momentum. In the current environment, he said the path of least resistance appears to be to the downside.

“The near-term outlook for gold remains negative, with rising yields and a stronger US dollar acting as stronger drivers than geopolitical risks,” he said. “However, the current action is occurring during a historically low-volume trading week, and thin trading volumes could limit further volatility.”

Next week, investors and experts will focus on important economic data from the US, as global markets prepare to enter the new year with many expectations and challenges.

Monday (December 30, 2024): The US pending home sales report is due out, a key gauge of the health of the housing market, which is facing pressure from high interest rates.

Wednesday (January 1, 2025): On the first day of the new year 2025, global financial markets will take a break from trading to welcome the new year.

Thursday (January 2, 2025): Weekly US jobless claims data is expected to provide a clearer view of the labor market - a key factor in the US Federal Reserve's (FED) policy decisions.

Friday (January 3, 2025): The ISM Manufacturing PMI, a key indicator of economic activity in the manufacturing sector, will be released. Analysts expect the index to reveal growth as well as challenges in the US manufacturing industry.

See more news related to gold prices HERE...