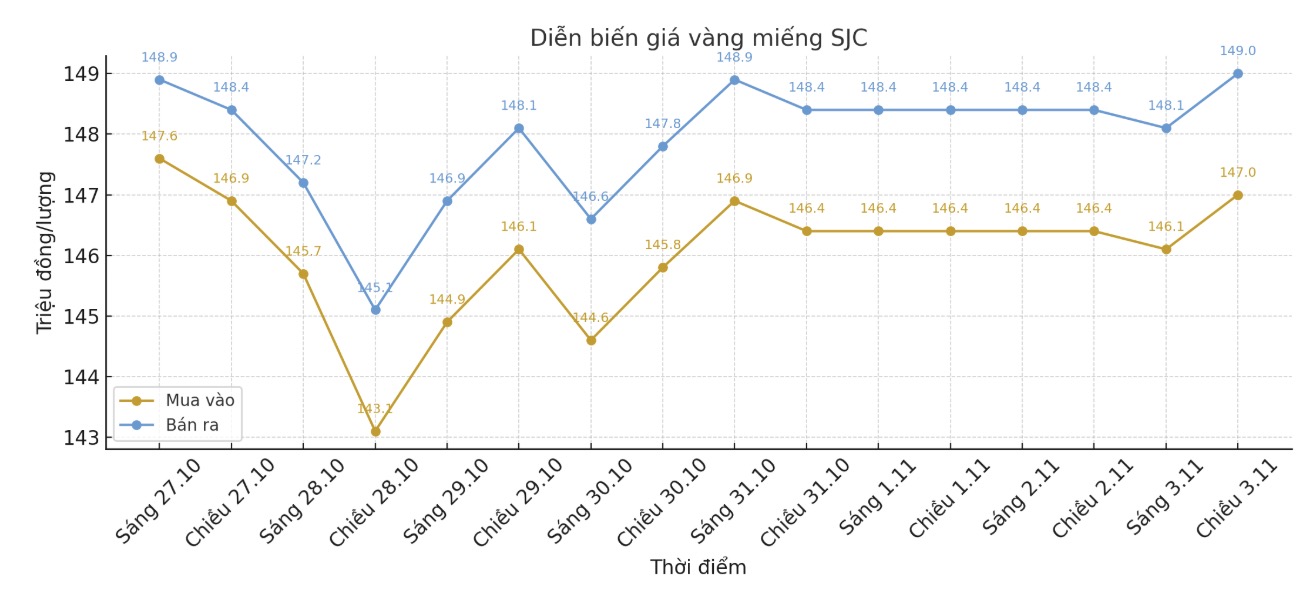

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 147-149 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.5-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.5-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

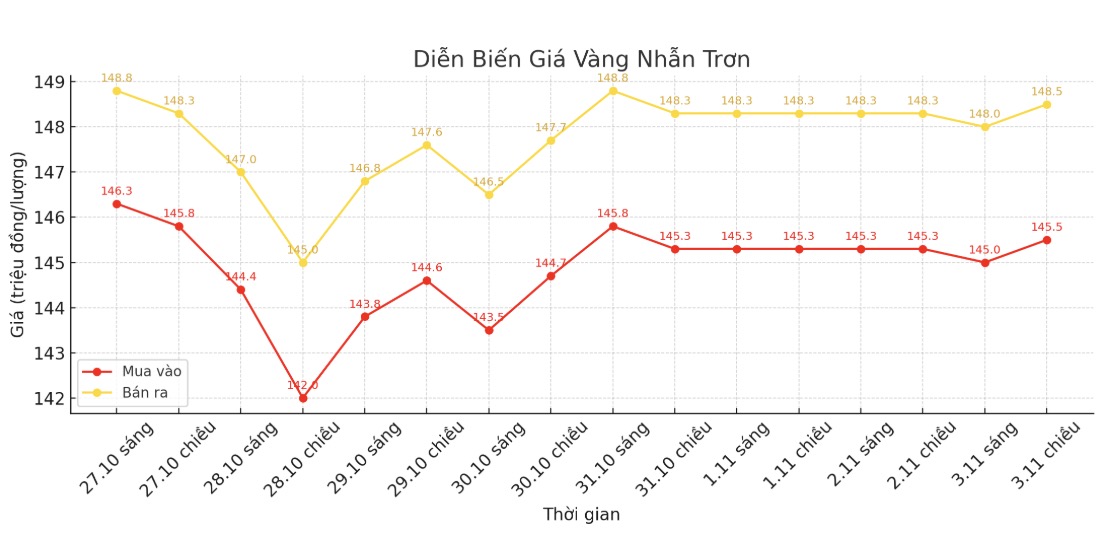

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

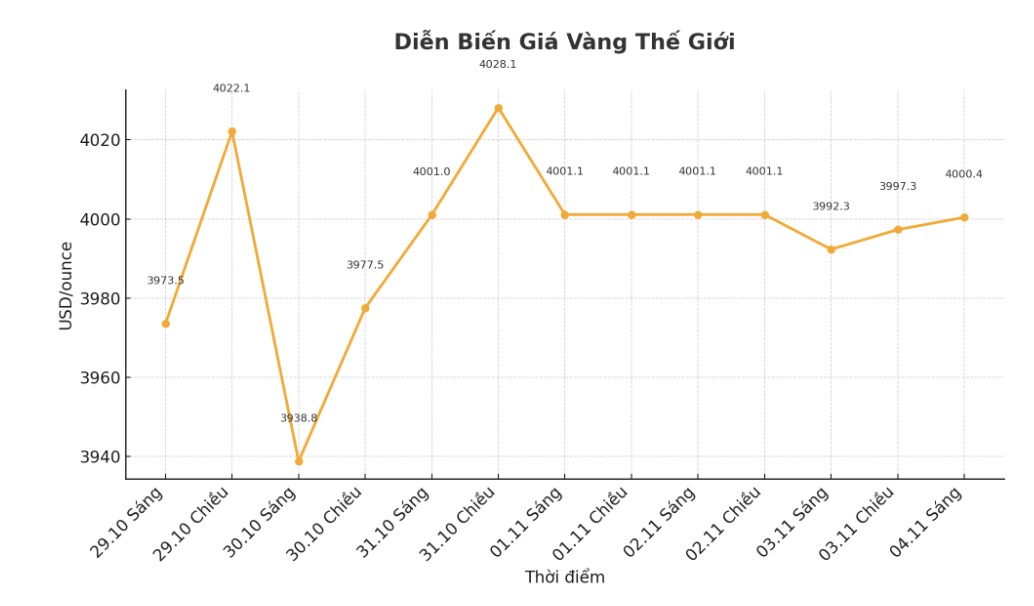

World gold price

The world gold price was listed at 5:40 at 4,0004.4 USD/ounce, up 3.1 USD compared to a day ago.

Gold price forecast

World gold prices recovered slightly, while silver prices decreased slightly, showing that buyers in the precious metal market have somewhat stabilized prices after a period of strong fluctuations recently. This is considered a positive signal for both markets, in the context that investors are waiting for a new fundamental factor to create momentum for a clearer price trend.

Accordingly, December gold futures on the CME increased by 13.2 USD, to 4,010.4 USD/ounce, while December silver futures decreased by 0.105 USD, down to 48.055 USD/ounce.

In the international market, notable information comes from China when the country decided to end its long-standing tax incentives for gold. Accordingly, retailers will no longer be entitled to deduct value-added tax (VAT) when selling gold.

This new regulation applies to both investment products such as gold bars and gold bars with high purity, as well as non-investment products such as jewelry and industrial materials. Analysts say this move will help the Chinese government increase budget revenue, but at the same time increase the cost of buying gold for domestic consumers.

Technically, gold investors are aiming to close above a solid resistance zone at $4,100/ounce to confirm a new uptrend. On the contrary, the seller will try to push the price below the strong support zone at 3,800 USD/ounce.

The most recent resistance level was recorded at the peak of last night's session at 4,043.1 USD/ounce and the high of the previous Friday session at 4,059.9 USD/ounce. Meanwhile, the support zone is at the bottom of today's session at 3,971.30 USD/ounce and next at 3,950 USD/ounce.

For silver, December delivery contracts recorded an upward target at the $50/ounce resistance zone, while the downside target was at the $45/ounce support level.

The most recent resistance level was determined at 49 USD/ounce and 49.225 USD/ounce, while the corresponding support level was 47.8 USD/ounce and 47 USD/ounce.

In outside markets, the US dollar index picked up slightly, while crude oil prices recovered and traded around $61.25/barrel. The yield on the 10-year US Treasury note stood at 4.11%.

The world gold market is currently priced through two main mechanisms: the spot market - where prices reflect instant sales, and thefutures market - where prices are set for future delivery. Due to high liquidity at the end of the year, December gold contracts are the most actively traded on the CME exchange.

Schedule of releasing important economic data for the week

Wednesday: ADP Employment Report, ISM survey for the service sector.

Thursday: Bank of England (BoE) monetary policy meeting.

Friday: Preliminary survey of consumer confidence - University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...