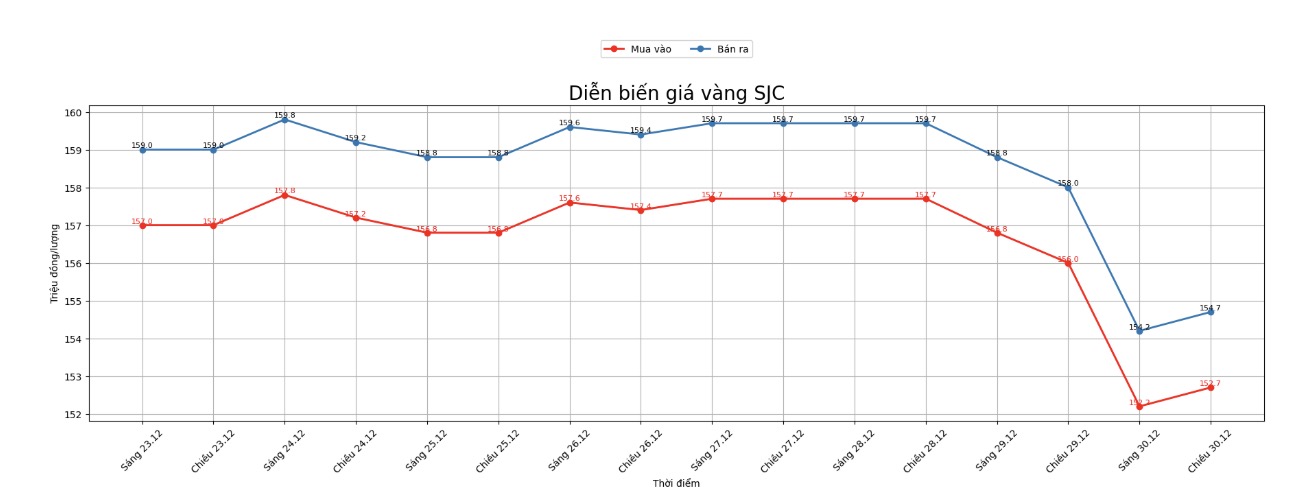

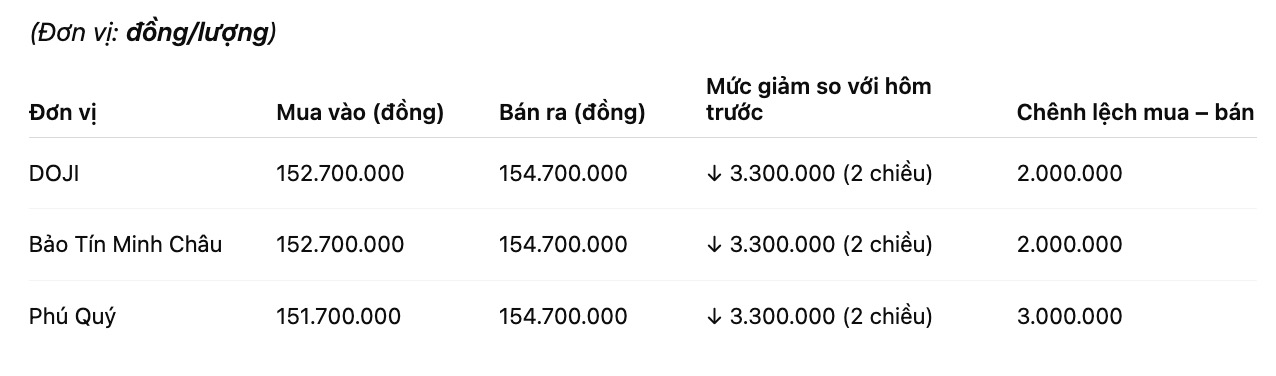

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 152.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 152.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 151.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

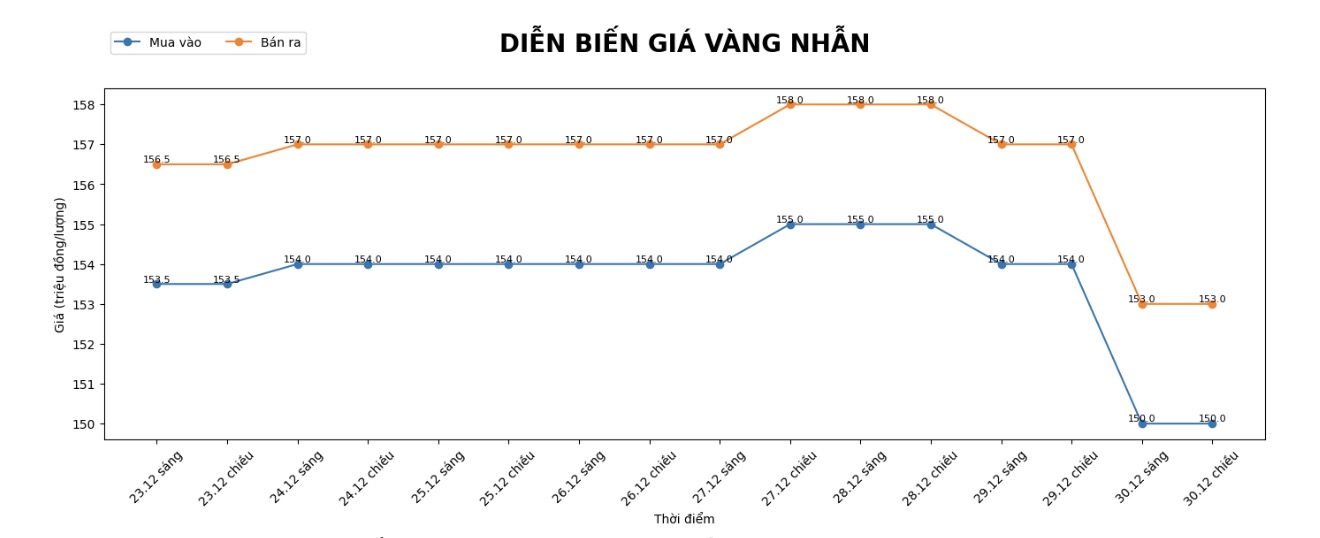

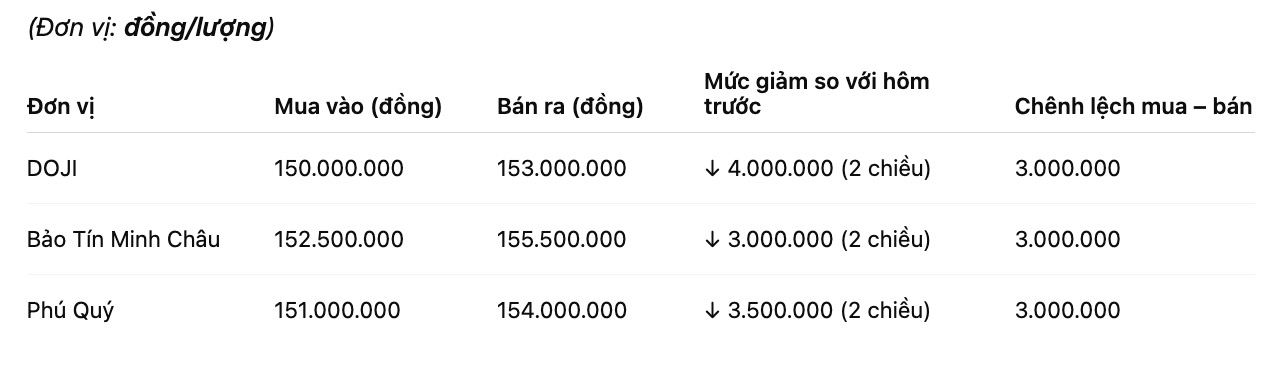

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 150-153 million VND/tael (buying - selling), down 4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buying - selling), down 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 151-154 million VND/tael (buying - selling), down 3.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

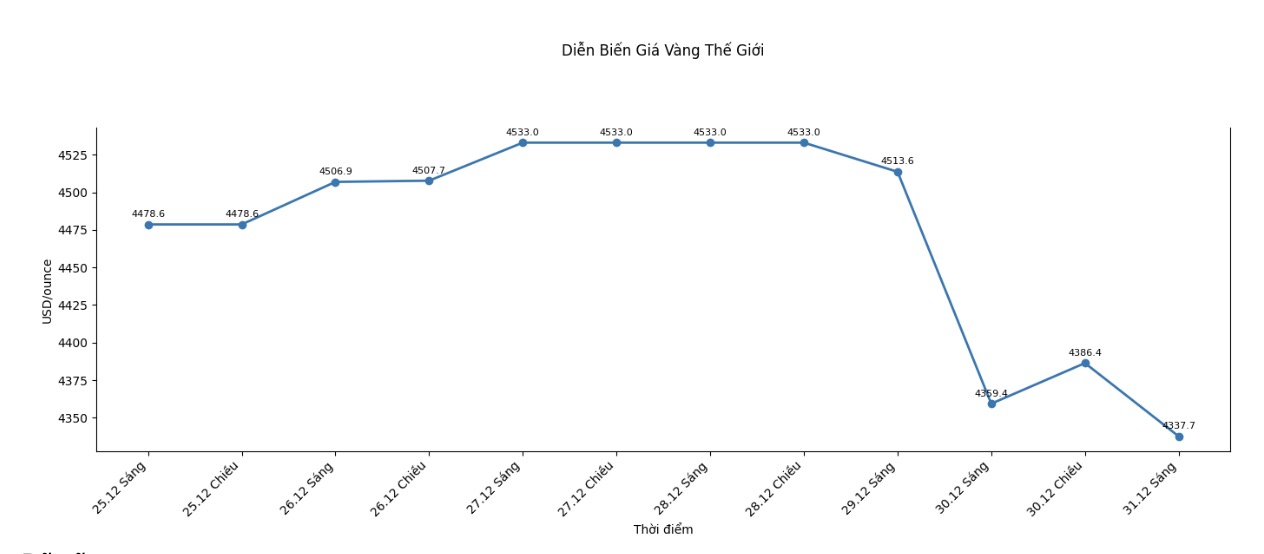

World gold price

World gold price listed at 5:12 am at the threshold of 4,337.7 USD/ounce, up 7.4 USD/ounce.

Gold price forecast

Gold prices rebounded, while silver prices surged sharply in last night's trading session. Both precious metals recorded a recovery after a deep decline in the first session of the week. As the year gradually closed, volatility in the global market increased, thereby stimulating demand for assets considered safe havens.

The dien bien in today's session is assessed by analysts as particularly important. If selling pressure continues to prolong after the sharp decline of the previous session, the gold and silver market may face significant technical damage in the short term, while breaking the upward trend that has formed.

However, the buying side cannot be subjective. The closing movement of the market at the end of the week - approaching the peak or bottom of the week - is likely to orient the trading trend of the two precious metals in the coming time.

In that context, global risks and instability continue to play a supporting role in the demand for gold and silver holdings. Concerns related to security, trade and the international economy are causing cash flow to turn to highly defensive assets.

Technically, the next price increase target for February gold futures is to close above the strong resistance zone at a record high of 4,584 USD/ounce. Conversely, the short-term price reduction target of the selling side is to push the price below the important support level of 4,200 USD/ounce.

In the immediate future, the resistance levels are at 4,433 USD/ounce and 4,450 USD/ounce respectively. The nearest support zones are determined at 4,338 USD/ounce and 4,416 USD/ounce.

According to the Wyckoff rating scale, the gold market currently reaches 7.5 points, showing that the upward trend is still dominant but contains no small risk of correction in the short term.

In foreign markets, the US USD index increased slightly. Crude oil prices edged up, trading around 58.25 USD/barrel. The yield of US 10-year government bonds currently fluctuates around 4.13%.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...